Dominos Keep Falling ⏳💣

FTX claims another victim, Maker DAO rejects a $500 million proposal, Compound updates its rules, wrapped tokens crisis, Aave goes through big changes, and more...

On the Pod…

'The Last Big Whale': Why the Crypto Contagion of 2022 Eventually Hit Genesis

Michael Jordan, founder at DBA and former co-head of investments at Galaxy Digital, and Alex Pack, managing partner at Hack VC, talk about the potential insolvency of Genesis and DCG, the cycle of credit expansion, and the importance of DeFi to prevent these situations. Show highlights:

what will happen with Genesis and its parent company DCG

where the insolvency of Genesis might have come from

how the expansion of crypto lending in 2021 is impacting the markets and the role the Fed played in this expansion

how the Terra collapse kickstarted a ton of contagion effects in crypto companies

Alex's story of why he did not invest in Alameda in 2018

whether it is possible to prevent the "FTXs of the future"

the importance of assessing the quality of collateral assets

the story of when SBF called DeFi a "Ponzi black box"

the mystery of where FTX Ventures got the $2 billion it planned to invest

What’s Poppin’?

Crypto Lender BlockFi Files for Bankruptcy as FTX’s Contagion Effects Continue

by Juan Aranovich

BlockFi filed for bankruptcy in the United States, becoming the latest victim of this crypto winter. How did it reach this point?

DCG and Genesis’s Can’t Sell ‘Highly Illiquid’ GBTC Shares: Messari Founder

by Samyuktha Sriram

Certain public market rules means that DCG and Genesis cannot sell their GBTC shares with ease, according to Messari’s Ryan Selkis.

Wrapped Crypto Tokens in a ‘Confidence Crisis’: Kaiko Research

by Samyuktha Sriram

A continued discount on Wrapped Bitcoin (WBTC) – the largest wrapped version of Bitcoin – has market participants on edge.

MakerDAO Votes to Increase DAI Savings Rate

by Samyuktha Sriram

MakerDAO’s community is currently voting to increase the savings rate for its stablecoin DAI to as much as 1%.

Aave Freezes 17 Low-Liquidity V2 Pools and Votes to Migrate 26 Assets to Ethereum V3

by Samyuktha Sriram

The Aave community has voted to freeze 17 relatively illiquid pools on the protocol in the interest of risk management.

Compound Finance Slashes Borrow Caps for 10 Markets

by Samyuktha Sriram

DeFi lending platform Compound Finance has restricted the maximum amount that can be borrowed on ten tokens.

In case you or someone you know still has Qs about crypto...

Tomorrow 11/30, Laura will chat with TED's Simone Ross about all things crypto you're wondering about!

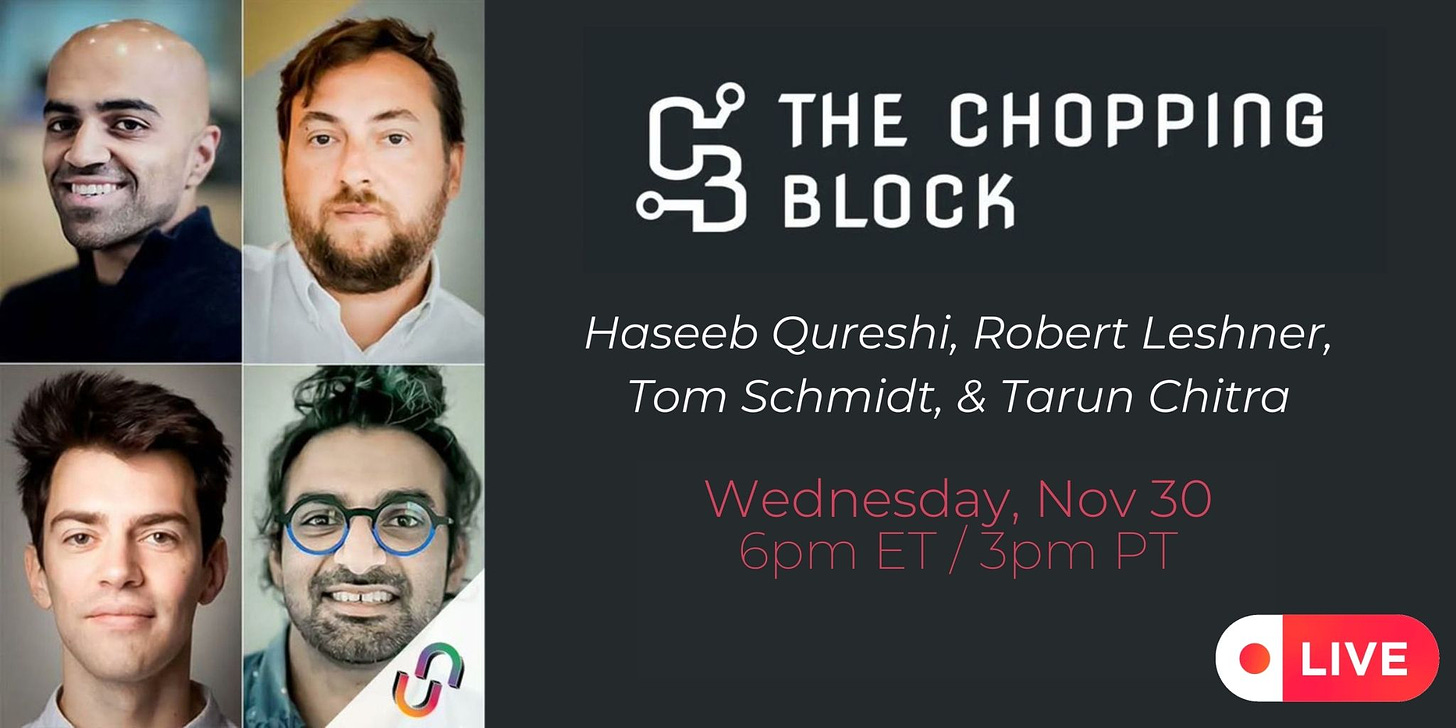

Join The Chopping Block's live stream tomorrow on YouTube at 6pm ET/3pm PT!

In Other News…✍️✍️✍️

The House Financial Services Committee will hold its first FTX hearing on Dec. 13.

BlockFi sues Sam Bankman-Fried over Robinhood shares.

President of TIME Keith Grossman joined crypto payments infrastructure firm MoonPay as president of enterprise after three years at the media firm.

Crypto wallet ZenGo found that users left $27 million of funds unclaimed in Polygon bridge.

Major crypto exchange Kraken settled Iran sanctions violations with the U.S. Treasury.

Despite the FTX collapse, JPMorgan believes that centralized exchanges will continue to control the majority of global digital-asset trading volumes.

Crypto exchange Coinbase makes new hires to strengthen its position in Europe.

Japanese social media firm Line shuts down Bitfront, its American crypto exchange.

Today in Crypto Adoption...

Following an announcement earlier this month, Fidelity opened up retail crypto trading accounts.

The $$$ Corner…

Web3 gaming-focused DAO Game7 launched a $100 million grant program to boost blockchain-enabled games.

What Do You Meme

📈 Your Market Update 📉

BTC is up 1.79%, trading at $16,497

ETH is up 3.85%, trading at $1,214

BTC dominance: 36.6%

Crypto market cap: $866 billion

*All data as of today, 5 am ET

Recommended Reads

Degentrading on why GMX, a DeFi protocol, could fail:

AI N on frequent batch auctions:

Aylo, founder of Alpha Please, on the state of Arbitrum:

⛓️ Join Unchained Premium to get access to:

Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

And now, a new offering: transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Facebook, Instagram, Twitter, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze