Another Bankruptcy? 📉

Unchained Daily feat. Uniswap's trading volume, FTX's contagion, the 'Alameda Gap', and more...

November 16, 2022

On the Pod…

The Chopping Block: Why Lenders Didn't Liquidate Alameda When It Was Underwater

Welcome to The Chopping Block! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra were joined by Laura Shin, CEO of the show, to chop it up about the collapse of FTX. The conversation covered:

Why FTX blew up, and whether it was a Ponzi scheme

How Sam Bankman-Fried became a billionaire

The weird sale of Serum, a project backed by SBF

The lack of proper accounting and security practices in FTX and Alameda, and whether FTX faked its volume figures

How the media and VC culture built SBF's character

How Sam convinced Tom Brady to invest in FTX

Whether Sam’s Effective Altruism caused his mistakes

How FTX's failure will set the crypto industry back

What’s Poppin’?

Liquid Global and Salt Lending Halt Withdrawals After FTX Collapse

by Samyuktha Sriram

Liquid Global and Salt Lending are the latest additions to the FTX contagion, with both platforms halting withdrawals on Tuesday.

Uniswap Beats Coinbase to Become Second Largest Venue for ETH Trading

by Juan Aranovich

Uniswap became the second-largest exchange for Ethereum trading in the last 24 hours. Was FTX the catalyst that DeFi needed?

‘The Alameda Gap’ Sends Crypto Liquidity Plummeting

by Samyuktha Sriram

The absence of Alameda, one of the biggest market makers in crypto, has thinned out liquidity across several exchanges.

FTX Attacker Now Holds $285M of Ethereum

by Samyuktha Sriram

The FTX drainer is one of the largest ETH holders in the world.

Hardware Wallet Ledger Sees Biggest Sales Day After FTX Collapse

by Samyuktha Sriram

Hardware wallets are seeing massive demand after the collapse of centralized trading platform FTX.

In Other News…✍️✍️✍️

Serum (SRM), the token of the Solana-based, SBF-backed DEX protocol, doubled in price on Tuesday.

Authorities in South Korea are pushing for a regulatory framework after the failure of FTX.

The Golden State Warriors will end their $10 million sponsorship agreement with FTX.

Alameda Research owes bankrupt lender Celsius $12 million.

Today in Crypto Adoption...

Businesses that accept Circle’s stablecoin USDC will now be able to interact with Apple Pay.

The Federal Reserve and four other major banks are testing a program to use digital tokens to settle transactions.

The $$$ Corner…

NFT fraud detection startup Yakoa raised $4.8 million in an equity round co-led by Brevan Howard Digital, Volt Capital and Collab+Currency.

Shima Capital led a $2.3 million pre-seed round for Web3 gaming monetization platform PlayEmber.

Brian Armstrong, the CEO of Coinbase, sold over 30,000 Class A Coinbase shares for $1.6 million, according to a filing with the SEC.

Cathie Wood’s fund ARK acquired 315,000 shares in Grayscale’s Bitcon Trust (GBTC).

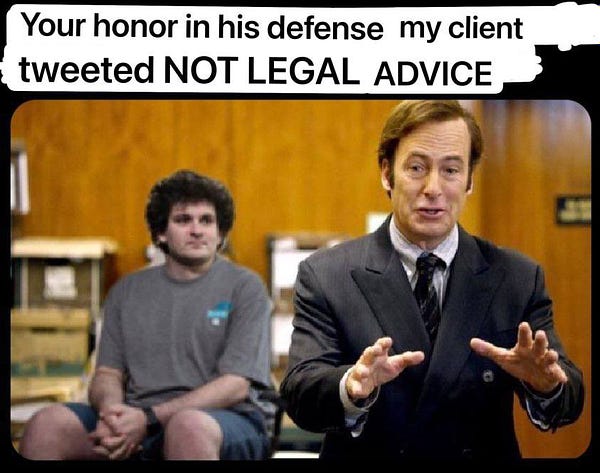

What Do You Meme

Tune in to NPR's "All Things Considered" to hear Laura discuss how FTX’s collapse impacts crypto.

📈 Your Market Update 📉

BTC: $16,720

ETH: $1,229

BTC dominance: 37.12%

Crypto market cap: $865 billion

*All data as of today, 5 am ET

Recommended Reads

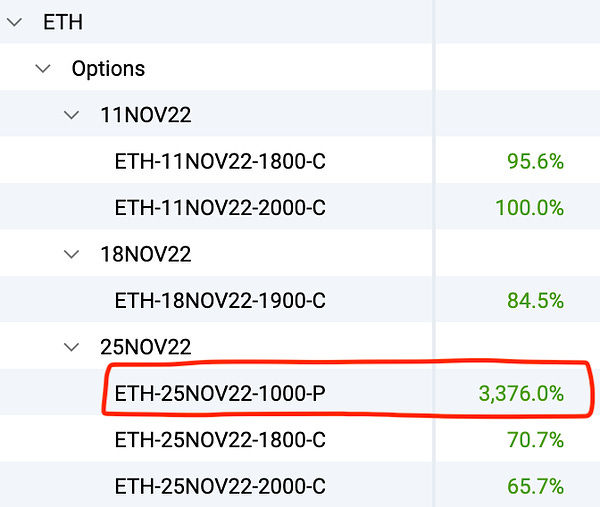

HanSolar on options and how to trade this volatile market:

Jason Choi on SBF and FTX:

Petrify, a web3 analyst, on the moment Alameda started to go wrong:

If you liked what you read:

⛓️ join Unchained Premium to get access to:

Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

A subscriber-only chat group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

Transcripts of all the shows, for subscribers only.

👍 follow me on Facebook, Instagram, Twitter, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze