After ETH ETFs, What's Next for the SEC?

Weekly News Recap: 🏛️ Terraform Labs Settles with SEC, 🔗 Ethereum ETFs Approved, 💸 Ryan Salame Sentenced, and More!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

If you like Unchained: Refer us with a friend and earn a Premium subscription!

With Ether ETFs in the Works, How Else Might the SEC Pivot on Crypto?

After some big wins for the crypto industry (and big losses for the U.S. Securities and Exchange Commission), Jason Gottlieb, partner at Morrison Cohen, delves into how the upcoming US elections could reshape the SEC’s crypto agenda, the political pressures influencing SEC decisions, and the potential impact that a new SEC Chair could have.

Gottlieb provides insights into ongoing court battles involving major crypto firms like Coinbase and explores the broader political implications of the Democrats’ recent outreach to the crypto industry.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Overcast, Podcast Addict, Pocket Casts, Castbox, Amazon Music, or on your favorite podcast platform. Or watch it on YouTube.

Weekly News Recap

Former FTX Executive Ryan Salame Sentenced to 7.5 Years in Prison

After pleading guilty in September, Ryan Salame, the former co-CEO of FTX Digital Markets, has been sentenced to seven and a half years in prison for making unlawful political donations, defrauding the Federal Election Commission, and conspiracy to operate an unlicensed money transmitting business. Salame, who’s now only 30 years old, was a key figure in the now-bankrupt cryptocurrency exchange FTX, led by Sam Bankman-Fried.

Salame’s sentence includes three years of supervised release and financial penalties exceeding $11 million in forfeiture and restitution. Damian Williams, U.S. Attorney for the Southern District of New York, stated, “Salame’s involvement in two serious federal crimes undermined public trust in American elections and the integrity of the financial system.”

Salame’s conviction follows the March sentencing of Bankman-Fried, who received a 25-year prison term for stealing $8 billion from FTX customers.

Terraform Labs and Do Kwon Reach Settlement With SEC

Terraform Labs and its co-founder Do Kwon reached a "settlement in principle" with the U.S. Securities and Exchange Commission (SEC) over a civil fraud case, according to a court filing. The agreement follows a period of numerous legal battles in jurisdictions around the globe after the collapse of Terra’s $40 billion ecosystem.

The SEC accused Terraform Labs and Kwon of misleading investors about the stability of their products, culminating in the collapse of the algorithmic stablecoin UST in May 2022. Terra/Luna was the first in a series of dominoes to fall across the industry in 2022. In a recent trial, a Manhattan jury found Terraform and Kwon liable for civil fraud in the SEC case.

A court conference on Wednesday confirmed the settlement, with official documentation due by June 12. Kwon, currently out on bail in Montenegro, faces extradition to either the U.S. or South Korea, and criminal charges in both countries.

ETH ETFs Approved, But Staked Ether Could Still Face SEC Scrutiny

The SEC's pending approval of Ethereum spot ETFs seemingly classifies ether (ETH) as a commodity by labeling the ETFs as “commodity-based trust shares.” The approval strengthens the defense of companies like Consensys and Coinbase, who are currently under SEC scrutiny. Sam Enzer of Cahill Gordon & Reindel noted, “The SEC, in approving these ETFs, implicitly acknowledges ether as a commodity, which is inconsistent with treating it as a security.”

However, the seeming shift still leaves unresolved issues in the SEC’s ongoing legal battles with crypto companies, giving the agency room to scrutinize transactions involving ether.

It also doesn’t mean that staked ETH is out of the crosshairs. Despite the ETF approvals, the SEC has not provided clear guidance on staking, an area of concern since Ethereum’s transition to a proof-of-stake model in 2022. Gary Gensler, SEC Chairman, has suggested that staking activities might fall under securities regulations, creating potential legal challenges for the Ethereum Foundation or staking providers like Lido and RocketPool.

Caitlyn Jenner Criticizes Sahil Arora Amid Memecoin Controversy

Caitlyn Jenner has been actively promoting her memecoin, $JENNER, launched on the Solana-based platform Pump.fun. Despite this, she publicly criticized Sahil Arora, who allegedly assisted in the token's launch, accusing him of "f*cking with too many powerful people." Jenner's precise involvement beyond promotion is unclear, sparking speculation about her control over the account. Arora, also linked to memecoin launches for other celebrities like Rich The Kid, faces multiple misconduct accusations.

Solana has seen a surge in celebrity interest, with figures like Davido, Iggy Azalea, Rich The Kid, and Trippie Redd engaging with the blockchain. Davido launched “DAVIDO” on Pump.Fun, generating nearly $50 million in volume within ten hours. Azalea's token, MOTHER, saw its market cap reach $12.57 million with $98.87 million in trading volume in 24 hours. Both Davido and Azalea expressed a desire to responsibly participate in the crypto community.

This trend highlights the growing influence of celebrities on the crypto market and underscores Solana's rising prominence. Pump.Fun, where these tokens were launched, generated $14.12 million in fees over the past month, despite a temporary halt in trading due to a security breach two weeks ago.

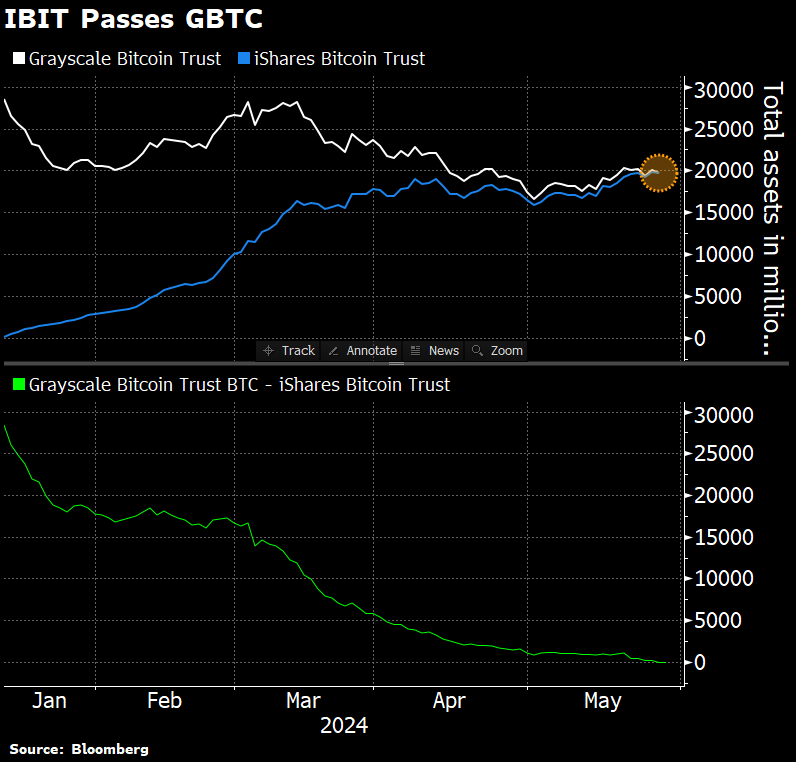

BlackRock’s IBIT Becomes World’s Largest Bitcoin Fund

BlackRock's iShares Bitcoin Trust has surpassed the Grayscale Bitcoin Trust to become the world's largest Bitcoin fund, amassing nearly $20 billion in assets since its launch in January The fund held $19.68 billion as of Tuesday, compared to Grayscale's $19.65 billion, according to Bloomberg data.

A BlackRock spokesperson commented, “The success of IBIT underscores investors' preference to access Bitcoin through the convenience of the ETF vehicle in an institutional-grade product. We remain focused on education for investors and providing access to Bitcoin with convenience and transparency.”

Grayscale has faced outflows of $17.7 billion since the ETFs' debut, partly due to higher fees and arbitrage exits.

DWF Labs to Invest in Memecoins, Shows Strong Interest in LADYS

This week, Web3 investment firm DWF Labs announced it intends to invest in memecoins, indicating a growing interest in this niche area among institutional investors. Managing Partner Andrei Grachev said on social media that the firm is "in talks with a few memecoins and willing to deploy a large amount of funds to let them grow faster and efficiently."

Onchain data reveals DWF Labs’ involvement with LADYS, the memecoin of the Milady NFT ecosystem. A DWF Labs wallet has received substantial sums of LADYS tokens, bridging over $500,000 worth to the Arbitrum network in recent transactions. Additionally, another DWF wallet transferred $5 million USDT to a Milady multisig signer, according to Lookonchain.

Gemini to Return $2.18 Billion to Users

Crypto exchange Gemini will return $2.18 billion to users of its Earn program, 18 months after pausing withdrawals. This follows a significant $2 billion settlement from the New York Attorney General with Genesis, Gemini’s lending partner, aimed at compensating defrauded investors.

Owned by the Winklevoss twins, Gemini notified customers that initial distributions, covering about 97% of the assets owed by Genesis as of November 16, 2022, are now accessible. The company said via email, “This means that if you lent one bitcoin in the Earn program, you will receive one bitcoin back. And it means that you will receive any and all increase in the value of your assets since you lent them into the Earn program.”

The $2.18 billion distribution signifies a 232% recovery for users since the withdrawal halt. The Earn program, launched in 2021, offered high yields by lending user crypto to institutional borrowers through Genesis. However, withdrawals were frozen after Genesis paused loan operations in November 2022 and filed for bankruptcy in January 2023.

Polyhedra and zkSync Clash Over "ZK" Token Ticker

A dispute has arisen between Polyhedra and zkSync over the ticker symbol "ZK," which zkSync wishes to use for its upcoming token generation event and airdrop. Polyhedra, which already uses the ticker, accused zkSync of spreading misinformation and not engaging directly to resolve the issue. Polyhedra argued, “If every project that has issued tokens faces the threat of having its ticker taken by a heavily invested project, the industry will become chaotic.”

Initially, Polyhedra planned to use the ticker $ZKB but switched to $ZK during its March airdrop. The zkSync community had anticipated using the "ZK" ticker, but zkSync did not publicly confirm this until recently. Bybit announced it would change Polyhedra's ticker symbol, though the new symbol remains unspecified. Social media reactions largely support zkSync, with some accusing Polyhedra of trying to preemptively claim the ticker.

The controversy took a turn on Thursday. Leaders from major zero-knowledge (ZK) projects, including StarkWare and Polygon, publicly sided with Polyhedra, condemning Matter Labs' attempt to trademark "ZK" in nine countries. Eli Ben-Sasson, CEO of StarkWare, called the move “an absurd IP-grab,” while Polyhedra co-founder Tiancheng Xie insisted, “ZK should be accessible to everyone, period.”

Mt. Gox Cold Wallet Transfers $9 Billion in Bitcoin

A cold wallet associated with the bankrupt crypto exchange Mt. Gox transferred 141,664 BTC, worth approximately $9 billion, to a new address for the first time in five years, sparking speculation that the estate handling Mt. Gox's bankruptcy may be preparing to distribute funds to creditors.

Mt. Gox, once a leading crypto exchange, collapsed after multiple hacks between 2011 and 2014, leading to its bankruptcy. The process of repaying creditors has been prolonged, with the latest deadline set for October 31, 2024.

Despite the large move of funds, onchain analysts at CryptoQuant aren’t concerned about these coins flooding the market anytime soon. “There is no immediate selling pressure for Bitcoin from these movements as the transfers have occurred within the addresses of the same entity (Mt. Gox Rehabilitation Trustee) and are not still available to the open market,” they wrote in a report.

PayPal USD Goes Live on Solana

Fintech giant PayPal launched its stablecoin, PayPal USD (PYUSD), on the Solana blockchain, aiming to offer users faster and more cost-effective transactions compared to its initial launch on the Ethereum network last year.

Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currency at PayPal, said, “Making PYUSD available on the Solana blockchain furthers our goal of enabling a digital currency with a stable value designed for commerce and payments.” PYUSD will facilitate cross-border transactions, including remittances, leveraging Solana's capabilities for high transaction speeds and low costs.

😂 Fun Bits: How to Pitch the ETH ETF to TradFi

The spot Ether ETF approvals have sparked a conversation on X: how do you pitch Ethereum to TradFi?

Eric Balchunas tackled this challenge by posting a poll on X, asking for the best one-liner to describe Ethereum. The goal? To find a catchy phrase that resonates with the traditional finance crowd, much like "digital gold" for Bitcoin.

The top three responses were programmable money, Digitad oil, and world computer, with “programmable money” taking the top spot with more than 50% of the vote. However, there were also plenty of humorous replies from the Bitcoin maxis, such as "scam," "ponzi," and "digital dog shit," which I somehow don’t think would be too compelling.