Could FTX Be Revived?

Weekly News Recap: 😱 FTX might reboot, SBF says he's innocent 😇 again, ❌ Genesis is close to go bankrupt, 🤑 3AC founders raise funds for new exchange, 😂 a not-so-major action, and more!

Wait, why am I receiving two emails in one day?

On Unchained, we run two newsletters: Unchained Daily, which goes from Monday through Saturday, and Unchained Weekly (this one!), which recaps all the major crypto news of the past week. (It’s narrated on the podcast, so if you’re looking for the links to the stories heard on the show, they’re all in here!)

If you want to receive only one of the newsletters (for example, receive the daily and not the weekly, or vice versa), just go here and select whichever you want!

Why Crypto Developer Activity Continues to Grow Despite the Bear Market

While 2022 was a bleak year for crypto prices, one bright spot was that developer activity grew. “Prices today are back at where they were roughly in January, 2018 levels, but developers have increased by 297%,” said Maria Shen, partner at Electric Capital, on Friday’s episode of Unchained.

The annual Electric Capital developers report offers an indication of how the technical side of the ecosystem is growing irrespective of price. While it is true that in the second half of 2022, as crypto collapses and bankruptcies grew, there was a drop in the number of developers, the year still showed 5% overall growth. And certain ecosystems, especially Ethereum’s seem especially resilient.

Shen unpacks the many fascinating findings of the report — including the surprising numbers around what happened to Terra’s developers after the blockchain collapsed. Be sure not to miss this episode to see into the future direction of the industry.

Weekly News Recap

New FTX Leadership Is Considering Reviving the Exchange

According to The Wall Street Journal, the new leader of the failed cryptocurrency exchange FTX, John Ray III, announced that he has established a task force to investigate possibly restarting the platform.

In an interview for Unchained Premium two weeks ago, Sunil Kavuri, an FTX creditor, claimed most of the creditors were in favor. The idea was also mentioned in an Unchained episode with Thomas Braziel and Wassielawyer.

Ray said, "everything is on the table" as FTX explores the options for reviving the exchange. This includes examining whether relaunching FTX's international exchange could potentially provide greater recovery for customers than liquidating assets or selling the platform.

Currently, the market for bankruptcy claims on FTX's crypto deposits is not optimistic about their value. Data from Xclaim shows that FTX claims are selling for 15.5% of the face value of account balances.

However, this week, the FTX Debtors group, represented by law firm Sullivan & Cromwell, revealed that it has identified $5.5 billion of liquid assets, which includes $1.7 billion of cash, $3.5 billion of crypto assets, and $300 million of securities. It is worth noting, however, that the firm is counting FTT, FTX’s exchange token, as a liquid asset, which is somewhat questionable.

Moreover, in order to repay creditors, the company has been granted permission to sell some of its assets, including its subsidiaries LedgerX, Embed Technologies, FTX Japan and FTX Europe.

Sam Bankman-Fried Reiterates FTX.US Is Solvent as SEC Charges Him With Fraud

Former FTX CEO Sam Bankman-Fried is disputing claims made by Sullivan & Cromwell that the exchange has a substantial shortfall. In a post on his recently launched Substack newsletter, Bankman-Fried asserted again that FTX.US is solvent, and that the numbers presented by Sullivan & Cromwell do not accurately reflect the exchange's financial status. He provided an Excel spreadsheet that he created as evidence, which he claims shows that customer balances, bank balances, and net asset value have been understated by the litigation firm.

On Thursday morning, the Securities and Exchange Commission filed charges against Bankman-Fried for allegedly defrauding equity investors in the platform.

The SEC's complaint alleges that SBF orchestrated a years-long fraud to conceal from FTX's investors the undisclosed diversion of customer funds to his privately held crypto hedge fund, Alameda Research, as well as the special treatment afforded to Alameda on FTX.

The complaint seeks injunctions against future securities law violations, disgorgement of ill-gotten gains, a civil penalty and an officer and director bar. The SEC's ongoing investigation is being conducted in conjunction with the U.S. Attorney's Office and the Commodity Futures Trading Commission.

FTX Roundup

In other FTX news…

A week after the new management of FTX requested all political donations to be returned, CoinDesk reported that 196 members of the new Congress -- roughly one-third of the total -- took cash from the former FTX CEO and other senior executives. Only 27% responded to queries about what they planned to do with the money.

In a Twitter thread, former president of FTX.US, Brett Harrison, claimed that Bankman-Fried showed emotionally volatile behavior and avoided conflict, ultimately leading Harrison to leave the company.

A coalition of major news outlets submitted a petition to the court handling the FTX case, requesting the release of the identities of the individuals, besides his parents, who signed Bankman-Fried's $250 million bail bond. The media outlets include the Associated Press, Bloomberg, the Financial Times, CNBC, Reuters, Insider, and the Washington Post's publisher, who argue that it is in the public interest to know who is financially backing Bankman-Fried.

Genesis May Soon File for Bankruptcy

Major crypto lender Genesis Global Capital, part of the Digital Currency Group conglomerate, is expected to file for Chapter 11 bankruptcy as soon as this week, according to Bloomberg.

According to sources familiar with the situation, creditors of Genesis are currently in negotiations regarding a potential bankruptcy filing. The negotiations involve a prepackaged bankruptcy plan in which creditors agree to a forbearance period of one to two years. In exchange for this agreement, creditors would receive cash payments and equity in DCG.

Scott Johnson, a finance lawyer, said: “Prepack[aged] bankruptcy would almost certainly mean little to no market impact and a very quick process. About as good a resolution as one would hope for.”

The company froze customer redemptions on November 16, following the downfall of FTX, and this week, it informed its shareholders that it will be suspending its quarterly dividend payments until further notice.

As the crisis has come to a head, a lawsuit seeking class-action status was filed against Tyler and Cameron Winklevoss and their exchange Gemini for allegedly defrauding investors by falsely advertising unregistered securities. This lawsuit comes after the SEC charged Gemini and Genesis with offering unregistered securities last week.

Meanwhile – popping up, as he is wont to do in situations like these – Tron CEO Justin Sun revealed in an interview with Reuters that he is open to investing up to $1 billion in the acquisition of certain assets of DCG.

CoinDesk Explores Potential Sale

The Wall Street Journal reported that CoinDesk, the media company owned by DCG, enlisted the help of investment bank Lazard to explore potential options for the company, including a full or partial sale. In a statement, CEO Kevin Worth revealed that the company has received many inquiries and expressions of interest in recent months, leading to the engagement with Lazard and the exploration of a potential transaction.

Silvergate Reports Significant Losses

Silvergate, the crypto-focused bank that has been under the spotlight for its involvement with FTX, reported a net loss of $1 billion in the fourth quarter of 2022.

The dire earnings report shows the extent of the impact on the digital asset industry from the downfall of FTX, which spurred Silvergate customers to withdraw $8 billion from the bank in Q4.

The bank also said it would take an impairment charge of $196 million in assets. Silvergate CEO, Alan Lane, stated that the bank was in the process of evaluating its product portfolio and customer relationships with a focus on profitability.

3AC Founders Plan to Build New Exchange for Crypto Bankruptcy Claims

The former founders of the now-defunct Three Arrows Capital, Kyle Davies and Su Zhu, are trying to make a comeback. The duo is looking to raise $25 million in seed funding for a new crypto bankruptcy claims exchange that they initially proposed be called "GTX." The name, as per the leaked pitch deck, was chosen "because G comes after F," though after the name was ridiculed, they backtracked.

The exchange aims to fill the power vacuum left by FTX and aims to dominate the market within 2-3 months of going live. The platform plans to offer a solution for trading claims for users who have funds stuck on FTX, Celsius, BlockFi and even Mt. Gox. The team estimates a claims market size of $20 billion based on FTX users caught in bankruptcy proceedings.

The fact that the founders of 3AC, which also filed for bankruptcy, are now looking to raise funds for a new venture has been met with mixed reactions, with some in the crypto community questioning the ethics of the move.

Wintermute CEO Evgeny Gaevoy warned that anyone investing in this new venture would find it hard to work with his company in the future.

Crypto Markets Recover Post-FTX Losses

The markets are experiencing a much-needed relief rally.

Bitcoin is trading at around $21,000, a price point even higher than before the collapse of FTX. In the last 30 days, BTC is up 25%. Meanwhile, ETH, the second largest cryptocurrency by market cap, has risen 30% in the same period and is trading above $1,500.

Metaverse-related tokens outperformed the markets last month, with GALA and MANA jumping over 100%. Moreover, as the Ethereum Shanghai upgrade comes closer, liquid staking derivative tokens are benefiting, with Lido’s LDO and RocketPool’s RPL increasing by 107% and 75% respectively.

The SEC Sets a New Record of Enforcement Actions

According to a new report from consulting firm Cornerstone Research, in 2022, the SEC initiated a record number of 30 enforcement actions related to crypto – a 50% increase from the previous year.

However, the entity led by Gary Gensler is getting some backlash.

Grayscale, the issuer of GBTC whose parent company is DCG, submitted a new court filing criticizing the SEC for denying its application for a spot Bitcoin ETF, calling the regulator's central premise “unreasonable.”

What’s more, the American CryptoFed DAO, which the SEC is trying to prevent from registering and selling tokens, stated that the regulator has not been responsive to its complaints. The DAO claims to have attempted to engage in dialogue with the SEC regarding the November stop order, but it says its inquiries have not been addressed.

Nexo Denies Accusations of Money Laundering

Cryptocurrency lender Nexo (disclosure: a former sponsor of Unchained) denied the accusations against it by the Bulgarian Prosecutor's Office, following the arrest of four individuals last week as part of an ongoing investigation into the company.

According to the prosecutor’s office, the suspects are believed to have laundered money through Nexo and concealed it from Bulgarian authorities. They are also suspected of tax crimes, computer fraud, and providing unlicensed banking services through the platform

Fun Bits

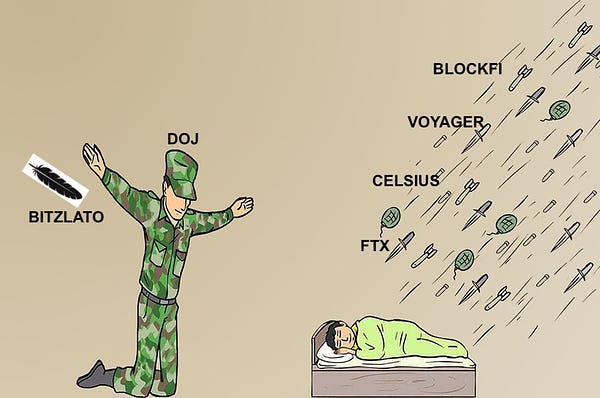

DOJ’s ‘Major Action’ Falls Flat

On Wednesday, the Department of Justice had the crypto community on the edge of its seat with an announcement of a "major international crypto enforcement action." The community was buzzing with speculation. But … drumroll please... they took down Bitzlato, a relatively unknown crypto exchange that was processing $700 million in illicit funds.The founder, Anatoly Legkodymov, was arrested in Miami, Florida.

Now, before you start stocking up on canned goods and preparing for the apocalypse, let me tell you, this is not the end of days. The crypto community was getting ready for a major showdown and what they got was a tiny little exchange that most had never even heard of.

🔗Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze

https://www.reddit.com/r/Superstonk/comments/10gl6fz/ftx_bombshell_former_ftx_lawyer_daniel_friedberg/j53dbez/