Here’s Why Grayscale Is Fighting the SEC

Weekly News Recap: 😱 BlockFi's exposure to FTX, 😱 $700M in assets seized, 👀 SBF's shady investment, ✍🏿 Celsius' plans to repay creditors, and more!

Wait, why am I receiving two emails in one day?

On Unchained, we run two newsletters: Unchained Daily, which goes from Monday through Saturday, and Unchained Weekly (this one!), which recaps all the major crypto news of the past week. (It’s narrated on the podcast, so if you’re looking for the links to the stories heard on the show, they’re all in here!)

If you want to receive only one of the newsletters (for example, receive the daily and not the weekly, or vice versa), just go here and select whichever you want!

Why Grayscale Is Suing the SEC Over Its Denial of a Bitcoin ETF

This Friday’s Unchained, features Grayscale CEO Michael Sonnenshein talking about why the company is suing the SEC and addressing the grievances GBTC investors have over the fact that the asset is trading at such a large discount to NAV.

Because of the 40+% discount and the management fee of 2%, these investors are essentially paying closer to 4% annually compared to NAV. Sonnenshein’s defense boiled down to: running GBTC — and suing the SEC — are expensive: “A lot of costs … go into running a product in the crypto space. It's not analogous today to the kind of economies of scale that you'll see for equity products or fixed income products. … We are committed to lowering the fee on GBTC when it converts to an ETF, but certainly in the meantime, all the fees that are being generated on GBTC, that is all the capital that we as an organization are putting into our lawsuit against the SEC, bringing the best legal minds possible to the case and really just continuing to advocate for our investors.”

Listen to the full episode to find out more about the relationship between Grayscale, Genesis and their parent company DCG and what Grayscale plans to do if its lawsuit against the SEC fails.

Weekly News Recap

BlockFi Has a $1.2B Exposure to FTX and Alameda

Bankrupt crypto lender BlockFi accidentally revealed financial documents that showed it had over $1.2 billion worth of assets tied to the cryptocurrency exchange FTX and its sister company, Alameda Research.

The extent of BlockFi's exposure to the exchange was not previously unknown, as the financials had been censored. As of January 14, the documents show that BlockFi assets connected to FTX are worth almost $416 million, while loans to Alameda amount to about $831 million. This is significantly higher than the previously reported figures of $355 million in assets on FTX and a $671 million loan to Alameda. The document also revealed that BlockFi's 125 active employees are being paid generously, with a combined compensation of $11.9 million per year.

Bloomberg reported that BlockFi is selling off $160 million in loans backed by around 68,000 Bitcoin mining machines as part of the company’s bankruptcy proceedings. Some of these loans have already defaulted and may be undercollateralized given the decline in the price of Bitcoin mining equipment. The entities bidding for the debts will likely be debt collection businesses, buying for cents on the dollar.

US Seizes $700 Million of FTX Assets

U.S. authorities have taken possession of $700 million worth of assets linked to bankrupt crypto exchange FTX and its former CEO Sam Bankman-Fried, according to a report from CoinDesk. The government is seeking the forfeiture of these assets on the grounds that they are not the property of the bankruptcy estate.

The assets in question include $525 million worth of Robinhood shares, which Bankman-Fried purchased with money borrowed from Alameda Research, and $171 million in cash from bank accounts tied to FTX-related entities. The government seized these assets and more in early January and is now seeking their forfeiture.

Furthermore, the DOJ seized $50 million in assets linked to Bankman-Fried. This sum was held in Farmington State Bank, a small, one-branch institution based in Washington that primarily focused on providing agricultural loans to farmers. The bank had a mere three employees at the time of Bankman-Fried's account creation and had been serving the local community for over a century.

Additionally, on Wednesday, FTX’s long-waited for creditor list was revealed – albeit with millions of customer names redacted. It turns out the bankrupt exchange owes money to a wide range of companies and individuals. Tech companies included Apple, Netflix, Meta and Amazon Web Services, and crypto firms such as Chainalysis, Coinbase, Yuga Labs and Binance Capital Management are owed money. Publications included the Wall Street Journal, CoinDesk and Benzinga. Athletes like Tom Brady and David Ortiz were also on the list, as was supermodel Gisele Bundchen.

Sam Bankman-Fried Invested $400M in Modulo Capital

According to the New York Times, Modulo Capital, an obscure crypto trading firm, received $400 million from Bankman-Fried prior to the FTX collapse in November. The firm was founded in March 2022 and received one of SBF's largest investments, drawing the attention of investigators. The transactions took place in the third and fourth quarters of 2022.

The founders of Modulo Capital reportedly had close ties to SBF. One of them, Xiaoyun "Lily" Zhang, had previously allegedly been romantically involved with Bankman-Fried. Modulo is now a key focus of the investigation by federal prosecutors into Bankman-Fried and the exchange.

Genesis Says It May Resolve the Bankruptcy Soon

Crypto lender Genesis Global Capital expressed confidence that it will be able to resolve its disputes with creditors this week, with a goal of emerging from Chapter 11 bankruptcy by the end of May.

According to Reuters, during a hearing in Manhattan, Genesis lawyer Sean O'Neal said, "Sitting here right now, I don't think we're going to need a mediator. I'm very much an optimist."

Brian Rosen, a lawyer for creditors who are owed $1.5 billion in claims, agreed: "We are getting closer."

The company filed for bankruptcy protection on January 21, two months after it halted withdrawals and new originations. The company listed just over $5 billion of assets and liabilities in its bankruptcy filing and said it owed more than 100,000 creditors at least $3.4 billion.

Gemini Lays Off More Employees

Gemini, the crypto exchange battling Genesis, laid off 10% of its staff according to an internal memo seen by The Information. This is the third round of cuts at the company in the past eight months. The cofounder of Gemini, Cameron Winklevoss, informed the staff, known as "Astronauts" about the layoffs via a message on Slack. He stated that the persistent negative macroeconomic conditions and “unprecedented fraud in the industry” left the company with no other choice.

Gemini employees are not the only ones affected by Genesis’s fallout. Luno, a Digital Currency Group-owned crypto exchange, also laid off 35% of its workforce.

‘Bitcoin Jesus’ Gets Sued

Genesis is suing Roger Ver for $20.9 million in damages. Ver, the CEO of Bitcoin.com, has also long been known as "Bitcoin Jesus.” The lender claims Ver failed to settle crypto options transactions before the expiry date. This is not the first lawsuit against Ver, as CoinFlex, a crypto exchange, also filed a lawsuit against him in July for failing to repay the debt on his margin position.

In a Reddit post, Ver stated that he has enough money to pay the debt, but he does not feel obligated to do so.

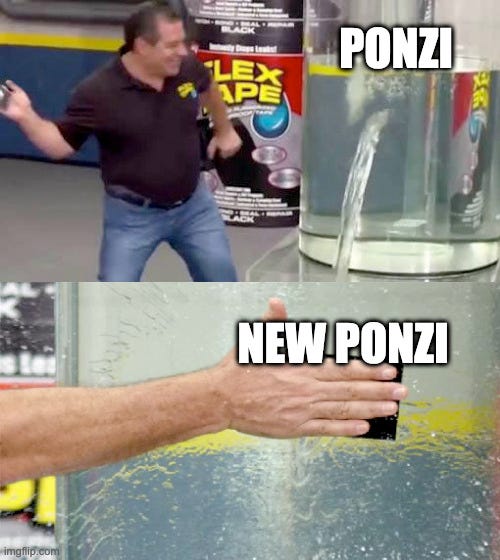

Celsius Plans to Issue a Token to Repay Creditors

Bankrupt crypto lender Celsius is planning to pay back creditors by issuing a new token, according to a recent report from Bloomberg.

The attorney for Celsius, Ross M. Kwasteniet, informed a bankruptcy court that the new token would be part of a payout plan from a reorganized company that is properly licensed. However, this plan needs to be approved by a creditor committee before it can move forward.

According to CoinDesk, the proposed token is called Asset Share Token (AST). Creditors who are owed an amount of crypto above a certain threshold would receive AST, which they can either retain for potential dividends or sell on the marketplace. The platform’s remaining customers would be given a one-time distribution of liquid crypto assets.

The lawyers for Celsius also stressed that, despite the recent ruling that assets in Celsius's Earn program are the property of the exchange's estate and not customer property, Earn customers would be treated like everyone else in the eventual recovery of assets.

Additionally, the mining division of Celsius plans to temporarily house 20,000 rigs that it is currently retrieving from Core Scientific, which could put the troubled firm founded by Alex Mashinsky in a better position.

Binance Makes a Mistake in Its Accountings

Binance, the world's largest crypto exchange, acknowledged that it made a mistake in storing token reserves and customer funds in the same wallet, as per a Bloomberg report.

The reserves for nearly half of the 94 tokens issued by Binance, known as "B-Tokens," were stored in a single wallet called "Binance 8," according to the exchange's website. This wallet contains more assets in reserve than are required as collateral for the issued B-Tokens, indicating that it also contains user assets.

Binance issues its own version of ETH, USDC, and USDT to be used on the BNB chain, which are supposed to be backed by 1:1 reserves of the currencies they are based on. However, mixing of B-Token collateral with customer assets is against Binance's own guidelines.

Earlier this week, Binance also announced that its SWIFT banking partner, Signature Bank, will no longer support transactions under $100,000 in value.

This change comes into effect on February 1st and will not affect credit and debit card purchases of cryptocurrencies or payments to and from third-party exchanges. Signature Bank is imposing this new transaction threshold to reduce its exposure to the digital asset market. Meanwhile, Binance is on the hunt for a new SWIFT partner to help facilitate its US dollar transactions.

Shanghai Upgrade Is Closer

Ethereum core developers announced the successful deployment of a shadow fork, which supports staked ETH withdrawals, as a test for the network's upcoming Shanghai upgrade. The shadow fork went live on Monday, and developers plan to test the upgrade's resilience by deploying "evil nodes" on both the execution layer and consensus layer. The final version of the Shanghai upgrade is set to go live on the Ethereum mainnet in March; it will allow validators to withdraw the $26 billion worth of ether that sits in the deposit contract.

Additionally, the team at liquid staking derivatives protocol Lido proposed a plan to support staked ether withdrawals after the Shanghai upgrade is activated. The process will be asynchronous and will have two modes - a “turbo” mode to unstake requests quickly and a “bunker” mode as an emergency plan which will be activated under mass slashing conditions.

Moreover, decentralized autonomous organization Index Coop launched a new structured product that will give investors exposure to the ETH liquid staking derivatives market.

Wormhole Hacker Levers Up on Staked Ether

As Shanghai comes closer, the crypto community is getting excited about the potential for staked ETH withdrawals. However, it seems that the hackers are also interested in this new development. Blockchain security firm Certik reported that the wallet address associated with the Wormhole hack, which occurred in February 2022, moved $155 million of Ethereum this week.

The funds were moved to the OpenOcean decentralized exchange and then converted into Lido Finance's staked ETH (stETH) and wrapped staked ETH. The hacker then used the stETH as collateral to borrow stablecoins and repeat the process. This is the largest movement of these stolen funds in recent months.

Speaking of exploits, the FBI announced that the Lazarus Group, a cybercrime organization sponsored by the North Korean government, is responsible for the theft of $100 million in crypto from Harmony's Horizon Bridge in June last year. The Lazarus Group has a history of orchestrating cyber attacks and is considered one of the most dangerous organizations in the world.

FUN BITS

Eric Wall Immortalizes His Enemies

Have you ever heard of the saying 'keep your friends close, but your enemies closer'? Well, one crypto enthusiast has been taking that phrase to a whole new level. Eric Wall, one of the best writers and analysts in the industry, is not only keeping his adversaries close, but also etching their faces onto tungsten cubes. That's right, Eric is building a collection of cubes made of the extremely dense tungsten metal, each engraved with the face of a defeated crypto enemy.

But why tungsten, you may ask? Well, it's said to be virtually indestructible and extremely resistant to scratches, kind of like Eric's arguments. And as for why he's doing this? Who knows, maybe it's his way of saying 'don't mess with me' or perhaps it's simply a reminder of his past victories.

🔗Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze