FTX Faces Lawsuit; Avi Eisenberg Is Arrested

Weekly News Recap: Martin Shkreli on SBF's new judge, FTX's lawsuit, Avi Eisenberg's arrest, the lawsuit against Gemini, NFT projects leaving Solana, and a funny video about SBF!

Wait, why am I receiving two emails in one day?

On Unchained, we run two newsletters: the daily ones, which go from Monday through Saturday, and the weekly (this one!) which recaps all the news in the crypto ecosystem in the past week. (It’s narrated in audio form on the podcast, so if you’re looking for the links to those stories heard on the show, they’re all in here!)

If you want to receive only one of the newsletters (for example, receive the daily and not the weekly, or vice versa), you can 100% do it.

How? Just go here and select whichever you want!

Why Martin Shkreli Thinks SBF’s New Judge Could Still Be Lenient

I didn't expect that my interview with Martin Shkreli last week would go so viral that it would get covered in TMZ, The Daily Mail, and The New York Post (the last of which I have written for!), but 2022 has been full of twists and turns for all of us.

My favorite was the endorsement from Tyler Cowen, who called it the best podcast he’d heard all year.

After the interview was published, however, news broke that the judge in the case, Ronnie Abrams, was recusing herself because her husband’s law firm had worked with FTX.

This week, I invited Shkreli back to get his analysis of the new judge, Judge Lewis Kaplan, who he also views as fairly positive for Sam — despite his “ill temper.”

We dive into Judge Kaplan’s sentencing history, his unusual work history, plus explore the various potential next developments in the case, starting with SBF entering a plea next week.

Martin explains why he is 99.99% sure that SBF will start with a not guilty plea — even if he has decided he will eventually plead guilty. Again, it’s a fascinating interview, which even gives insight into how prisoners participate in crypto while incarcerated. Be sure not to miss this.

Also: Happy New Year to everyone! I hope that you have a wonderful celebration with friends and family.

Weekly News Recap

FTX Customers Fight for Money While More Assets Get Mysteriously Swiped

A group of FTX customers filed a lawsuit against the failed exchange, arguing that any assets recovered should be “earmarked solely for customers” and not shared with other creditors.

They seek a ruling that customer assets such as those held by Alameda Research not be considered FTX's property. The case also aims to ensure that customers will be repaid first, even if the court finds that these customer assets are the property of the exchange.

According to the firm’s reported user numbers, FTX’s collapse may have affected over 1.2 million customers in the U.S. It also owes around $3.1 billion to its top 50 external creditors.

On Wednesday, blockchain researchers noticed activity from Ethereum addresses tied to Alameda. These wallets swapped altcoins for bitcoin, ether, and USDT and then sent the funds to mixers.

Speculation around these transfers is heightened due to the recent release on bail of former FTX CEO Sam Bankman-Fried. Just weeks prior to these fund movements, tokens worth $352 million were mysteriously removed from FTX coffers leading to speculation of a hack. This has been confirmed by the U.S. Department of Justice, which is currently investigating the incident.

In addition, this week, Caroline Ellison, former CEO of Alameda, admitted in a federal court in New York that she and Bankman-Fried deliberately misled lenders by creating false financial statements regarding the amount of money the firm was borrowing.

In her guilty plea, Ellison said that, starting back in 2019, the year FTX launched, Alameda’s account on FTX was granted an unlimited line of credit without being required to post collateral, pay interest on negative balances or be subject to margin calls.

Moreover, according to an affidavit filed with the high court in Antigua and Barbuda, FTX cofounders Bankman-Fried and Gary Wang borrowed $546 million from Alameda to buy a 7.6% stake in Robinhood.

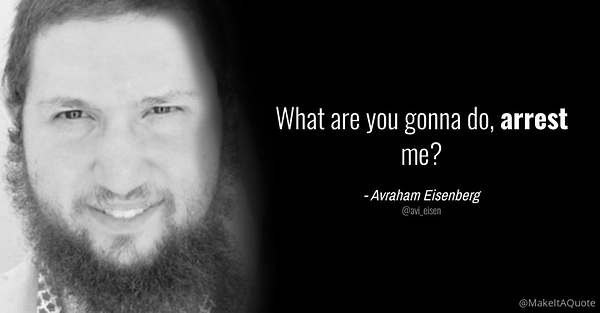

Mango Markets Exploiter Is Arrested

Avraham Eisenberg was arrested in Puerto Rico after US prosecutors charged him with fraud and commodities manipulation for his involvement in an exploit on the Mango Markets DeFi protocol in October.

According to the complaint, Eisenberg artificially inflated the price of MNGO relative to USDC, allowing him to borrow and withdraw $110 million from other investors' deposits.

Eisenberg claimed in a tweet that he had used the protocol as designed and that he was pursuing a “highly profitable trading strategy.” Mango was eventually able to recoup $67 million of the funds, but Eisenberg kept the remainder.

In an interview on Unchained, Eisenberg, when asked whether his trade and others like it were hacks or market manipulation, responded, “Sometimes the code doesn't match the docs. Sometimes the docs say something and it's just not implemented. And sometimes the code does exactly what was intended. It's just that what was intended isn't what anyone wanted.”

Eisenberg’s travel records suggest that, the day after the alleged market manipulation, he flew from the US to Israel in an attempt to avoid law enforcement, said FBI Special Agent Brandon Racz.

This case could have a regulatory impact on DeFi, with Delphi Labs General Counsel Gabriel Shapiro noting that this is not a good case on which to settle such matters.

He tweeted, “no one is who pro-DeFi should be celebrating this arrest--even if it is morally and legally justified, it is likely to set the movement back in bigger ways.”

Gemini Is Sued by Investors

Crypto exchange Gemini and its cofounders, the Winklevoss twins, are facing fraud allegations from investors over the sale of interest-bearing crypto assets through the Gemini Earn program. The Winklevoss brothers have been accused of unlawfully offering a product without properly registering it as a security in compliance with U.S. securities law.

The lawsuit alleges that Gemini abruptly halted its interest-earning program in November after FTX filed for bankruptcy. That led to a liquidity crisis at Genesis, which had borrowed the Gemini Earn assets.

According to the court filing, the halting of this program left its investors "effectively wiped out,” leading to significant financial losses. The investors who filed the lawsuit are seeking a trial by jury and are petitioning for a class-action lawsuit in order to receive damages, restitution, and “other statutory and equitable relief” from Gemini.

3Commas Admits Data Breach Affecting Thousands of Users

3Commas, a crypto bot trading service, admitted that its database of users’ API keys had been leaked, which could have allowed malicious actors to gain unauthorized access to its users’ accounts.

In a statement posted to Twitter on Wednesday, 3Commas CEO Yuriy Sorokin said: “We saw the hacker’s message and can confirm that the data in the files is true.” He added: “As an immediate course of action, 3Commas requested all its supported crypto exchanges, including Binance and KuCoin, to revoke all API keys connected to its service.”

API keys are essential for tying the 3Commas bot service to a user’s crypto exchange account and allow third-party services to execute trades on the user’s behalf. Earlier in the day, Binance CEO Changpeng Zhao warned users that they should disable their API keys if they had ever been connected to 3Commas.

This admission comes after weeks of repeated denials and assertions by 3Commas and its CEO that users were losing their assets due to phishing attacks. 3Commas users have lost at least $6 million to hackers starting in October, but that sum has more than doubled in recent weeks according to users who spoke to CoinDesk.

In light of this breach, 3Commas users are now planning a class-action lawsuit against the company, claiming that they have collectively lost $14 million due to the data leak.

Popular NFT Projects DeGods and Y00ts Leave Solana

Two of Solana's most prominent NFT projects – DeGods and Y00ts – confirmed their migration from the Solana network to Ethereum and Polygon respectively.

The reason for the move comes down to the waning performance of the Solana blockchain in the second half of 2022, according to DeGods’ leader Frank.

Rumors suggested that the DeGods team had asked the Solana Foundation for $5 million to stay on the platform but the team has categorically denied this. According to CoinDesk, Y00ts' move to Polygon is understood to have been paid for by the blockchain’s partnership fund, however, details of the deal haven't been made public yet.

The announcement triggered a surge in DeGods sales, with the collection's floor price increasing by 12%. Y00ts' floor price jumped by 5 SOL. Both projects accounted for around 70% of Solana NFT sales volume in the week leading up to the announcement, according to Magic Eden data.

While one of the main reasons to move to Ethereum is the high network effects, research shows that wash trades accounted for over $30 billion of Ethereum NFT trading volume, representing more than half of total NFT trade volumes in 2022 and almost 45% of all-time NFT trading volume.

This week, leading NFT marketplace OpenSea made a controversial move, as it delisted Cuban artists and collectors from its platform in order to comply with US sanctions.

On a related note, investment giant Fidelity filed three trademark applications in the US related to providing services in the metaverse.

Argo Blockchain Is Saved by Galaxy Digital

Argo Blockchain, a Nasdaq-listed Bitcoin miner, is set to receive a bailout of $100 million from Galaxy Digital, Michael Novogratz’s crypto-focused financial services firm.

The bailout deal involves a two-year hosting agreement between the two firms which will enable Argo's miners to keep running at its Helios mining facility in Texas.

The agreement includes the sale of the Helios facility to Galaxy for $65 million and a new $35 million loan from the firm. Argo CEO Peter Wall expressed his gratitude for the deal. He told CoinDesk: "This deal with Galaxy achieves all of our goals and lets us live to fight another day."

One day before the announcement, Argo had requested that trading of its shares be suspended on Nasdaq.

Argo’s is not an isolated case. The bear market has battered other miners too, with Core Scientific filing for Chapter 11 bankruptcy protection earlier this month.

According to a report by Hashrate Index, Bitcoin mining companies finished 2022 with a total of $4 billion in debt. In addition, Tom Dunleavy, a Messari analyst, said that publicly traded Bitcoin miners sold nearly all the coins they mined in 2022.

On the topic of miners, Bitcoin mining equipment and hosting provider Blockware Solutions is being sued for allegedly breaching a contract, negligence, and fraud by a customer seeking at least $250,000 in damages.

The Bear Market Continues

The crypto markets are still in a downtrend. The stock of Coinbase dropped to a new all-time low of $31.89 per share on Wednesday, and it’s down 87% this year.

In addition, crypto exchange Kraken is ending its operations in Japan, citing unfavorable market conditions and a need to restructure. Payward Asia Inc., the firm's Japan-based subsidiary, will officially deregister with the Financial Services Agency on Jan. 31, giving customers until then to withdraw funds in fiat currency or transfer them to a private wallet.

MicroStrategy, the largest corporate holder of Bitcoin reserves, revealed that it sold some of its BTC holdings for the first time ever, but only to generate a tax benefit.

After selling 704 BTC, the company acquired 810 more tokens.

MicroStrategy now holds 132,500 BTC, and its average purchase price is around $30,400 per bitcoin. At today’s prices, that’s roughly a 50% unrealized loss.

FUN BITS

SBF Says He’s Sorry

Despite being in a bear market, there’s clearly a bull market for memes around FTX.

Autism Capital, an anonymous Twitter account that has been leaking all kinds of details on FTX and Sam Bankman-Fried, shared an animation video about SBF. The video features the disgraced founder saying he “accidentally” stole the customer’s life savings to create a “giant overleveraged Ponzi for himself.”

Throughout the video, SBF says he’s sorry a gazillion times, in different locations: The Bahamas, FTX’s office, in a garden eating a cucumber, with NFL star Tom Brady, and even playing League of Legends.

“If you deposit it, I donate it,” reads a street poster, alluding to Sam’s effective altruism.

After that, he gets arrested, but not for long…

Here’s the full video:

🔗Join Unchained Premium to get access to:

Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

And now, a new offering: transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze