Will This Make Tether Shake? 😮

Plus, MSFT ❌ orange pill, 📊 Goldman’s crypto gambit, 📲 Airdrop ball-drop, and more!

I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

🤝 Binance to integrate USDC for trading, payments, and treasury

❌ Microsoft votes down Bitcoin treasury plan

✅ Ripple stablecoin gets N.Y. regulatory thumbs-up

🏦 Goldman eyes BTC/ETH market making

🎭 Magic Eden’s token struggles to launch

🚀 Raydium beats Uniswap for two months straight

Earn 20%+ APR on ETH with High Growth Vault by Kelp

High Gain is your tokenized solution for generating the highest rewards on ETH in 1 click– while keeping you liquid with hgETH.

What’s Poppin’?

By Juan Aranovich and Tikta

Binance, Circle Team Up to Expand USDC Adoption

Crypto exchange Binance and Circle, the issuer of stablecoin USDC, today announced a partnership to accelerate USDC adoption across Binance’s platform.

The agreement, unveiled at Abu Dhabi Finance Week, will integrate USDC into Binance’s ecosystem for trading, payments, and savings, while also incorporating it into Binance’s corporate treasury.

Circle CEO Jeremy Allaire praised the partnership, describing it as a “major shift in the emerging crypto market structure.”

Binance, which serves more than 240 million users globally, plans to expand USDC availability across its products and services and will also add USDC to its corporate treasury.

Microsoft Shareholders Reject Bitcoin Treasury Proposal

Microsoft shareholders have voted down a proposal that would have instructed the company's board to consider adding bitcoin to its treasury holdings.

The tech giant’s shareholders rejected the proposal in a vote at the 2024 annual shareholder meeting held virtually on Dec. 10.

The proposal, entitled “Assessment of Investing in Bitcoin” was put forward by the National Center for Public Policy Research, and urged the board to consider diversifying 1% of its total assets into bitcoin as a potential hedge against inflation.

It was endorsed by MicroStrategy CEO Michael Saylor, who last week told Microsoft’s board in a three-minute presentation “why the company should do the right thing and adopt Bitcoin.”

Ripple’s RLUSD Stablecoin Gets Nod in New York

Ripple’s RLUSD stablecoin has received final approval from the New York State Department of Financial Services, according to an announcement by CEO Brad Garlinghouse on social media.

The regulatory green light clears the way for RLUSD’s launch, and exchange and partner listings are expected to go live shortly.

RLUSD, initially announced in April, has been tested since August and will operate on the XRP Ledger and Ethereum.

Ripple has already partnered with major exchanges such as Uphold, Bitstamp, and Bitso to support the stablecoin’s liquidity, alongside market makers B2C2 and Keyrock.

Goldman Sachs Mulls BTC, ETH Market Making

Global investment bank Goldman Sachs will “evaluate” the idea of making markets for bitcoin and ether, subject to regulations in the U.S. improving, according to statements made by the firm’s CEO, David Solomon, at a Reuters leadership summit on Tuesday.

Solomon said the technologies were “getting a lot of attention at the moment” amid a shift in perceptions of how crypto would be regulated under the incoming Trump administration.

Bitcoin rallied from $69,374 on Nov. 5’s election day to an all-time high of around $103,900 on Dec. 5. At the time of writing, the original crypto asset was trading roughly 7% below that level, at $96,527.

President-elect Donald Trump has said he would create a strategic bitcoin reserve and end what has been dubbed "Operation Choke Point 2.0," an allegedly coordinated effort by the Biden administration to cut the crypto industry off from the U.S. banking sector.

Magic Eden’s Native Token Debut Sputters

Solana-based NFT marketplace Magic Eden launched its ecosystem token, ME, on Tuesday, but some users reported being unable to access its airdrop.

Although ME's fully diluted valuation reached $15 billion during the first few minutes of trading, its value quickly dropped to around $6 billion, according to data from decentralized exchange and blockchain network data firm DEXScreener.

Social media was peppered with complaints from users, some reporting that the website was down during the claiming process and others saying they had experienced problems with the mobile app.

ME has a total supply of 1 billion tokens, of which 12.5% was designated for the airdrop, 37.7% set aside for community incentives, and the remaining 49.8% allocated to contributors and strategic participants.

Solana’s Biggest DEX Overtakes Uniswap Trading Volume

Raydium, the largest decentralized exchange running on the Solana blockchain, outpaced Uniswap’s trading volume during the previous two calendar months.

After Raydium became the No. 1 DEX by volume across all chains in October, its November trading volume exceeded Uniswap’s by around 30%, reaching a total of $124.6 billion, according to data from crypto economy research firm Messari.

As expected, memecoin trading activity accounted for 65% of that volume.

“Raydium's growth also reflects the broader trend of Solana’s daily DEX volume surpassing Ethereum’s,” Messari analyst Matt Kreiser wrote.

“In November, Solana had a nearly 50% share of monthly DEX volume across all chains, 175% more than Ethereum’s roughly 18% share,” he said.

Unlock zero trading fees, up to 5.1% APY on USDC, boosted staking rewards and more with Coinbase One.

Try it free for a month with code UNCHAINED.

Under the First Crypto President, What Will Regulation of the Industry Look Like?

From the nominations of Paul Atkins to SEC Chair and David Sacks to AI and Crypto Czar, the Trump administration’s plans for crypto and technology are shaping up to be transformational.

With Paul Atkins as the incoming SEC Chair, David Sacks as the AI & Crypto Czar, and potential CFTC leadership changes, the Trump administration is signaling a major shift for crypto, AI, and financial regulation.

Guests Mike Selig and Jake Chervinsky break down what this means for token launches, enforcement actions, inter-agency collaboration, and the fate of Operation Chokepoint 2.0. Could this mark the end of the U.S.’s regulatory hostility toward innovation?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Daily Bits… ✍️✍️✍

💰 Ethereum spot exchange-traded funds recorded $305.7 million in inflows yesterday, with Fidelity’s FETH dominating the day at $202 million, while Bitcoin spot ETFs led the pack with $438.5 million in inflows.

📈 Japanese exchange Coincheck is set to list on Nasdaq through a de-SPAC transaction with Thunder Bridge Capital, giving the company an initial implied market cap of $1.3 billion.

🇷🇺 Russian lawmaker Anton Tkachev proposed creating a strategic bitcoin reserve to mitigate financial instability caused by sanctions, inflation, and traditional currency volatility, mirroring plans discussed in the U.S.

📊 Ethereum rollup project Fuel launched its native FUEL token, designed to decentralize the network and eliminate transaction fees through an "application-specific sequencing" model, with a total supply of 10 billion and an airdrop allocation for early contributors.

Today in Crypto Adoption...

🤝 Regulators in El Salvador and Argentina yesterday signed an agreement to collaborate on fostering crypto innovation and sharing expertise to advance digital asset regulation across Latin America.

The $$$ Corner…

💼 Digital asset holding company COSIMO announced a $25 million funding round led by former Bridgewater executive Des Mac Intyre as it consolidates its crypto investments, custody services, and staking hedge fund operations under a unified brand.

🖥️ Crypto-AI startup Exabits closed $15 million in a seed round at a $150 million valuation, focusing on graphics processing unit tokenization to create liquid markets for decentralized computing and reporting significant revenue growth.

💵 Bitcoin app Relai raised $12 million in series-A funding, increasing its valuation to $72 million as its platform facilitated $650 million of bitcoin transactions this year and prepares for EU expansion with a MiCA license by 2025.

🧠 Web3 AI cloud platform Hyperbolic secured $12 million in series-A funding led by Variant and Polychain Capital to enhance its decentralized AI infrastructure and develop its own blockchain to support open-access AI services.

🌌 The Interchain Foundation acquired Cosmos startup Skip to unify product development and strengthen the Cosmos Hub's central role in the ecosystem, addressing long-standing fragmentation and competing visions.

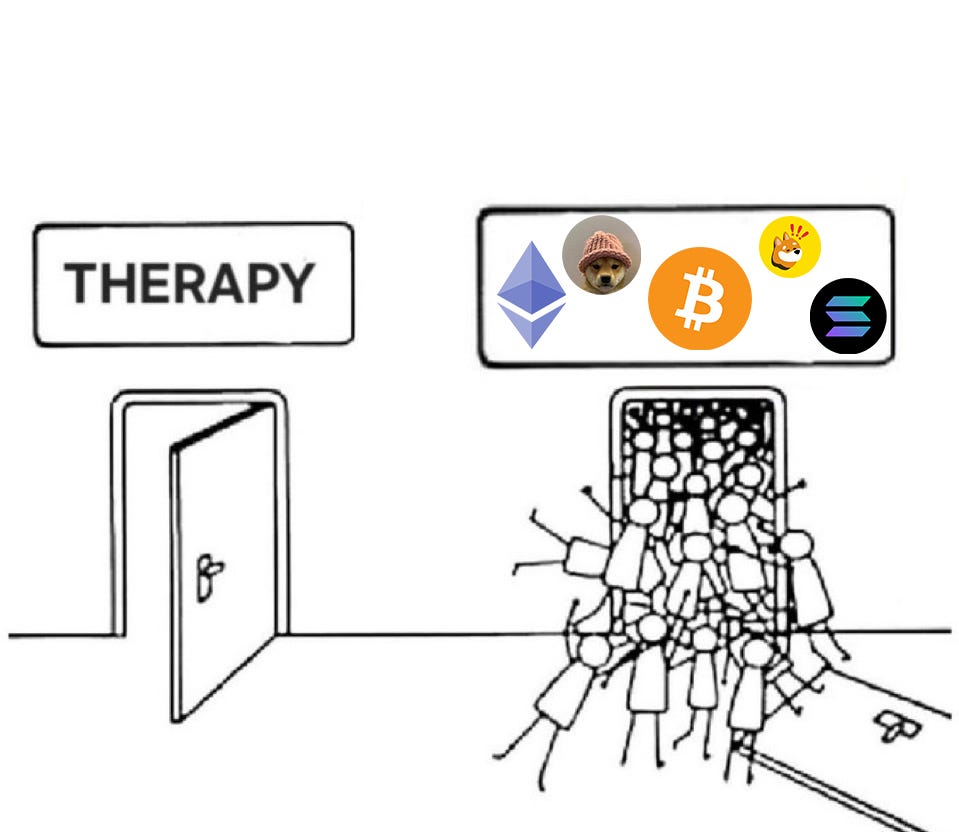

What Do You Meme?

📈 Your Market Update 📉

BTC is up 0.7%, trading at $98,216

ETH is up 0.7%, trading at $3,726

BTC dominance: 52.84%

Crypto market cap: $3.68T

*All data as of today, 08:00 am ET. Source: CoinGecko

Recommended Reads

CoinDesk: Polymarket's Shayne Coplan: He Took Prediction Markets Mainstream

The Block: Here’s what Satoshi said to do if quantum computing cracks Bitcoin

We Are Hiring!

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!