🔮 How Polymarket Saw Biden's Dropout First

Weekly News Recap: 🚀 Pump.Fun surpasses Ethereum, 💰 Polkadot’s treasury woes, 📉 Silvergate’s $63M settlement, and More!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

If you like Unchained: Refer us with a friend and earn a Premium subscription!

How Crypto Prediction Market Polymarket Signaled Early That Biden Might Drop Out

Are prediction markets the key to finding the truth in an era of media narratives and social media algorithms?

Prediction markets are gaining mainstream traction, particularly with the upcoming US elections. In this episode, Nick Tomaino, founder at 1confirmation, which is an investor in Polymarket, explores how platforms like Polymarket identified the possibility that President Biden might drop out of the campaign before the mainstream media did. He talks about the journey of Polymarket, the challenges it faced, and how it overcame them to provide a credible platform for betting on political outcomes.

Finally, Nick explains why prediction markets are currently illegal in the U.S., the implications of the Supreme Court striking down Chevron deference, and what the future holds for prediction markets in the U.S.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Weekly News Recap

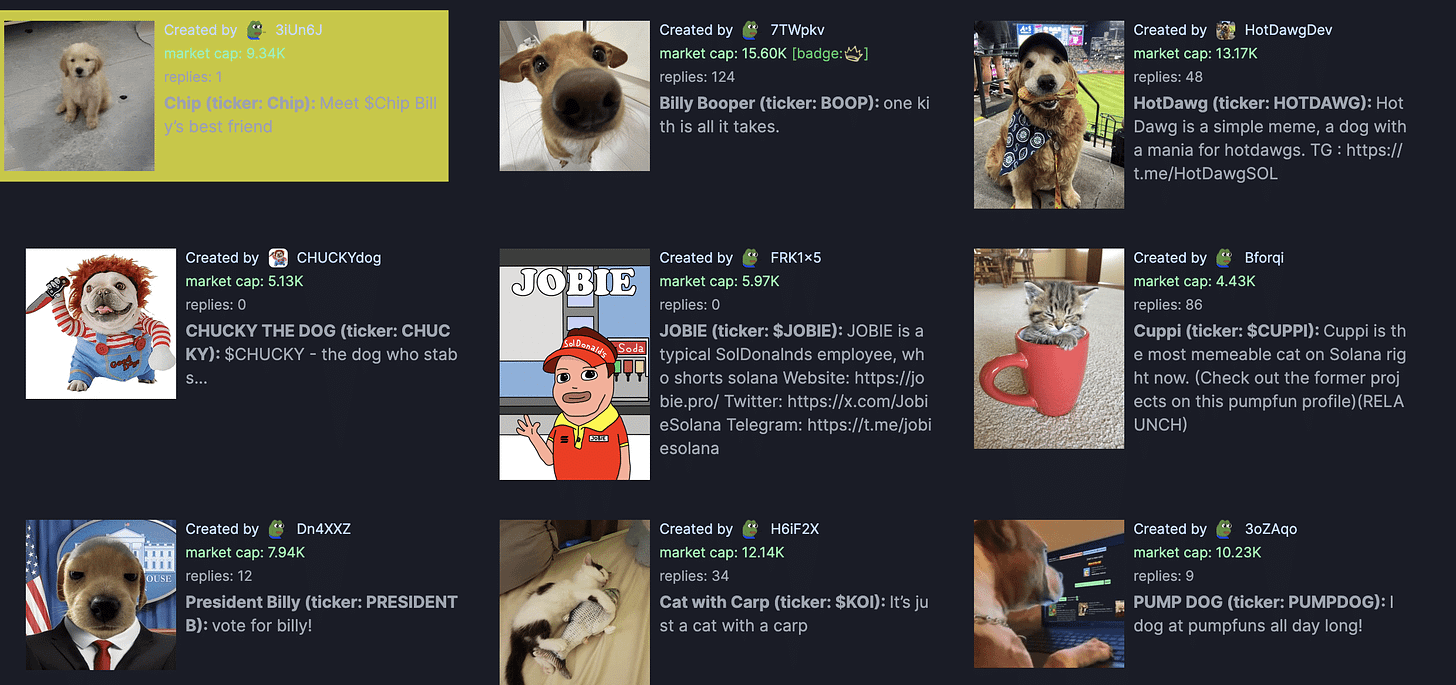

Memecoin Platform Pump.Fun Surpasses Ethereum in Daily Revenue

The memecoin craze continues as Solana-based platform Pump.Fun outperformed Ethereum in daily revenue on Monday. Pump.Fun, which offers a low-cost way to create memecoins, generated an impressive $1.99 million in 24 hours, surpassing Ethereum’s $1.19 million in revenue and Tron’s $1.58 million, according to data from DefiLlama.

Despite a $1.6 billion drop in the total memecoin market cap since mid-June, Pump.Fun averages $692,000 in daily revenue. Celebrities such as Caitlyn Jenner and Iggy Azalea have launched their own tokens on the platform, fueling its popularity.

Pump.Fun, which launched its mainnet in early 2024, is projected to have an annualized revenue of $268.95 million, per DefiLlama. The platform earns revenue through a 1% swap fee on trades and additional listing fees on decentralized exchange Raydium.

Also this week, restaking protocol Symbiotic crossed $1 billion in Total Value Locked (TVL), gaining ground against restaking first mover EigenLayer. Symbiotic and Karak are two emerging players that are challenging the restaking stalwart, Unchained has an explainer on what makes them different from EigenLayer.

Polkadot’s Treasury Could Deplete in Two Years, Says Ecosystem Ambassador

After analyzing Polkadot's onchain treasury, head ecosystem ambassador Tommi Enenkel warns that its $245 million treasury could run dry in two years. The report shows $87 million spent in the first half of 2024, with significant allocations to outreach, development, and liquidity incentives.

Enenkel estimates that the treasury has $200 million in liquid assets available within the next year cautioning that, at the current spending rate, it may last only two years if DOT's value remains stable. However, the Web3 Foundation disagrees, emphasizing that the treasury is continually replenished through staking. The Web3 Foundation is an organization that oversees the Polkadot ecosystem’s growth.

Fabian Gompf, CEO of the Web3 Foundation, said, "The treasury has continuous inflows. It’s never going to run out of funds." The Polkadot community recently rejected a proposal to reduce DOT's 10% annual inflation rate, which primarily funds staking rewards.

Grayscale’s Solana Trust Trades at High Premium Amid ETF Filings

After last week's Solana ETF filings by investment firms VanEck and 21Shares, Grayscale’s Solana Trust (GSOL) continues to trade at a significant premium. As of the latest data, GSOL shares are priced at $431, while the Net Asset Value (NAV) stands at $57.

Grayscale’s closed-end funds, such as GSOL, offer limited shares, creating higher demand and premiums compared to open-ended funds. Investors prefer these trusts for their ease of placement into tax-advantaged accounts.

Silvergate Bank Pays $63M to Settle Charges with Regulators

Silvergate Bank agreed to pay $63 million to settle charges with the SEC, Federal Reserve, and California regulators. The bank, known for its crypto-friendly stance, was accused of failing to maintain a proper anti-money laundering program and misleading investors about the effectiveness of the program.

The SEC alleged that former executives, including CEO Alan Lane and chief operating officer Kathleen Fraher, were aware of these deficiencies. Lane and Fraher settled without admitting guilt, accepting a five-year ban from public company roles. Silvergate’s former chief financial officer Antonio Martino denied the charges.

Speaking of legal actions, TRON founder Justin Sun won a defamation lawsuit this week in the People’s Court of China against Chongqing Business Media Group, which was ordered to apologize and retract false statements.

US Marshals Service Awards $32.5M Contract to Coinbase for Asset Custody

The U.S. Marshals Service (USMS), an arm of the Department of Justice, has selected Coinbase Prime to provide custody and advanced trading services for its large-cap digital assets under a $32.5 million contract. The agency highlighted the need for managing and disposing of significant amounts of cryptocurrency securely and professionally.

Coinbase was chosen for its strong track record in institutional-grade crypto services. This decision comes amid ongoing legal battles between Coinbase and the SEC, as noted by Alex Kruger on this week's episode of Bits + Bips, who pointed out the irony of Coinbase being sued by the SEC while simultaneously partnering with the US government.

Phase 2 of Blast’s Reward Program to Distribute 10 Billion Tokens

After its airdrop last week, Ethereum layer 2 network Blast launched phase 2 of its token rewards program, allocating 10 billion BLAST tokens to incentivize mobile dapp use and development. Running until June 2025, the program splits rewards evenly between users who earn "points" and "gold” users. Points are accrued through ether, wrapped ether, Blast’s stablecoin USDB, and BLAST balances, while gold is earned based on dapp traction.

Bitcoin Miner Genesis Digital Assets Eyes US IPO

Bitcoin mining company Genesis Digital Assets is exploring a US initial public offering (IPO), according to a Bloomberg report on Tuesday. The firm is working with advisors to potentially raise a pre-IPO funding round in the coming weeks. Genesis, which was backed by defunct hedge fund Alameda Research, has raised over $550 million from investors since 2021, reaching a valuation of $5.5 billion in its latest round.

Alameda Research invested $1 billion in Genesis, though a Wall Street Journal report revealed that only half of this was used for operations, with the rest buying out co-founders’ shares. Genesis operates 20 data centers globally, boasting a total power capacity of over 500 megawatts and 150,000 miners.

Lido Advances Decentralization Path

Lido Finance, the leading firm in liquid staking, launched its community staking module on the Holesky test network on Monday. This initiative allows new entities, including solo stakers, to become node operators without requiring DAO approval. The move aims to diversify Lido’s node operator set, which has been permissioned since its inception.

This step comes as the SEC alleges that Lido’s liquid staking token, stETH, is an unregistered security. Lido’s stETH, which represents staked ether, dominates 29% of the total staked ether supply and has a $33 billion market cap. Dmitry Gusakov, tech leader for Lido’s community staking product, emphasized in a governance post that this module will enable more accessible and decentralized staking operations.

Bittensor Halts Network After $8M Wallet Exploit

Bittensor, a decentralized AI blockchain, paused its network following a security breach targeting user wallets. Onchain analyst ZachXBT reported that approximately $8 million worth of TAO tokens were stolen, possibly due to private key leakage. The incident caused a 17% drop in TAO’s value.

A Bittensor Discord administrator confirmed the network was halted to prevent further unauthorized access while the team investigates. Co-founder Ala Shaabana stated the blockchain is in "safe mode," with blocks being produced but transactions halted.

Fun Bits: Polkadot’s Treasury Tweets Take a Light-Hearted Turn

Previously, we told you about Polkadot’s treasury concerns. But what we didn’t mention is the humorous and lighthearted approach their community manager is taking on X.

Polkadot's official X account has been engaging with the community in a fun and witty manner.

The day after the news broke, they posted: "gm to all marketers and KOLs ☀️"

Then, after Near Protocol’s account pointed out that you “can't spell Polkadot without KOL,” the Polkadot account responded: “Community voted, we’re rebranding to KOLKADOT"

Lastly, on Wednesday, Polkadot posted: "KOLs, you can contact the marketing bounty (yes, that marketing bounty) via the form here: [and a link to a form]"

Polkadot is embracing humor and camaraderie, showing that even in the face of serious issues, a little levity can go a long way in keeping the community engaged and entertained.