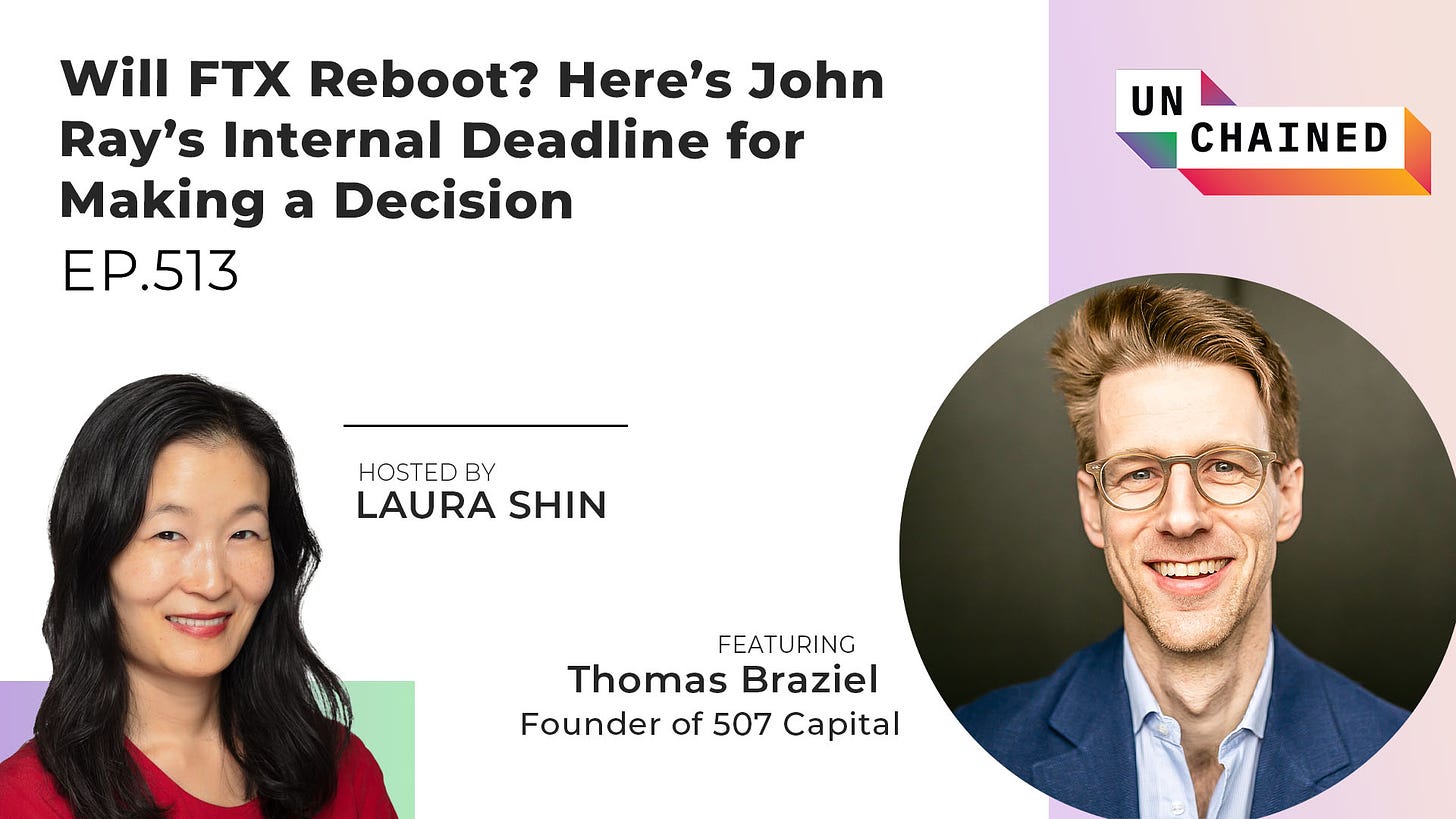

Is FTX 2.0 Really Coming?

Weekly News Recap: 🎤 New episode with bankruptcy expert Thomas Braziel, on, and more ❕

In today's episode of Unchained, Laura talks with Thomas Braziel, the founder of 507 Capital, to unravel the latest developments surrounding FTX.

Thomas dissects the Daniel Friedberg lawsuit and its implications on the FTX whistleblowers, and sheds light on potentially fraudulent claims made during FTX's Series C funding round.

The discussion covers the potential legal consequences for Fenwick and Weston and delves into the approach John Ray is taking to prosecute the questionable transactions of FTX.

Thomas also shares his interactions with Ray, who gave him an estimate of the anticipated timeline for FTX's reorganization plan.

Will there be an FTX 2.0? “I think the odds are pretty low,” says Thomas.

Weekly News Recap

Nevada Regulators Call Halt on Prime Trust

This week, Nevada's Financial Institutions Division (FID) has taken stringent action against crypto custodian Prime Trust. The regulator petitioned the Eighth Judicial District Court of Nevada for a temporary restraining order and an order appointing a receiver due to Prime Trust's burgeoning liabilities. FID's actions arose out of concerns for a "substantial deficit" between the firm's assets and liabilities, which as per the filing, risks "irreparable harm" to customers and the emerging cryptocurrency market.

According to the filings, Prime Trust owed its clients more than $85 million in fiat, but possessed only about $2.9 million in reserves. Furthermore, the custodian was accountable for over $69.5 million in crypto liabilities, but held about $68.6 million.

A pivotal issue was Prime Trust’s discovery, in December 2021, that it was unable to access users’ legacy wallets. At that point, it took to purchasing crypto with customer funds. In a statement, Fireblocks, contracted by Prime Trust for crypto asset management, clarified that the inaccessible wallets were controlled by Prime Trust, not Fireblocks.

FID's enforcement move comes days after BitGo withdrew its plans to acquire Prime Trust, following a cease and desist order by Nevada regulators due to a "considerably deteriorated" financial condition. Both Prime Trust and FID have requested the receivership, showing a concerted effort to mitigate further financial distress.

BitGo CEO Mike Belshe said that, despite pulling out of the deal with Prime Trust, it is planning further acquisitions, predicting more industry consolidation in the coming months.

Sam Bankman-Fried’s Legal Motions to Dismiss Charges Denied

FTX founder Sam Bankman-Fried’s legal defenses faltered this week. U.S. District Judge Lewis Kaplan refused his motion to subpoena documents from former FTX law firm Fenwick & West. Kaplan clarified that neither the law firm nor the FTX debtors are part of the "prosecution team," hence, the government is under no obligation to present documents not within its jurisdiction. The judge rebuffed the motion as a "fishing expedition" that lacks specificity and relevance.

Furthermore, Judge Kaplan denied Bankman-Fried's request to dismiss most charges against him, labeling them "moot or without merit." Bankman-Fried, facing what would likely be a long prison sentence if convicted, had attempted to dismiss fraud charges, arguing that FTX customers suffered no "economic loss" from the alleged fraud. Kaplan dismissed this argument as incorrect both factually and legally, citing the multibillion-dollar deficit Alameda had on its balance sheet.

This legal predicament arrives as Bankman-Fried prepares to defend his actions based on Fenwick & West's advice, thereby proving his lack of criminal intent. However, Kaplan's rulings seem to thwart these attempts, leaving the FTX founder in a challenging position as his October trial approaches.

Coinbase Challenges SEC's Regulatory Authority

Crypto exchange Coinbase has pushed back against its ongoing lawsuit from the U.S. Securities and Exchange Commission (SEC). The company filed a motion to dismiss the SEC's lawsuit, arguing that the digital tokens under scrutiny do not classify as securities. Paul Grewal, Coinbase's chief legal officer, highlighted the SEC's divergence from established law, describing the lawsuit as an “extraordinary abuse of process.”

Coinbase underscores that the SEC is overstepping its legal purview, emphasizing inconsistencies in the SEC's treatment of specific tokens and indicating that six of the 12 tokens now in dispute had not faced previous objections from the regulatory body. In its legal defense, Coinbase stands firm that no securities transactions are occurring on its platform, thereby challenging the SEC's regulatory authority in the crypto space.

Fidelity Joins the Bitcoin ETF Race

On Wednesday, financial services giant Fidelity filed for a spot Bitcoin Exchange-Traded Fund (ETF) with the SEC, confirming an earlier report by The Block. This move comes amid other major asset managers like BlackRock, WisdomTree, Invesco, VanEck, and Bitwise filing similar applications. Ark analyst Yassine Elmandjra noted, "BlackRock’s decision to file for a Bitcoin ETF signals that large institutional players are positive on the long-term outlook for the digital asset.” This development has uplifted sentiment in the market, with the Bitcoin price reaching a one-year high. Grayscale Bitcoin Trust's (GBTC) shares also hit a one-year high amid renewed hopes for the trust's conversion into an ETF.

Moreover, Cboe BZX Exchange revised its filing for the proposed ARK 21Shares Bitcoin ETF to incorporate a surveillance sharing agreement, akin to a feature in BlackRock's planned spot bitcoin fund, aiming to deter market manipulation and fraud. ETF expert James Seyffart, who was on Unchained last week, said: “This is big. It means CBOE and 21shares/Ark also believe this could be the key move for SEC approval. Ark is due August 13th and first in line. *If* it is indeed the silver bullet -- they would be approved first.”

Azuki Faces Backlash as Elementals Debut Stirs Up NFT Controversy

In the world of NFTs, Chiru Labs' Azuki collection faced a rocky week. Azuki's newly released NFT collection, Elementals, was criticized for its striking similarity to its original Azuki NFT collection, leading to a significant slide in prices. Charlotte Fang, the creator of the popular Milady NFT collection, expressed the community sentiment on Twitter, saying the new art was “basically identical to the main collection.”

Acknowledging the community backlash, Azuki admitted they "missed the mark" on their launch, emphasizing the need for better communication and execution. They wrote: “the mint process was hectic, the PFPs feel similar and, even worse, dilutive to Azuki.” The company assured that the "OG Azuki collection defined who we are," and it will always remain their top priority. The developers admitted that their ambitious goals led to the community's confusion over the tangible differences between the original and new collections.

The Elementals offering generated around $37.5 million in sales within just 15 minutes, marking it as the most significant NFT offering in recent months.

To listen to an extensive debate on the failed Azuki drop, don’t miss this week’s episode of The Chopping Block.

Binance.US’s Legal Battle Intensifies

Binance.US recently faced a setback in its ongoing legal wrangle with the SEC as a federal judge dismissed the motion aimed to restrain the regulator from making what Binance deems misleading public statements. U.S. District Court Judge Amy Jackson noted that the court's role wasn't to "wordsmith" public declarations of either party, doubting that the SEC's actions would materially affect the case's proceedings.

The complaint, lodged by Binance.US's lawyers, expressed concern over the SEC's June 17 press release, which suggested that user assets were at risk of being commingled and potentially moved offshore. Binance.US claims these declarations, despite the regulator's lack of evidence supporting them, have already unnerved customers and banking partners, potentially tainting the jury pool.

Simultaneously, amid this intensifying U.S. regulatory scrutiny, Binance is eyeing the Middle East for potential expansion. However, Binance retracted its licensing application in Austria, following its recent decisions to exit the Netherlands, Cyprus, and the U.K., as it streamlines its European entities. Moreover, Germany's financial watchdog BaFin reportedly denied Binance's application for a crypto custody license.

BlockFi Faces Liquidation Amid Allegations of Fraud

Embattled crypto lender BlockFi is on the brink of liquidation as the company's creditors press for a resolution to ongoing bankruptcy proceedings. Creditors have accused CEO Zac Prince and his management team of fraudulent activities and delay tactics, particularly in connection with loans issued to Alameda Research.

BlockFi, grappling with a restructuring plan and lawsuits that could significantly influence client recoveries exceeding $1 billion, may now face liquidation at the hands of creditors demanding action. The creditors stated: “It is time for the court to order an end to the burn and, thereby, end the extortion tactics.” BlockFi’s fate now hinges on the decision of around 100,000 eligible creditors who will vote on the proposed restructuring plan by July 28, 2023.

Three Arrows Capital Founders Face $1.3 Billion Recovery Claim

The founders of Three Arrows Capital (3AC), Su Zhu and Kyle Davies, are on the sharp end of a $1.3 billion recovery claim by the fund's liquidators. The cofounders are accused of incurring debt while 3AC was insolvent, following the collapse of LUNA and its stablecoin UST, which led to significant losses. Reportedly, creditors of the now-defunct hedge fund are owed a whopping $3.3 billion.

"Zhu and Davies are accused of causing Three Arrows to take on significant leverage after the hedge fund suffered big losses," stated an insider, as per the Bloomberg report. The latest twist is that Teneo, the appointed liquidators, are pursuing Zhu and Davies in a British Virgin Islands court to recover the losses.

Sui Foundation Battles Allegations Over Locked Staking Rewards

The Sui Foundation, the entity behind the Layer 1 blockchain Sui, is under fire following allegations from a Twitter account, DefiSquared, that it sold locked staking rewards on Binance. DefiSquared claimed to have evidence that Sui misrepresented its token emission numbers and sold tokens meant to be non-circulating.

Despite this, the Sui Foundation has refuted these claims, stating that the gradual increase of SUI's token supply aims to add liquidity to the ecosystem. It insisted that neither staking rewards nor other tokens from locked and non-circulating staked SUI have been sold on Binance or elsewhere.

The disputed transactions were tied to a May 31 incident where DefiSquared alleged that 2.5 million SUI tokens ended up on Binance's hot wallet. The Sui Foundation responded that the transaction was a payment subject to contractual lockup and pledged to publish a detailed token release schedule soon.

Six Engineers Want to Revive Terra

A team of anonymous developers, self-titled the "Six Samurai,” have come forward with a plan to revive the Terra Classic blockchain. The proposal aims to restore the value of Terra Classic's native token, LUNC, and increase blockchain decentralization. "LUNC has limitless upside potential, and we want to help realize it by leveraging our skills to bring value to the blockchain and all its investors in order to accomplish a true revival of the ecosystem," the team stated. Key proposed strategies include reducing node sync times, establishing a terraUSD testnet, and creating community subpools for better financial management.

FUN BITS 😁

Bitcoin’s above $30k! Woohoo! Ginny from Unchained gives us her take on the latest price action.

If you enjoyed this, don’t forget to follow Unchained on all social media platforms. Find the links below ⬇️

If You Like What You Read:

👯♀️ refer Unchained with a friend and earn a Premium subscription

👍 follow Laura on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze