Have We Learnt Nothing ⁉️

In today's edition: 🎙️ New pod about crypto bankruptcies, 💵 3AC founders' new exchange, 👀 DCG speculations, 📈 SushiSwap's goals, and more!

New Pod Today!

How Crypto Bankruptcy Claims Buyers Will Profit From the Collapse of FTX

From 3AC to FTX (and possibly more to come), it’s boom times for those trading crypto bankruptcy claims. Thomas Braziel, founder and CEO of 507 Capital, gives a crash course on bankruptcy law, offering the latest updates on the FTX, Celsius, and Three Arrows Capital cases. Plus, insight on how 2023 could finally be the year Mt. Gox creditors get (some) closure.

Show highlights:

how Tom got into crypto with the Mt. Gox bankruptcy and whether "crypto distressed" is an emerging asset class

how buying bankruptcy claims is also a way to buy crypto assets at a discount

whether it's possible to tokenize bankruptcy claims

what is likely to happen when Mt. Gox creditors are returned their BTC

the importance of Celsius' separation of custodial assets vs. assets in interest-bearing accounts

why the fact that FTX recovered $5 billion in assets is "amazing"

why so many stakeholders disputed the ownership of the $450 million in Robinhood shares

why there's so much difference in the prices of FTX, Voyager, BlockFi and Celsius claims

whether the customer list of FTX should be kept private

what type of creditors are Gemini Earn customers

🥇 Help Improve the Newsletter! 🗣️ Take Our Survey

We're experimenting with the format of the Unchained Daily and are interested in your feedback. Please fill out this survey so we can better serve you!

What’s Poppin’?

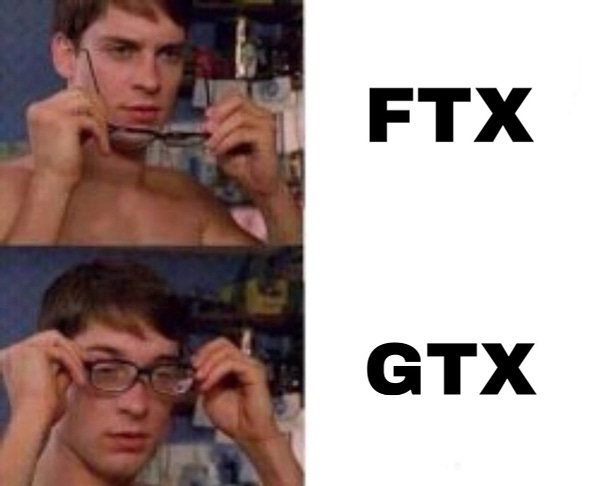

3AC Founders Are Raising $25M for ‘GTX’

by Samyuktha Sriram

What Happened: Kyle Davies and Su Zhu, founders of the now-defunct hedge fund Three Arrows Capital, hope to raise $25 million in seed funding for their new venture “GTX.”

GTX is a crypto exchange, so-named “because G comes after F,” according to the pitch deck.

The DCG Rumor Mill as It Stands

by Samyuktha Sriram

Speculation about Digital Currency Group's difficulties have been circulating on social media this week. It can be difficult to determine the truth, but it's worth contemplating the effects of three potential situations.

Scenario #1: Genesis gave clients “phony financial statements”

Scenario #2: Genesis is actually insolvent

Scenario #3: Losses from 3AC’s collapse created a black hole on DCG’s balance sheet

SushiSwap Aims to ‘10x Market Share’ in 2023

What Happened: Jared Grey, the “head chef” at decentralized exchange SushiSwap, shared a roadmap for the protocol outlining its plans to scale.

This year, the team will release a DEX aggregation router and the “Sushi Studios” decentralized incubator, increasing its swap volume and fees. It also plans to change up its tokenomics and diversify its treasury.

“By executing our vision, we intend to 10x our market share in 2023,” said Grey.

Why It Matters: SushiSwap sunset its lending protocol Kashi and token launchpad Miso earlier this year, citing a lack of resources.

The protocol’s Treasury has around 1.5 years of runway left before running dry, revealed Grey in December.

The dire financial situation makes it all the more essential that the protocol’s plans this year are a success.

Alameda Liquidators Lost $11M After Taking Over

Alameda Research’s liquidators have incurred $11.5 million worth of losses over the past two weeks, of which at least $4 million were entirely preventable, according to analysis from Arkham Intelligence.

These losses were a result of “a series of market movements that have busted multiple Alameda positions left open after bankruptcy.”

Last week, Arkham found that the liquidators lost 4 WBTC worth $72,000 after they forcibly closed an Aave position, which in itself incurred a penalty. They were liquidated because they opted to remove extra collateral on the DeFi position, instead of paying back the debt to close it out.

“The liquidators, themselves, were liquidated. Are they in over their heads?” wrote Arkham.

Binance Lets Institutional Investors Hold Collateral in Cold Wallets

Crypto exchange Binance launched an off-exchange settlement solution for clients called “Binance Mirror.” The service will allow institutional investors to hold their collateral in cold storage wallets.

The offering is likely aimed at boosting investor confidence, which has been dampened after FTX’s collapse earlier this year revealed that the exchange misused customer funds. Holding assets off-chain will not only protect them from hacks, but also ensure that the exchange isn’t moving around their funds on the blockchain.

On Unchained Premium

Why Did Regulators Fine Coinbase $100M?

Yana Afanasieva, founder of Competitive Compliance, explains why the narrative around NYDFS’s $100 million settlement with Coinbase over its compliance program is wrong.

In Other News…✍️✍️✍️

Silvergate, a banking institution focused on crypto, reported a loss of $1.05 billion for Q4, compared to a profit of $18.4 million during the same period the previous year.

The creators of memecoin Shiba Inu (SHIB) revealed plans to launch Shibarium, a layer-2 network built on Ethereum.

Nexo, a crypto lending platform, is taking legal action against the regulator of the Cayman Islands for refusing to grant them an operating license.

BNB Chain carried out a significant token burn of over $500 million worth of BNB.

Following the announcement that Microsoft may invest $10 billion into OpenAI, crypto AI tokens skyrocketed in value.

Vauld, an Asian crypto lender facing financial difficulties, was granted an extension on its legal protection from creditors, but for a shorter period than requested.

Today in Crypto Adoption...

The digital version of the Chinese Yuan (e-CNY) was utilized to purchase securities for the first time.

Brazil's second-largest private bank, Bradesco, issued its first digital token representing a bank credit note

What Do You Meme

📈 Your Market Update 📉

BTC is up 1.78%, trading at $21,185

ETH is up 1.54%, trading at $1,565

BTC dominance: 39.74%

Crypto market cap: $1.03 trillion

*All data as of today, 5 am ET

Recommended Reads

FTX Secretly Channeled A $50 Million Loan To Its Bahamian Bank Through An Executive’s Company by David Jeans, and Sarah Emerson from Forbes

Complete Knowledge by James Austgen, Kushal Babel, Vitalik Buterin, Phil Daian, Ari Juels and Mahimna Kelkar

Tascha Che on tokenomics mistakes of web3 platforms

⛓️ Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze