Arbitrum Lesson: Governance Is Not Easy 🫠

Weekly News Recap: 🎙️ New pod on the US regulatory crackdown, 🗣️ Cobie's tweet on CZ, 💹3AC founders launch exchange, 🐰a surprising Easter egg, and more ❕

Rep. Emmer on Why He Believes Gary Gensler Is a ‘Bad-Faith Regulator’

In this episode of Unchained, Representative and House Majority Whip Tom Emmer talks about the the recent enforcement actions taken by the CFTC against Binance, as well as the SEC's handling of the ‘Coinbase Earn’ product.

Rep. Emmer is not clearly not satisfied with the administration of SEC Chair Gary Gensler, calling him a 'bad-faith regulator.' The Representative also did not hide his philosophical disagreements with US Senator Elizabeth Warren, as he claimed that she has been 'dancing on the grave' of some of the recent banking failures.

Emmer argues that the current regulatory environment is limiting innovation and entrepreneurial activity in the US, and he expresses concern that other countries, such as China, are moving ahead with blockchain and digital currency projects. He also criticizes the upcoming launch of the Federal Reserve payment system FedNow, arguing that the private sector should be handling these types of initiatives. This episode is not to be missed!

Weekly News Recap

Arbitrum Governance Proposal Sparks Controversy

This past week, the Arbitrum team tried, but failed, to pass a controversial proposal.

Arbitrum Improvement Proposal (AIP) 1 aimed to allocate 750 million ARB tokens, valued at around $1 billion, to the Arbitrum Foundation for funding special grants without undergoing a full on-chain governance process. However, over 78% of token holders voted against the proposal.

Then Arbitrum employee Patrick McCorry revealed that the proposal served as a formality to inform the community of decisions that had already been implemented.

On-chain data shows that the Arbitrum Foundation had already used 50.5 million of the proposed 750 million ARB tokens. The Foundation clarified that 10 million ARB was converted to fiat, while 40 million was loaned to a "sophisticated actor" in the space, which appears to be Wintermute, according to Lookonchain.

After facing significant community backlash, the team decided to break down this contentious first proposal into separate ones.

In a new announcement on Wednesday, the Arbitrum Foundation said it would keep the remaining 700 million ARB tokens in its wallet until the decentralized autonomous organization (DAO) approves a budget and lockup schedule.

The Arbitrum debacle was discussed at length in this week’s episode of The Chopping Block. Haseeb Qureshi, host of TCB and managing partner at Dragonfly, suggested that this event will forever change the governance in Arbitrum. He said, “It's a precedent that tends not to go away.”

Crypto Influencer Cobie’s Tweet Kickstarts $50 Million in Liquidations

An encrypted message containing the text "Interpol Red Notice for CZ" sparked a frenzy on social media on Monday, leading to more than $50 million in Bitcoin liquidations.

The message was shared by Crypto Twitter influencer Jordan Fish, aka Cobie, and was encrypted using the SHA-256 cryptographic hash function. Though it is theoretically impossible to decrypt the hash function in a few hours, the meaning behind the message was revealed, igniting rumors of an international arrest warrant for Binance CEO Changpeng Zhao (CZ).

Bitcoin's value subsequently dropped to an intra-day low of $27,414, and over $50 million in BTC liquidations occurred. Binance dismissed the rumor as false, and Cobie later addressed the situation, stating that someone with whom he had discussed the rumor likely leaked the hidden message, causing the chaos. Cobie apologized for the incident and plans to reduce his tweeting in the future.

Despite facing a lawsuit from the U.S. Commodity Futures Trading Commission, on-chain data reveals no sign of investors fleeing Binance, according to a Glassnode report. Although the exchange recorded the largest net outflows in history with negative $295 million in stablecoin outflows per day, its Bitcoin and Ethereum balances remain unharmed. Glassnode analysts commented, "Despite net outflows of stablecoins, the market does not yet appear to be expressing widespread concern about Binance's standing."

Moreover, CoinDesk reported that Binance declined an offer from Tron founder Justin Sun to purchase his stake in competitor Huobi due to its alleged links to China, which Binance wants to distance itself from, according to an anonymous source.

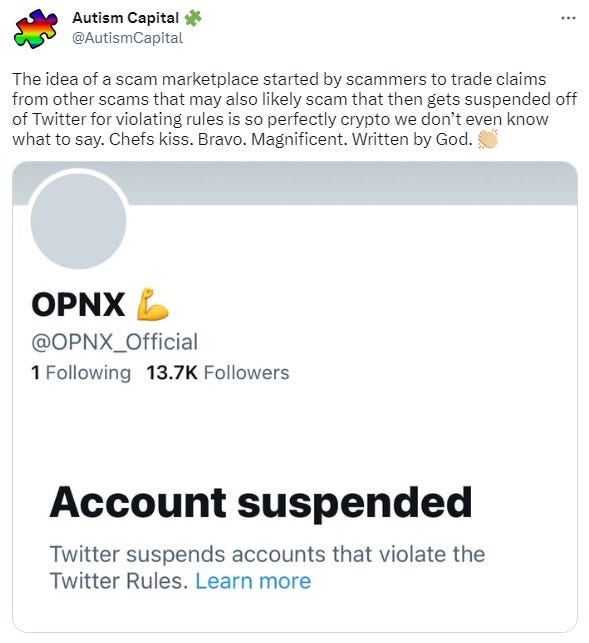

3AC Founders-Led Exchange OPNX Goes Live

The founders of bankrupt crypto hedge fund Three Arrows Capital (3AC), Kyle Davies and Su Zhu, launched a new venture called Open Exchange (OPNX), which offers spot and futures trading of cryptocurrencies and plans to facilitate claims trading for users affected by bankruptcies of crypto trading platforms such as FTX, Celsius, and even 3AC. OPNX's CEO Leslie Lamb stated, "There are over 20 million claimants worldwide for FTX, Celsius, and other platforms that are stuck waiting years just to access their funds."

The exchange saw just $13.64 in trading volume in its first 24 hours, though CEO Leslie Lamb said the firm plans to grow liquidity via an open and transparent market making program.

Despite facing criticism over their failed past ventures, Davies and Zhu appeared undeterred, responding to critics on Twitter, even though the OPNX Twitter account was suspended.

Meanwhile, Mark Lamb, cofounder of CoinFLEX, offered Bitcoin Cash promoter Roger Ver an “olive branch” that includes two years of free trading on OPNX to settle an alleged $84 million debt between them and end their longstanding feud.

Ethereum Projects Want to Prevent MEV

Over 30 Ethereum projects have joined forces to launch MEV Blocker, a tool designed to prevent Maximal Extractable Value (MEV) bots from front-running transactions. Developed by CoW Swap, Agnostic Relay, and Beaver Build, the initiative is supported by several popular Ethereum-based protocols such as GnosisDAO, Balancer, ShapeShift, and ParaSwap.

MEV Blocker routes transactions through a network of searchers, structured to block front-running and sandwich attacks. Users will receive 90% of the profits that searchers bid to back-run transactions, while validators will receive 10% of the profits. MEV bots have reportedly extracted more than $1.38 billion from users, impacting traders, liquidity providers, and NFT minters alike.

By adding the customer Remote Call Procedure (RPC) endpoint to crypto wallets, users can shield their transactions from MEV bots. However, according to Gnosis CEO Martin Köppelmann, transactions may take 10% longer than usual with this RPC.

This initiative comes after a recent incident in which an Ethereum validator successfully front-ran MEV sandwich bots, making off with $25 million in a single block. The validator exploited a relayer bug to force a series of transactions, outpacing the MEV bots. Despite being slashed from the network, the validator's significant profit remains in three wallets. Polygon's chief information security officer Mudit Gupta commented on the situation, stating that the "economic incentives are broken here."

Euler Finance Exploiter Gives Back All the Stolen Funds

And speaking of hacks, at least this one got a happy ending. Following weeks of drama, the hacker behind the largest DeFi hack of 2023 returned all the $200 million in crypto stolen from Euler Finance.

Euler’s team confirmed the recovery of the funds taken during the March 13 exploit. Initially, the hacker seemed unrepentant, but eventually had a change of heart and began returning small batches of the stolen funds through encrypted blockchain messages.

The hacker's tone turned apologetic last week, when they returned 7,000 ETH to Euler with an attached message expressing regret. Identifying themselves as Jacob, the hacker wrote, "I didn't want to, but I messed with others' money, others' jobs, others' lives. I really f**d up. I'm sorry." After returning $120 million of the stolen funds, Jacob stated their intention to return the remaining funds "ASAP" while ensuring their own safety.

U.S. Treasury Department Issues a Report on DeFi

The U.S. Treasury Department has turned its attention to the decentralized finance (DeFi) sector, releasing its first-ever report on illicit finance risks associated with the industry.

The 42-page document highlights that DeFi services are being exploited by various bad actors, including cybercriminals, ransomware attackers, and the Democratic People's Republic of Korea, to launder and transfer illicit funds. Although DeFi services are subject to the Bank Secrecy Act, many are not complying with Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) obligations, the report says.

However, the report also acknowledges that, when compared to government-issued or fiat currency transactions, illicit activities in DeFi and crypto remain relatively small in volume and value.

Binance.US Still Can’t Acquire Voyager

A federal judge in New York, Jennifer Rearden, put the $1 billion deal between Binance.US and bankrupt crypto lender Voyager Digital on hold, citing a "substantial case on the merits" from the U.S. government.

The government's objections claim that the contract would effectively protect Voyager from breaches of tax or securities law. Voyager and its creditors face potential losses of $100 million if the legal disputes aren't resolved by April 13. Delays could also cost $10 million per month and leave over 1 million Voyager customers unable to access their savings.

The deal, approved by U.S. Bankruptcy Judge Michael Wiles in March, allows Binance.US to withdraw if the agreement isn't closed within four months. Despite the Securities and Exchange Commission's concerns about the Voyager token VGX potentially being an unregistered security, Wiles dismissed the agency's arguments.

P2P Bitcoin Marketplace Paxful Shuts Down

Paxful, a peer-to-peer Bitcoin marketplace, suspended operations, citing key staff departures and a lawsuit filed by co-founder Artur Schaback against CEO Ray Youssef and the company.

Youssef asked users to withdraw their funds and consider alternative payment applications like Noones, a peer-to-peer Bitcoin super app. He claimed that Schaback's litigation team drove away senior staff, leaving Paxful with no engineers, compliance, or security personnel.

Youssef explained that "all customer funds are accounted for" and urged users to "self-custody." Despite some users experiencing difficulties withdrawing funds, Youssef promised that "funds are safe and they will clear soon." With the platform's closure, Paxful's wallet remains operational for users to safely retrieve their funds.

Coinbase Insider Trading Case Might Reach a Settlement

The SEC is reportedly close to settling an insider trading case with former Coinbase employee Ishan Wahi and his brother, Nikhil Wahi. A joint court filing revealed that the SEC has "an agreement in principle with Ishan Wahi to resolve all of the SEC’s claims" and is in "good faith discussions" with Nikhil Wahi.

Ishan had earlier sought to dismiss the civil charges but pleaded guilty in February to related criminal wire fraud charges. The case alleges that the Wahis and their friend Sameer Ramani made at least $1.1 million in illicit profits by trading tokens before Coinbase announced their listings. The settlement requires approval by SEC Chair Gary Gensler, and four other commissioners.

FUN BITS

Hidden in Your Mac … The Bitcoin White Paper

What’s been hidden inside every MacOS version since 2017, from Mojave to Ventura? Of course, it’s the Bitcoin whitepaper.

A user by the name of bernd178 first discovered this back in April 2021, buried within the Image Capture Utility's Virtual Scanner II function. Alongside a nondescript image of a San Francisco bay lies a PDF copy of Satoshi Nakamoto's Bitcoin white paper. Recently, blogger Andy Baio re-discovered this crypto easter egg and shared it on his blog, Waxy.

Baio wrote: “Of all the documents in the world, why was the Bitcoin white paper chosen? Is there a secret Bitcoin maxi working at Apple?"

What Would You Pay for Crypto Bankruptcy Claims?

Ginny Hogan of Unchained has her take on the launch of Open Exchange

If you enjoyed this, don’t forget to follow Unchained on all social media platforms. Find the links below ⬇️

🔗Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze