Genesis Files for Bankruptcy 😱

In today's edition: 🎤 New podcast on developer activity, ❌ Genesis' bankruptcy, 🕊️ John Ray's plans to revive FTX, 🤝 Nexo's settlement with the SEC, and more ❗

New Pod Today!

Why Crypto Developer Activity Continues to Grow Despite the Bear Market

Maria Shen, partner at Electric Capital, unpacks the venture firm’s latest Developer Report. Hotly anticipated among crypto observers, the annual report captures which chains developers are building on.

Despite 2022’s price carnage, the report finds developer interest remains strong. Ethereum is the leading chain by far but EVM-compatibility is emerging as a major force in winning developers’ hearts and minds. Shen unpacks Bitcoin’s stability, Terra’s implosion, and many more insights from crypto’s open-source code repos.

Show highlights:

why the report "undercounts" developers and how it defines active developers

how developers represent a fundamental measure of the health of emerging technologies like crypto

the meaning of developer numbers going up even when prices plummet

why in recent years the speed of developer growth jumped so drastically

what happened after the number of developers reached an all-time high in June 2022

the role of Terra in the decline of developer activity in 2022’s second half

why Ethereum dominates the ecosystem and whether it will continue to be the leader

why the number of Bitcoin developers has remained flat over the last year

whether looking at the number of developers in the NFT ecosystem is even relevant

🥇 Help Improve the Newsletter! 🗣️ Take Our Survey

We're experimenting with the format of the Unchained Daily and are interested in your feedback. Please fill out this survey so we can better serve you!

What’s Poppin’?

Genesis Files for Bankruptcy

Digital Currency Group subsidiary Genesis has filed for Chapter 11 bankruptcy protection. Genesis Global Holdco, LLC and two of its lending subsidiaries Genesis Asia Pacific Pte. Ltd and Genesis Global Capital, LLC filed voluntary petitions in a bankruptcy court in the Southern District of New York.

Genesis’s derivatives and spot trading subsidiaries were not included in the filing and will continue operations. The firm said it has $150 million in cash on-hand to provide the required liquidity to facilitate the restructuring process.

Gemini co-founder Cameron Winklevoss called Genesis’s bankruptcy filing “a crucial step” in recovering clients’ assets, but said, “Unless Barry and DCG come to their senses and make a fair offer to creditors, we will be filing a lawsuit against Barry and DCG imminently.” Genesis owes Gemini Earn users $900 million and has been in talks with the firm over a resolution plan for the last few weeks.

Genesis Transfers $150M to Crypto Exchanges and New Wallet

by Samyuktha Sriram

Genesis has made a series of transfers to crypto exchanges, suggesting that it could be looking to liquidate its assets.

Nexo Pays $45M to Settle With SEC

Crypto lender Nexo (disclosure: a former sponsor of Unchained) has agreed to pay $45 million to the U.S. Securities and Exchange Commission to settle charges for failing to register its Earn Interest Product, according to a Thursday announcement from the regulator. The product, launched in 2020, offered retail investors the ability to earn interest on their crypto assets deposited on the platform.

Nexo said the settlement was made on a no-admit-no-deny basis and has agreed to cease offering the product in eight states and stop sign-ups from customers in the country. The firm’s regulatory troubles are not just restricted to US soil – earlier this week, Bulgarian prosecutors raided Nexo’s offices in Sofia and alleged that the firm was involved in an international money laundering scheme.

Paxos Says New Proposal Will Earn MakerDAO an Extra $29M

Stablecoin issuer Paxos wants MakerDAO to raise the debt ceiling for USDP to $1.5 billion from the existing $450 million. In exchange, Paxos would pay a monthly marketing fee equal to 45% of the Effective Federal Funds Rate, according to a proposal posted on Maker’s governance forum.

“Given the current US federal interest rate of ~4.3%, the full USDP PSM [Peg Stability Module] would be able to generate up to $29M in annual revenue for MakerDAO,” said Paxos.

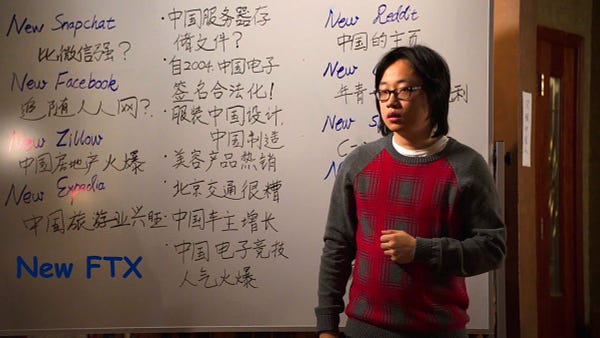

FTX’s New CEO Explores Restarting Crypto Exchange

FTX CEO John Ray III has set up a task force to look into the possibility of restarting the bankrupt crypto exchange, according to a report from The Wall Street Journal. Ray said that despite the misconduct carried out by some of its top executives, customers had praised the technology on the platform, making a potential reboot valuable.

Former FTX CEO Sam Bankman-Fried commented on the development, saying he was “glad Mr. Ray is finally paying lip service to turning the exchange back on after months of squashing such efforts.”

Following the news, FTX’s native exchange token FTT surged 47% on Thursday.

Robinhood Launches Wallet Mobile App

Popular retail brokerage Robinhood has officially launched the Robinhood Wallet mobile application, which supports trading tokens and NFTs on the Ethereum and Polygon blockchains. The wallet is being rolled out to 1 million users who signed up for its waitlist.

The launch marks Robinhood’s official entry into the crypto wallet market. Unlike the “crypto wallet” product previously released on the platform, this new offering is more comparable to existing software crypto wallets like MetaMask.

Robinhood’s General Manager Johann Kerbrat described the wallet as ‘browser’ for Web3, in a statement to Decrypt.

Cardano Founder Charles Hoskinson Wants to Buy CoinDesk

Charles Hoskinson, founder of the Cardano blockchain, said he is considering buying Digital Currency Group’s subsidiary CoinDesk, as per a report from Bloomberg. The business is currently offered for sale at a price of $200 million – a significant jump from the $600,000 it was acquired for in 2016.

Hoskinson said he is interested in revamping the media publication and turning it into a mix of a news and community site. CoinDesk has hired investment banker Lazard to explore a partial or full sale, The Wall Street Journal reported on Wednesday.

Huobi Finally Confirms Justin Sun Leadership

Huobi has confirmed that Tron founder Justin Sun was at the helm of the Singapore-based crypto exchange’s advisory board. Sun was rumored to have taken control of the exchange in October after Huobi’s majority shareholder Leon Li sold his entire stake to Hong Kong-based investment firm About Capital.

Blockchain reporter Colin Wu had published a blog that claimed Sun was About Capital’s core investor, and was the real buyer of Li’s $1 billion stake.

In Other News…✍️✍️✍️

Customers of Compass Mining, a provider of Bitcoin mining machines and hosting services, are suing the company for $2 million, alleging fraud, breach of contract, and negligence.

Crypto exchange OKX revealed that it holds $7.2 billion in Bitcoin, Ethereum, and USDT, as per its Proof-of-Reserves (PoR) report.

The MakerDAO community voted to retain the Gemini USD (GUSD) stablecoin in its reserve system for the DAI stablecoin, following a dramatic poll that flipped at the last moment.

Renowned investor Peter Thiel’s Founders fund sold all its crypto holdings prior to the market crash last year, making a profit of $1.8 billion.

Blur, an NFT marketplace, announced that it will be postponing the release of its BLUR token from January to February 14th.

1inch Network (disclosure: a former sponsor of Unchained), a decentralized exchange aggregator, created a new hardware wallet to provide added security for users to store their crypto assets offline.

Today in Crypto Adoption...

The Chinese central bank enabled smart-contract functionality for the digital yuan through Meituan, one of the country's leading e-commerce apps for food delivery and lifestyle services.

The $$$ Corner…

SSV DAO, the organization behind the SSV.network staking protocol, is launching a $50 million fund to support the development of Distributed Validator Technology (DVT) infrastructure.

Candy Digital, a startup focused on sports NFTs, raised $38 million from 14 investors in a Series A extension funding round.

a16z invested in the $32 million seed round of Plai Labs, a web3 social platform builder.

Polychain Capital led a $22 million funding round for =nil; Foundation, an Ethereum research and development firm.

Crypto wallet provider Cypher closed a $4.3 million seed funding round led by startup accelerator Y Combinator.

Gateway, a web3 credential protocol, garnered $4.2 million in a seed round led by Reciprocal Ventures.

Polygon Ventures and Blizzard Avalanche participated in a $4 million funding round for Neopets Meta, a web3 game.

MoonPay, a major crypto infrastructure firm, acquired Nightshift, a web3 creative agency, but did not disclose the terms of the deal.

What Do You Meme

📈 Your Market Update 📉

BTC is up .78%, trading at $20,793

ETH is up 1.67%, trading at $1,552

BTC dominance: 40.26%

Crypto market cap: $1 trillion

*All data as of today, 5 am ET

Recommended Reads

Fais Khan on whether zero-knowledge proofs are worth the hype:

andyguzman.eth on zero knowledge applications in Ethereum

⛓️ Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze