Did LayerZero Triumph Over Sybils With Its Airdrop? 🪂

Weekly News Recap: DJT token drama, 🔍 CFTC probes Jump Crypto, 💥 Kraken's extortion claim, and more!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

If you like Unchained: Refer us with a friend and earn a Premium subscription!

LayerZero Fought the Sybils and Airdropped Its Token. Did the Team Win?

LayerZero’s token claims went live on Thursday, and as with every recent airdrop, there was plenty of controversy.

In this episode, Bryan Pellegrino, cofounder and CEO of LayerZero Labs, joined to discuss their ambitious anti-Sybil campaign and the subsequent token distribution. He delved into the challenges of ensuring genuine user participation, the decision to offer a self-report option for Sybil attackers, and the complexities imposed by industrial-grade farmers. Bryan shared what he would have done differently and why a mandatory donation to Protocol Guild was imposed.

Also, are airdrops dead? How can the industry improve this not-so-effective distribution method?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Overcast, Podcast Addict, Pocket Casts, Castbox, Amazon Music, or on your favorite podcast platform. Or watch it on YouTube.

Weekly News Recap

Martin Shkreli Admits to Creating Controversial Trump-Linked DJT Token

Martin Shkreli, the former pharmaceutical executive who was convicted of securities fraud for misleading investors, confessed to co-creating the Trump-themed DJT memecoin, sparking controversy in the crypto community.

Initially denying involvement, Shkreli claimed to have created the token with Barron Trump, who is Donald Trump’s son, during a widely attended X spaces on Tuesday, following an intense investigation by blockchain sleuth ZachXBT and crypto trader GiganticRebirth (GCR).

The drama began when the DJT token, which was rumored to be officially endorsed by the Trump family, started to gain significant attention. Shkreli initially denied any association with the token, despite evidence proving otherwise. This led to a $100 million bet by GCR, challenging the token's authenticity. GCR, a known Trump supporter, wagered that the DJT token was not officially endorsed by Donald Trump or his family.

Onchain sleuth ZachXBT solved the case, submitting evidence to Arkham Intelligence who had offered a $150,000 bounty to whoever identified the token’s creator. Shkreli then confessed, providing ZachXBT with over 1,000 pieces of evidence that he had created the token with Barron Trump.

CFTC Investigates Jump Crypto Amid Regulatory Scrutiny

On Thursday, Fortune reported that the Commodity Futures Trading Commission (CFTC) is investigating Jump Crypto, a division of the Chicago-based trading firm Jump. The probe focuses on the firm's trading and investing activities in the crypto sector, according to an insider. This investigation follows a series of setbacks for Jump Crypto, known for its algorithmic trading and market-making in the crypto industry.

Jump Crypto gained prominence in 2021, led by Kanav Kariya, a former intern turned president of Jump’s Crypto division. The firm was a key market maker and investor in crypto projects, including Wormhole and Pyth. However, Jump faced challenges, such as a $325 million hack of Wormhole and losses from the FTX collapse. The CFTC's inquiry adds to previous regulatory attention, including SEC and Justice Department cases involving Jump's crypto dealings.

SEC Concludes Ethereum 2.0 Investigation

In a significant development for the industry, Ethereum software firm Consensys announced that the U.S. Securities and Exchange Commission (SEC) concluded its investigation into Ethereum 2.0, which refers to when the Ethereum blockchain switched from proof-of-work to proof-of-stake consensus mechanism. The decision to close the investigation marks a substantial victory for Ethereum and its supporters.

Consensys revealed that the SEC’s enforcement division notified the company of the investigation's closure, describing the outcome as a "major win" for developers and industry participants. The decision to close the investigation follows Consensys’ letter to the SEC on June 7, which sought clarification on ether's status in light of the approval of spot ether ETFs where the funds are listed as “commodity-based trust shares” in the ETF issuance order.

Consensys also filed a lawsuit against the SEC in April, challenging the agency's categorization of ether as a security. The lawsuit highlighted the company's struggle for regulatory clarity, arguing that ether should be treated as a commodity.

Kraken Accuses CertiK of Extortion in $3 Million Bug Exploit

Major crypto exchange Kraken has accused security firm CertiK of extortion after a bug exploit led to the withdrawal of nearly $3 million from the exchange’s treasury. Kraken's chief security officer, Nick Percoco, revealed that a critical bug discovered on June 9 allowed users to artificially inflate their account balances without completing deposits.

CertiK initially reported the bug and credited their account with $4, they allegedly informed two others who then exploited the flaw further. Kraken requested the return of funds, but CertiK reportedly demanded Kraken disclose the potential impact of the bug before complying, which Percoco labeled as “extortion” on X.

While Percoco did not initially name the security firm involved, it was revealed when CertiK defended its actions on X, stating it was given insufficient time to return the funds and accusing Kraken of threatening its employees. CertiK maintained that its actions were part of an investigation into Kraken’s security vulnerabilities.

Nasdaq Files Combined BTC/ETH ETF; While Ethereum ETF Issuers Respond to SEC

On Tuesday, Nasdaq filed for the first combined Bitcoin and Ethereum ETF, managed by Hashdex, with allocations of around 70% to Bitcoin and 30% to Ethereum, which is based on the relative free float market capitalizations of Bitcoin and Ethereum.

Nate Geraci, president of the ETF Store, expects future ETFs to use similar allocation strategies, reflecting market conditions and manager preferences. These combined ETFs offer investors diversified exposure to the cryptocurrency market.

Simultaneously, prospective Ethereum ETF issuers are addressing feedback from the U.S. SEC on their S-1 forms, according to The Block. Sources described the comments as "light" and "reasonable," with issuers aiming to submit revised forms by Friday. Following the approval of their 19b-4 forms in May, issuers hope for the effective approval of their S-1 forms soon, potentially leading to product launches by July.

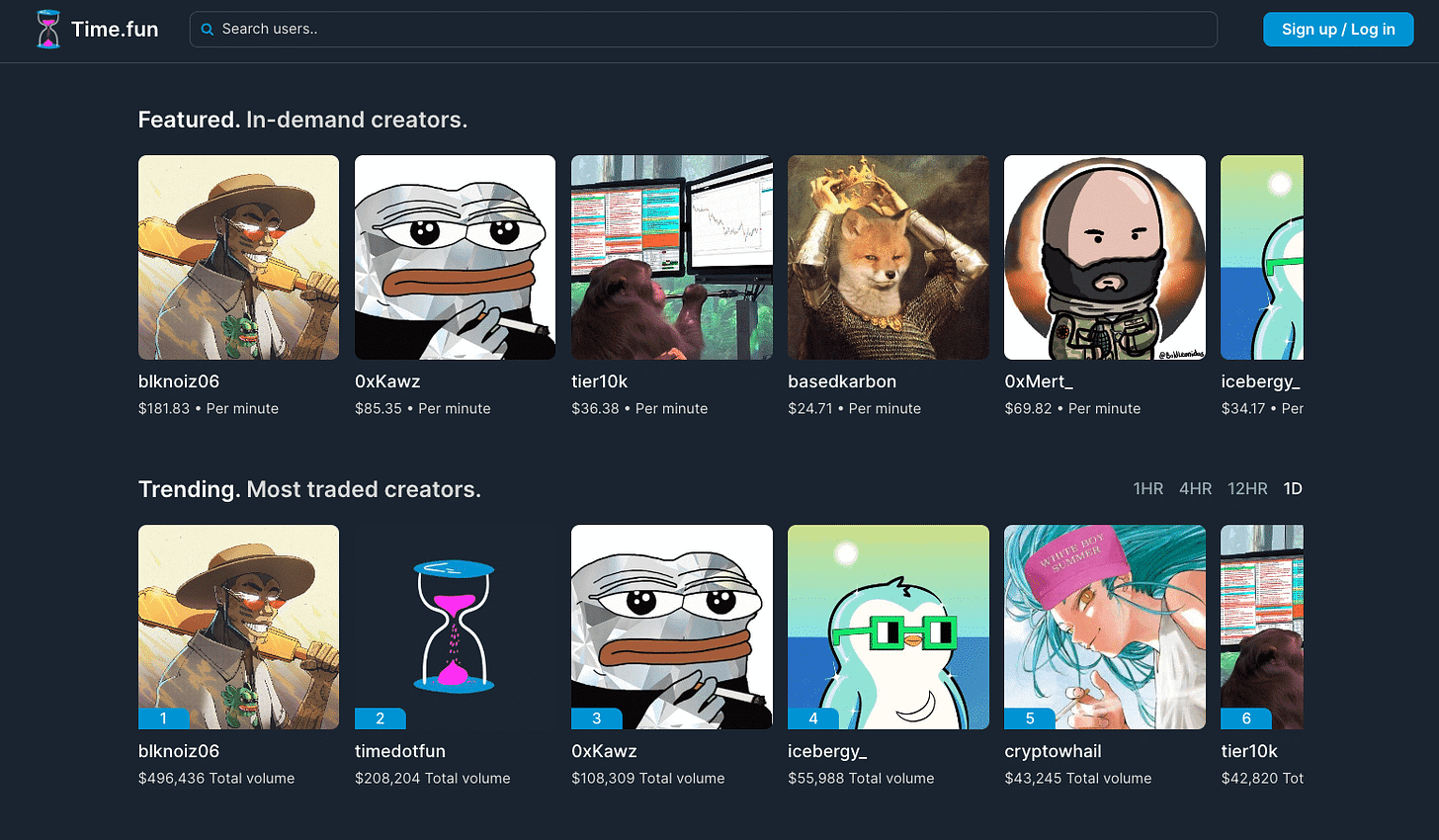

New Social Platform Time.Fun Captivates Crypto Community

A new social platform, Time.Fun, is grabbing the attention of the crypto community. Launched on Base, a layer 2 blockchain network incubated by Coinbase, Time.Fun has already generated over $1 million in trading volume and attracted notable figures like memecoin trader Ansem and Mert Mumtaz, who is the co-founder of Solana developer platform Helius.

Backed by crypto accelerator AllianceDAO, Time.Fun allows users to tokenize their time. According to Time.Fun’s founder, @0xKawz, each token represents a minute of a user’s time, enabling users to trade these tokens, book one-on-one sessions, and interact with creators. "Tokenizing the most valuable asset someone can own, which is their time," is the platform's core vision, they explained.

Ethena Updates Tokenomics, Mandates Locking of Airdropped ENA Tokens

Ethena, the synthetic dollar protocol on Ethereum, has introduced controversial changes to its governance token ENA's tokenomics. Recipients of ENA airdrops are now required to lock up 50% of their tokens within Ethena, Pendle Finance, or generalized restaking pools.

Ethena Labs explained that these changes aim to better align the use of its USDe stablecoin with the ENA token. Despite the potential yields from new staking options, the forced lock-up has sparked backlash. Pseudonymous user @DarkCryptoLord on X criticized the protocol asking, "What’s the point of a governance token?" While DeFi educator John Galt added that forcing holders discredits the reliability of all future ENA airdrops.

Ethena responded, stating the goal is to shift ENA holders from "mercenary capital to long-term aligned users," and assured that forfeited tokens would solely benefit ecosystem-aligned users, not the team or investors.

ZkSync Airdrop Trades Below Expectations as Users Sell Off

ZkSync's highly anticipated airdrop went live on Monday, with users claiming over 2.62 billion ZK tokens worth approximately $630 million in the first ten hours. Despite the initial excitement, the token traded below expectations, opening at around 30 cents and dropping 27% to 22.8 cents.

About 40% of the top 10,000 addresses sold their entire airdrop allocation, according to Nansen. Many crypto projects that have recently conducted airdrops have fallen victim to “mercenary airdrop farming,” leaving industry leaders questioning what is next for airdrops.

In related news, EigenLayer initiated the second phase of its EIGEN token airdrop on Wednesday, expanding the total distribution to nearly 113 million EIGEN tokens, which is 6.75% of its total supply. This phase targets users who interacted with DeFi and Liquid Restaking Token protocols before March 15.

SEC Opposes Ripple's Effort to Reduce $2 Billion Fine

The SEC has pushed back against Ripple's attempts to lower a proposed $2 billion fine for selling XRP to institutional investors. The SEC argued that Ripple's comparison to a recent Terraform Labs settlement is flawed since Terraform is bankrupt and in the process of winding down operations, while Ripple is not agreeing to any similar relief.

Ripple, in its June 13 filing, argued that its fine should not exceed $10 million, citing differences in fraud allegations and penalty calculations. The SEC countered that the circumstances and financial metrics of the two cases are not directly comparable.