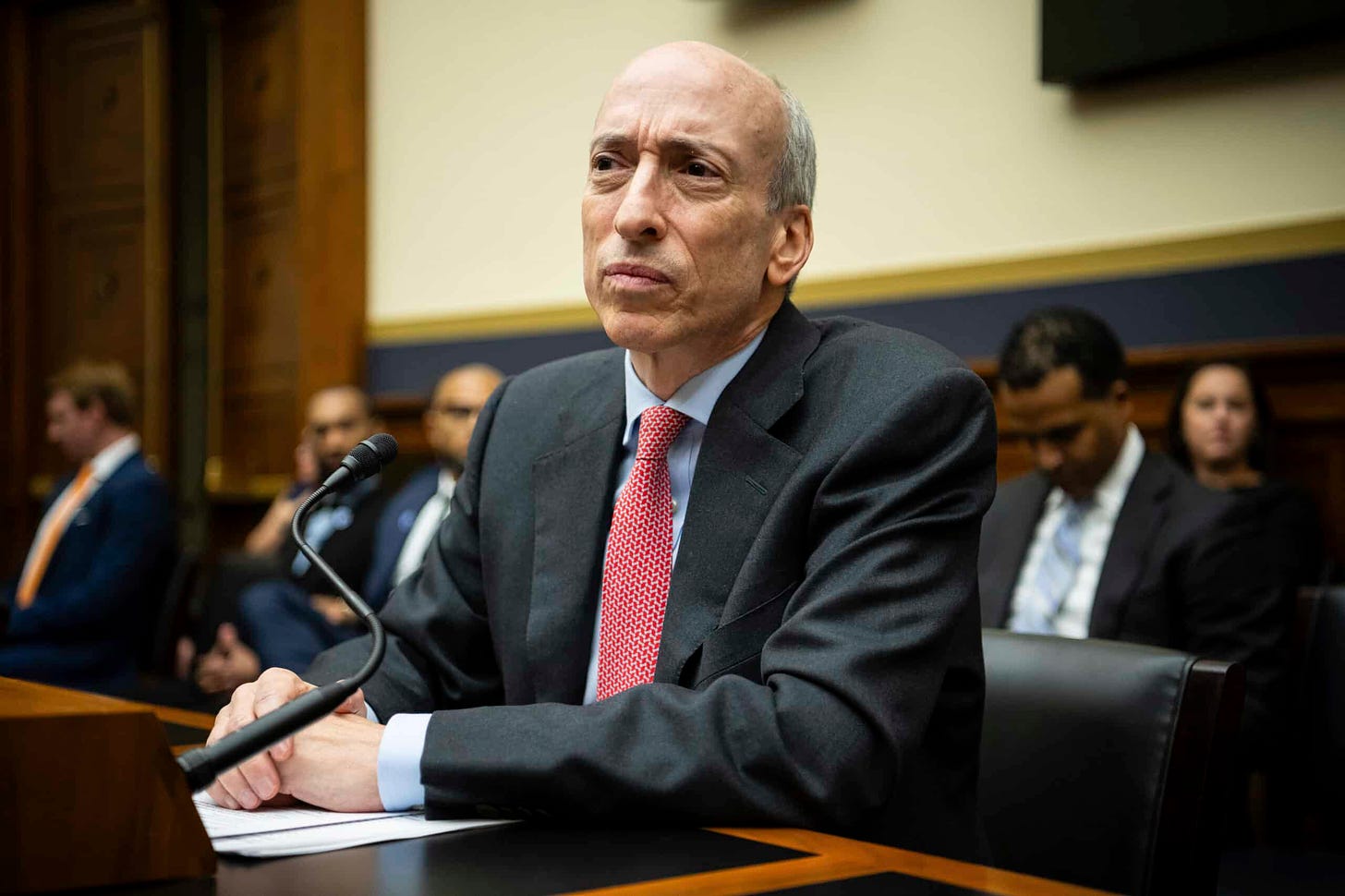

How Much Damage Will Gary Gensler Do Between Now and January 20?

It depends on who you ask 👀

You are reading Unchained’s regulatory newsletter Unregulated, your go-to source for the latest insights, breaking scoops, and in-depth analysis on all things crypto regulation—one of the most critical topics in the industry today.

Note: If you prefer to keep receiving only our daily newsletter and to opt out of the regulatory updates, simply head to your Substack settings and uncheck the regulatory newsletter box.

Hey! I’m Veronica Irwin, Unchained’s regulatory reporter.

I had a lot on my mind election night. However, as a crypto regulation reporter, I kept returning to one thought: what is Gary Gensler thinking right now? Trump has been promising for months to fire the SEC Chair on his first day in office, and got a lot of the crypto community to come off the political sidelines by doing so.

Gensler’s leadership of the SEC is also partly responsible for igniting a massive fundraising campaign on behalf of the industry to elect more pro-crypto politicians to Congress. I can’t help but wonder if Gensler felt some type of way watching pro-crypto candidates critical of his de facto “regulation by enforcement” policy win races across the country. Oh to be a fly on the wall…

While Gensler could resign any day now, he also has the option to stay at the helm of the Securities and Exchange Commission for the next 74 days if he so chooses. This raises the question: Just how much damage to crypto can Gary Gensler still do?

What Gary Gensler Could Still Do Against Crypto in His Remaining Days as SEC Chair

The deeply unpopular agency chief retains the ability to bring a number of different actions, but those could easily be undone, sources say.

After Donald Trump’s decisive win in the US presidential election, crypto markets rallied. Investors were elated to learn that the self-proclaimed “crypto president” would lead the country for the next four years, supported by a Republican Senate and a likely Republican House. Politically, the crypto community’s largest remaining concern now is what SEC Chair Gary Gensler does in the remaining 75 days before Trump is sworn in on January 20.

The President-elect has promised to remove Gensler immediately upon taking office, and political experts are divided on whether that will incentivize Gensler to wreak havoc on the crypto industry in the time he has left, or lay down his arms. Where experts agree is that whomever Trump chooses to replace Gensler will have the authority to halt ongoing investigations, lawsuits, or even new rulemaking processes as soon as they are appointed.

“Any enforcement actions he launches can be rescinded,” said Jonathan Padilla, CEO of Web3 marketing tool Snickerdoodle Labs, who is active within the Democratic Party. Any new SEC rules could also be undone by either a new Chair or new legislation passed through the notably more pro-crypto US Congress next year. “Basically, everything can be undone in 100 days,” Padilla said.

Read More: Bitcoin Just Gained $100 Billion in Market Cap Overnight. Is it Time to Take Profits?

Despite Trump’s repeated promises to “fire” Gensler on day one of his new administration because of his often hostile stance to the crypto industry and “regulation by enforcement” approach, Trump likely cannot legally remove Gensler from the commission entirely. He can, however, demote him to commissioner, a role with significantly less power. It is also customary for SEC chairs, who are appointed by the president, to resign when a new administration takes over, though an SEC spokesperson declined to comment when asked by Fox News personality Eleanor Terrett on Wednesday if Gensler planned to remove himself before Trump took over.

The Commission did not immediately respond to questions for this story.

What Gensler Could Do

The probability that Trump will replace Gensler with someone with strongly differing views could incentivize Gensler to do whatever he can to rein in the industry in his final days, some in the industry have publicly warned. “Crypto policy will immediately and significantly shift when new leaders take over the federal agencies,” Variant Fund Chief Legal Officer Jake Chervinsky said on X on Wednesday morning. “Between now and then, the outgoing administration may be busy finalizing rules and filing enforcement actions.”

Others, like Padilla, speculate that Gensler is likely to ride out his final days quietly. A source with knowledge of the dynamics inside the SEC also proposed that Gensler’s staff could “slow walk” any actions he wished to carry out, making it more difficult for Gensler to create an impact.

Read More: From Pariah to Power Player: Crypto’s Political Triumph

If Gensler did choose to go out with a bang, he has several options. He could, for example, unilaterally initiate new investigations into companies he considers to be violating securities laws, which would become apparent via newly-issued Wells Notices or subpoenas. If Gensler is able to get other Democratic appointees on the commission to go along, it’s also possible he could initiate lawsuits against companies that have already received Wells Notices, such as crypto gaming company Immutable, NFT platform OpenSea, and stock and crypto trading platform Robinhood.

However, Gensler does not have adequate time before January 20 to resolve any new legal battles or finalize new rulemaking, since both processes typically take several months to complete. A new SEC Chair would then have the power to stay such lawsuits while the Commission pursued rulemaking, or drop the lawsuits altogether.

Gensler also has the power to solidify rulemaking that has already been proposed and gone through the public comment period required under the Administrative Procedure Act (APA). For example, he could finalize rulemaking on the SEC’s updated definition of “exchange,” which would expand registration requirements for market makers, including some crypto businesses.

In response, however, crypto advocates could sue the SEC over any new rules, sources said. And Congress could also use the Congressional Review Act to reverse these rules so long as it acts within 60 days of Congress being in session. Due to this time constraint, reversing any rules Gensler passed between now and January 20 would occupy Congress’s time early in the next administration.

Any rules which were finalized and for which Congress does not act on within 60 legislative days could also be unwound by a new SEC Chair. However, this would be a more prolonged process, since the agency would effectively be issuing new rules to cancel the rules Gensler had finalized, and therefore they would also need to follow the APA’s public comment process.

Though it is uncommon, there is some historical precedent for the SEC taking action during the period between a new president’s election and their inauguration. The Trump administration, for example, sued Ripple on December 22, 2020 just before ending its term, though the SEC was less politicized at that time and the timing may have had little to do with a Biden-appointed SEC Chair being expected to take a distinctly different tone. It is uncommon for the SEC enforcement action to be so intensely politicized, one source who spoke with Unchained explained, and the speculation as to what Gensler may do with respect to crypto in his final days is unprecedented. “This is a symptom of Gary’s term and his anti-crypto crusade,” the source, who has experience fighting SEC lawsuits, explained. “The SEC's enforcement approach has never been dependent on a presidential election in the way that it is today.”