How Will Pendle Recover Users After the Significant TVL Drawdown?

Weekly News Recap: 💥 Salame’s legal drama deepens, 🚀 BlackRock’s ETH ETF hits $1B, 🔥 Prometheum sparks controversy, and more!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

If you like Unchained: Refer us with a friend and earn a Premium subscription!

Pendle Ripped in Early 2024, But Usage Has Slowed Down. Can It Recover?

Pendle Finance saw massive growth earlier this year but has recently faced a significant drop in TVL. How will it bounce back?

Pendle Finance, an innovative protocol that lets users trade yield, surged in popularity earlier this year but is now grappling with a downturn in usage.

In this episode, founder TN Lee shares insights into Pendle’s approach, the factors behind its recent success, and the challenges it faces in recovering user engagement and TVL. Plus, since Pendle’s rise was driven by the points narrative, TN talks about how the protocol can keep growing.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Weekly News Recap

Ryan Salame’s Legal Battle Deepens with Indictment of Partner Michelle Bond

Former FTX executive Ryan Salame's legal troubles have escalated following the indictment of his partner, Michelle Bond, on charges of unlawful campaign contributions. Bond, a former congressional candidate and prominent crypto advocate, is accused of using $400,000 from a "sham consulting agreement" with FTX to finance her 2022 campaign for a U.S. House seat in New York. The indictment, unsealed by the U.S. Attorney for the Southern District of New York, alleges that Bond falsely reported the funds as consulting income, concealing their true origin.

Salame, who pleaded guilty last year to campaign finance violations and operating an unlicensed money-transmitting business, claims his plea deal was based on assurances that the government would drop its investigation into Bond. However, prosecutors have resumed their probe, leading Salame's lawyers to request either the dismissal of Bond’s indictment or the vacating of his own conviction.

Prosecutors deny any wrongdoing, stating they clearly communicated that Salame’s plea would not shield Bond from further investigation. The case has drawn significant attention due to Salame's ties to FTX, and the court is set to hear arguments on September 12.

BlackRock's Ethereum ETF Surpasses $1 Billion Milestone

On Tuesday, BlackRock’s iShares Ethereum Trust (ETHA) became the first U.S. spot ether ETF to exceed $1 billion in net inflows. The milestone follows a notable $26.8 million surge in inflows on Tuesday, solidifying BlackRock’s leading position in the Ethereum ETF market. ETHA's success highlights BlackRock's dominance, far outpacing competitors like Fidelity's FETH, which has garnered $375 million in inflows, and Bitwise’s ETHW with $310 million.

In contrast, Grayscale’s Ethereum Trust (ETHE) has faced challenges, experiencing substantial outflows totaling $2.47 billion, most likely due to Grayscale’s high management fees.

Also, BlackRock surpassed Grayscale in total assets under management for its crypto ETFs, now holding over $22 billion, making it the largest crypto fund manager, according to Arkham.

Prometheum Sparks Controversy by Classifying Uniswap and Arbitrum Tokens as Securities

Prometheum, an SEC-registered crypto platform, has ignited debate by declaring its intent to classify Uniswap's UNI and Arbitrum's ARB tokens as securities, alongside ether. The move, which aligns with the U.S. Securities and Exchange Commission’s (SEC) contentious stance against crypto, is seen as a bold step amid widespread industry pushback.

As Prometheum prepares to fully launch its custodial services in September, critics argue that the firm's strict adherence to the SEC’s position could stifle innovation. Many in the crypto community view the SEC's classification of these tokens as overreach, but Prometheum defends its approach as essential for providing a secure, regulated environment for digital asset investors. This decision places Prometheum at odds with much of the industry, where legal battles continue over whether such tokens should be treated as securities.

Crypto lawyer Austin Campbell posted on X: “UNI should pass a community governance proposal to burn all UNI tokens traded through or in custody with Prometheum.”

Eigen Labs Employees Bypass Airdrop Bans

Eigen Labs, the developer of EigenLayer, is facing scrutiny after a CoinDesk report showed that its U.S.-based employees bypassed restrictions to claim tokens from projects like Renzo and Ether.Fi. Despite these projects explicitly barring U.S. residents from participating in their airdrops due to regulatory concerns, blockchain data indicates that wallets linked to several Eigen Labs employees, including top executives, successfully claimed substantial amounts of tokens.

The revelation has sparked ethical questions within the industry, as Eigen Labs itself has employed geofencing and other measures to block U.S. users from its own airdrops.

Binance and Former CEO CZ Face New Money Laundering Lawsuit

Binance and its former CEO, Changpeng Zhao, are at the center of a new class action lawsuit, facing allegations of negligent compliance practices that allegedly enabled money laundering on the platform. Filed in the U.S. Western District Court of Washington, the lawsuit is spearheaded by three crypto investors—Philip Martin, Natalie Tang, and Yatin Khanna—who claim their stolen assets were laundered through Binance.

The plaintiffs argue that Binance's lax approach to anti-money laundering (AML) and Know Your Customer (KYC) protocols made the platform a favored tool for criminals. They allege that Zhao prioritized rapid growth and profits over legal compliance, turning Binance into a hub for illicit activities.

U.S. Treasury Withdraws Proposed Rule on Unhosted Crypto Wallets

The U.S. Treasury Department has quietly withdrawn a controversial proposed rule that would have imposed strict reporting requirements on unhosted crypto wallets. Originally introduced by the Financial Crimes Enforcement Network (FinCEN) in 2020, the rule sought to mandate that banks and money service businesses report transactions involving digital assets held in self-hosted wallets.

Crypto advocates criticized the proposal as an overreach, arguing it would infringe on financial privacy. The rule's withdrawal, announced in the Federal Register, was welcomed by the crypto community as a significant victory for user privacy and the industry’s regulatory efforts.

Democratic Party Platform Omits Crypto Amid Industry Concerns

The Democratic Party's newly released platform has raised eyebrows in the crypto community for its complete omission of cryptocurrency, Bitcoin, and digital assets. This silence dashes hopes for a potential "crypto reset" under Kamala Harris, the party's presidential candidate. Many in the industry had anticipated a shift toward more favorable policies, particularly after years of stringent regulation under the Biden administration.

Despite efforts by some Democratic lawmakers, such as Representative Ro Khanna, to push for pro-crypto policies, the platform was silent on the issue. In contrast, the Republican Party, led by Donald Trump, has openly supported crypto, highlighting the stark difference between the two parties as the 2024 election looms.

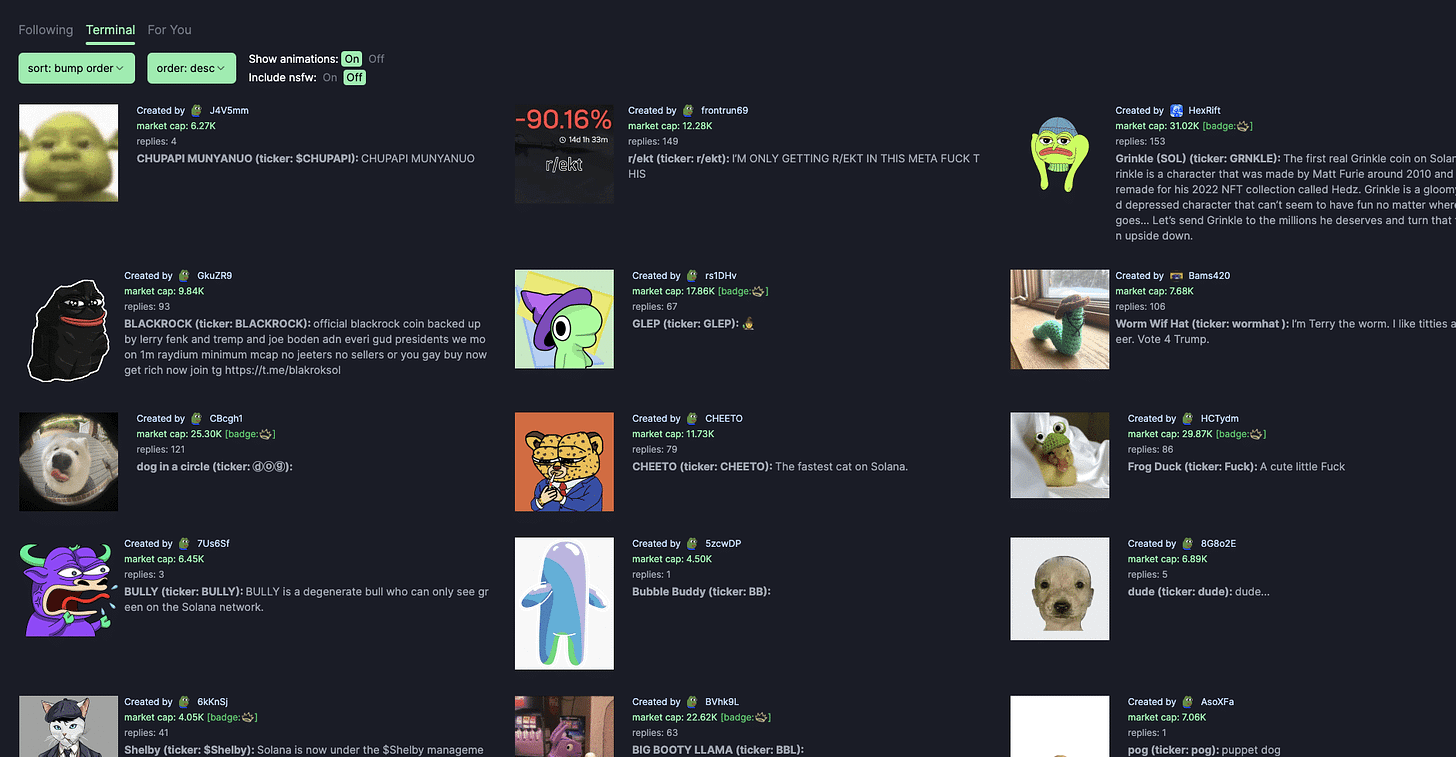

Pump.Fun’s Record Profits Highlight Users' Struggles With Memecoins

Pump.Fun, a Solana-based protocol that enables users to create and trade memecoins, has generated nearly $100 million in revenue since its mainnet launch earlier this year. Despite the platform's impressive earnings, most of its users are not seeing similar success. According to data from Dune Analytics, over two-thirds of wallet addresses on Pump.Fun are unprofitable.

Out of the 1.2 million tokens launched on the platform, only 32 have reached a market cap of over $1 million, highlighting the slim chances of success for most tokens. This disparity underscores the reality that while Pump.Fun thrives, its users often face significant losses, reinforcing the notion that "the house always wins."

SEC Rejects Cboe’s Filings for Solana ETFs, Citing Security Concerns

The SEC has rejected 19b-4 filings submitted by Cboe BZX for two proposed Solana ETFs, according to a source familiar with the matter. The rejections followed discussions in which the SEC reiterated its position that Solana should be classified as a security. As a result, the filings were withdrawn from Cboe's website before they could be placed in the Federal Register, halting the approval process.

Despite this setback, issuers like 21Shares and VanEck remain committed to pursuing Solana ETFs, with the possibility of refiling their applications with stronger arguments against the security classification.

Mango Markets Moves Toward SEC Settlement Over Securities Violations

Mango Markets, once a leading decentralized exchange on Solana, is preparing to settle with the U.S. SEC over allegations of securities law violations. The governing body, Mango DAO, has proposed a settlement that includes paying a $223,228 fine, destroying its MNGO token holdings, and delisting MNGO from trading platforms.

This comes after the protocol was severely impacted by a 2022 exploit orchestrated by Avraham Eisenberg, leading to significant financial losses.

Also this week, Solana-based UXD Protocol, with $7.5 million in deposits, is shutting down due to a lack of liquidity and insufficient excitement among DeFi users, with plans to return funds to investors pending a DAO vote.

Meanwhile, Solana experienced a record outflow of $39 million last week, attributed to a decline in memecoin trading, marking its largest outflow on record according to CoinShares.

Optimism Plans Hard Fork After Security Audits

Optimism, an Ethereum Layer 2 network, has announced a significant upgrade called "Granite" following security audits that uncovered vulnerabilities. OP Labs, the team behind Optimism, assured that no user assets were at risk despite the discovery of some high-severity issues.

As part of the response, the Optimism Foundation temporarily reverted its permissionless fraud proof system to a permissioned state to prevent potential instabilities. The Granite upgrade, scheduled for September 10, includes smart contract improvements and a Layer 2 hard fork to enhance the network’s security features. While the proposal has broad support, some community members have expressed concerns about proceeding without further audits.

Fun Bits: Trump’s Crypto Wallet Out-Earns “The Apprentice” Royalties

Forget reruns of "The Apprentice"—Trump's real passive income is coming from the blockchain! Thanks to NFT royalties and memecoin taxes, the former president is raking in more ETH than ever. Trump Digital Trading Cards are bringing in a steady stream of crypto, with his wallet pocketing a cool 782 ETH in secondary sales alone.

And that’s not all—unofficial Trump-themed memecoins are adding to the haul, dropping fractions of ETH into his wallet with every transaction. Who knew sitting back and watching the crypto world go wild could be more lucrative than TV royalties?