A Presidential Priority 👏

Plus, 🎁 Jupiter rockets upward, 🔥 SAB 121 bites the dust, ⚖️ Senator Lummis takes charge of crypto policy, and more!

Happy Friday! I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

🛡️ Trump makes crypto a national priority

🎁 Jupiter airdrop sees market cap soar

⚖️ SEC scaps SAB 121 rule

💼 Sen. Lummis takes charge of new crypto panel

🚨 Phemex loses millions in hot wallet hack

🌐 Binance Labs gets a new name

Share your vision with Stellar’s Build Better initiative. Help shape blockchain’s future and enter to win from a $30,000 prize pool.

What’s Poppin’?

By Veronica Irwin, Sage D. Young and Tikta

Trump Declares Crypto a National Priority

President Donald Trump declared crypto a national priority in an executive order signed on Thursday and set an intention to evaluate a strategic bitcoin reserve. In recent days, many social media users have speculated that he might establish one.

The order aims to deliver on multiple promises made to the crypto community, starting with some core and strongly held beliefs about coding, self-custody, and fair access to the banking system.

It also establishes an organization named the President’s Working Group on Digital Asset Markets to steward policies that will implement the intentions set forth in the order.

Jupiter’s Airdrop Propels Market Cap 87% Higher

Jupiter, a major decentralized exchange on Solana that has become one of the most closely watched projects in the blockchain’s fast-growing ecosystem, appears to have successfully managed its latest airdrop, increasing its market capitalization by 87% to nearly $3.5 billion.

The airdrop, one of the crypto industry’s biggest this year, started early on Wednesday with an allocation of 700 million JUP tokens to users.

On the first day, traders representing a half-million wallet addresses claimed 251 million JUP worth about $200 million, according to data from blockchain analytics firm Flipside Crypto.

Claims for the highly-anticipated airdrop will remain open until April 30.

‘Bye, Bye SAB 121’: SEC Revokes Controversial Crypto Rules

The U.S. Securities and Exchange Commission (SEC) has canceled Staff Accounting Bulletin 121, an agency rule introduced under former SEC Chair Gary Gensler that the crypto industry had been fighting to overturn.

The core issue with SAB 121 was that it required digital assets under custody to be disclosed as both assets and liabilities on balance sheets, making crypto custody prohibitively expensive for banks.

“Bye, bye SAB 121! It’s not been fun,” SEC Commissioner Hester Peirce wrote on X, referring to newly issued SAB 122, which rescinds the interpretive guidance related to crypto custody.

Acting SEC Chair Mark Uyeda had previously said that SAB 121 should be withdrawn, expressing concern over the fact that it was issued without a commission vote.

Sen. Cynthia Lummis to Chair Digital Assets Panel

Wyoming Republican Senator Cynthia Lummis has been appointed as the first-ever chair of the new Senate Banking Subcommittee on Digital Assets — a move that has convinced many industry watchers that a bitcoin strategic reserve is almost a certainty.

The subcommittee will focus on oversight of federal financial regulators to make sure so-called “Operation Chokepoint 2.0” — which the crypto community has long suspected was a Biden administration policy to discourage banks from servicing individuals and banks affiliated with crypto — is never repeated.

Lummis has emphasized the need for urgent bipartisan legislation to establish a comprehensive legal framework for digital assets and strengthen the U.S. dollar.

The subcommittee's formation aligns with President Donald Trump's recent executive order establishing a presidential working group on digital asset markets.

$30M Drained From Phemex Hot Wallets

Singapore-based crypto exchange Phemex appears to be the first exchange to fall victim to a major hack this year.

Blockchain security firm PeckShield flagged a suspicious outflow of funds from the exchange’s hot wallets on Thursday.

Web3 security auditor Hacken estimated that $30 million worth of USDC, CRV, USDT, AAVE, LINK, PEPE and FET was drained from the exchange.

Phemex suspended withdrawals on Thursday to conduct an emergency inspection.

“We are working on a compensation plan, which will be announced soon,” the team said on X. “Our ongoing business operations are fine. Trading services continue as usual.”

Binance Labs Rebrands to YZi Labz, CZ Takes ‘Active Role’

Binance Labs has rebranded to call itself YZi Labs, with an expanded vision to focus on investments outside crypto and blockchain.

Binance co-founder and former CEO Changpeng Zhao, perhaps better known as “CZ, ”will play “an active role” in investing activities and the renamed business will be led by Ella Zhang, who co-founded Binance Labs in 2018.

The rebranding aligns with YZi Labs' transition into a family office structure. It also plans to refine its incubation program, including the reintroduction of a 12-week in-person residency initiative for project founders.

Zhao was charged last year with violating U.S. securities laws by failing to prevent illegal activity on Binance.

He paid a $50 million fine, served a four-month prison sentence, and agreed to a lifetime ban on working at Binance.

Build real-time, reactive, fully on-chain applications with Somnia: 400,000 TPS, sub-second finality, and sub-cent fees. Perfect for gaming, social, and metaverse builders.

Daily Bits… ✍️✍️✍

💰 Silk Road founder Ross Ulbricht received more than $270,000 in crypto donations a day after his pardon by President Donald Trump, with over 170 Bitcoin transactions sent to his wallet following his 11-year imprisonment for operating the dark web marketplace on which users peddled drugs, guns and illegal services.

⚖️ Indian crypto exchange WazirX won Singapore High Court approval to restructure after a $230 million hack, enabling a meeting with users to finalize fund distribution, with repayment expected within 10 business days if the plan is approved.

📊 Half of TRUMP and MELANIA memecoin holders were new to Solana altcoins, with Chainalysis reporting that most wallets held less than $100 in assets, while a few whales saw profits exceeding $10 million.

🛠️ Decentralized borrowing protocol Liquity launched Liquidity V2 with market-driven borrowing rates and an ETH-backed stablecoin, BOLD, aiming to offer sustainable yields while leveraging “forkonomics” deals to expand across multiple Ethereum virtual machine chains.

📉 Decentralized liquidity protocol THORChain suspended THORFi services amid financial struggles, triggering a 30% drop in Rune’s value as the platform undergoes a 90-day restructuring process to address unserviceable debt and liquidity concerns.

The $$$ Corner…

📈 Ranger Labs, the developer of the encrypted derivatives exchange Ranger Protocol, raised $1.9 million to integrate AI-powered trading into its Solana-based derivatives exchange, expanding its platform, which has already facilitated $25 million in trades since its December launch.

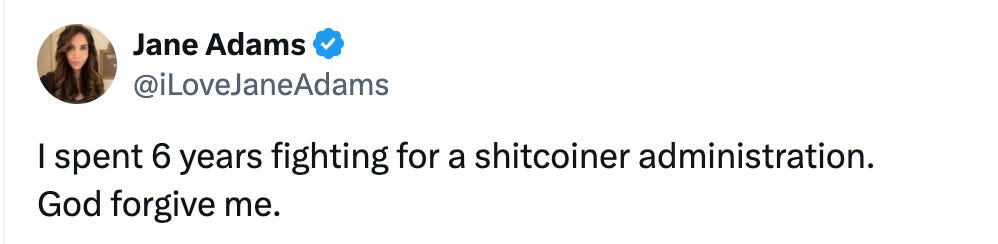

What Do You Meme?

📈 Your Market Update 📉

BTC is up 4%, trading at $105,633

ETH is up 6.4%, trading at $3,414

BTC dominance: 55.07%

Crypto market cap: $3.79T

*All data as of today, 08:05 am ET. Source: CoinGecko

Recommended Reads

DL News: Tornado Cash supporters savour ‘absolute win’ in sanctions case as TORN rally stalls

Mutlicoin Capital: The Solana Thesis: Internet Capital Markets

Messari: PayFi Ecosystem Analysis

We Are Hiring!

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!