Is FTX Planning to Retrieve Money From Retail Accounts? 🤔

Weekly News Recap: 🏛️ Warren's regulatory push, 🏦 Binance.US legal tussle, 💰 Tether's loan controversy, ⚖️ Gemini vs. DCG legal showdown, 🛡️ Balancer's security woes, and more!

This week, headlines erupted with the news that FTX has taken legal action against Sam Bankman-Fried's parents, Joseph and Barbara.

In this episode of Unchained, Thomas Braziel, founder of 117 Partners, delves into the intricacies of the case. From the likelihood of FTX winning in court to the potential for criminal charges, Braziel provides an expert's insight into this unfolding drama. He notes: “It's clearly something where they could face something,” hinting at the gravity of the situation.

Weekly News Recap

SEC and Binance.US Engage in Heated Legal Dispute Over Document Production

Federal magistrate judge, Zia Faruqui, denied the U.S. Securities and Exchange Commission's request to inspect Binance.US software, urging the regulatory body to narrow its demands for additional information. The SEC has been keen to scrutinize Binance.US's relationship with crypto custodian Ceffu, which according to its own site rebranded from Binance Custody in February and is “the only institutional custody partner of the Binance Exchange.”

According to a statement from the company, Ceffu takes its name from Binance’s Secure Asset Fund for Users, or SAFU, an emergency insurance fun that CoinDesk last year reported had $700 million worth of BNB in one account (now holding $286 million worth of BNB) and $300 million worth of bitcoin in another account (now holding $430 million worth of bitcoin). While the assets remain in the accounts previously associated with Binance’s insurance fund, a month after Ceffu was rebranded Binance released a statement saying it would start using two different stablecoins.

The SEC suspects Binance.US and Ceffu might not be as “separate” as Ceffu’s press release sought to make it appear, accusing the custodian of facilitating the movement of U.S. customer funds abroad. Binance CEO Changpeng "CZ" Zhao denied the SEC's claims that Binance.US used Ceffu for handling customer assets. In a social media post, he wrote: “Binance US does not use, and has NEVER used Ceffu or Binance Custody. You can't just make this stuff up.” That said, the judge encouraged both parties to cooperate and find a middle ground to move the case forward.

SEC Ramps Up Scrutiny on Crypto Exchanges and DeFi Projects

In a recent development that signals heightened scrutiny of the crypto industry, the head of the SEC's Crypto Assets and Cyber Unit, David Hirsch, announced the agency is intensifying its focus on businesses operating similarly to industry giants like Coinbase and Binance. During Hirsch’s address at a day-long event in Chicago for current and former SEC employees, he emphasized that the regulatory body is not limiting its investigations to prominent exchanges but is extending its probes to intermediaries and decentralized finance (DeFi) projects.

Despite facing recent legal setbacks, including the previously mentioned denied request to access Binance.US software, and challenges in cases related to crypto investment firms, the SEC remains steadfast in its mission, Hirsch affirmed. "We're going to continue to bring those charges," indicating what appears to be the continuation of a steadfast approach to monitoring firms that potentially violate federal securities laws. However, Hirsch also acknowledged constraints on the agency, including its limited enforcement budget, which could hamper additional investigations against well-funded exchanges embroiled in complex federal legal battles.

In this week’s episode of The Chopping Block, 0x Labs founder Will Warren talked about the challenges smaller startups face in dealing with a lawsuit, with legal fees amounting to large percentages of their capital raised. It remains to be seen whether small DeFi projects will be able to survive the U.S. regulatory onslaught. Making matters potentially much worse for those in the crypto industry, should any of these lightly funded startups lose their legal battles, it could set precedents that impact the rest of the industry.

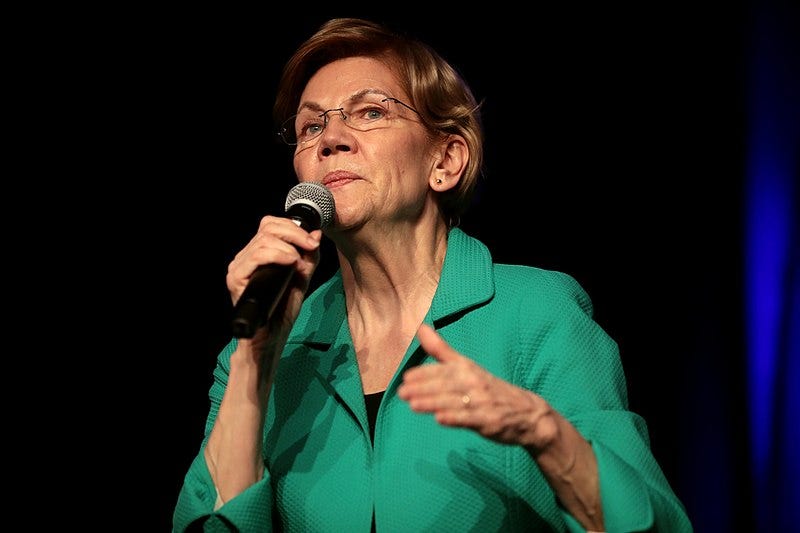

Senators Rally Behind Warren's Crypto Regulation Bill

Meanwhile, in Washington D.C., U.S. Senator Elizabeth Warren, a member of the Democratic party, gained robust support for her Digital Asset Anti-Money Laundering Act, a legislative effort initiated in July 2023 to curb illicit activities facilitated by cryptocurrencies. The bill, backed by a growing coalition of 10 senators, all Democrats or caucused with the Democratic Party, aims to tighten regulatory loopholes and impose stringent know-your-customer and anti-money-laundering requirements, on many participants in the crypto sector, including wallet providers and miners. In a statement, Warren emphasized the urgency to halt criminal enterprises exploiting the digital asset ecosystem.

In related news, New York's historically influential financial regulator behind the controversial BitLicense proposed stricter guidelines for cryptocurrency listings, focusing on technology, market, and regulatory risk assessments.

Tether Continues Issuing Loans Despite Prior Commitment to Cease

Contrary to Tether’s previous claim that it would halt secured loans by the end of this year, the stablecoin issuer has continued to issue USDT-denominated loans to clients, the Wall Street Journal reported. Tether’s latest quarterly financial update revealed a loan portfolio of $5.5 billion as of June 30, up from $5.3 billion in the previous quarter. Tether spokesperson Alex Welch confirmed the new loans, stating they were issued to "longstanding clients" to prevent liquidity depletion or unfavorable collateral sales. Welch added that Tether now aims to end its loans by next year.

Welch defended Tether’s actions, citing $3.3 billion in excess reserves and criticizing traditional financial institutions for not meeting crypto customer demand. The company's loan practices remain under scrutiny, as its balance sheets lack transparency about which assets are being used as collateral to stabilize Tether’s price. Ironically, more transparent stablecoin issuers like Circle, behind the USDC stablecoin, continue to see the market caps of their stable assets decline.

Gemini Slams DCG's Recovery Proposal Amid Ongoing Legal Battle

The legal skirmish between Gemini Trust and the Digital Currency Group (DCG) intensified this week as Gemini vehemently opposed DCG's recent recovery proposal for Genesis Global creditors. In a filing on September 15, Gemini's legal team denounced the plan as a "total mirage," accusing DCG of presenting "contrived, misleading, and inaccurate assertions" to Genesis creditors. The proposal suggested a recovery rate of 70-90% for unsecured creditors, with Gemini Earn users potentially seeing a 95-110% recovery.

Gemini insists that the proposed recovery rates do not reflect the real value terms. The ongoing dispute, marked by allegations of fraud and legal entanglements, sees both companies grappling with a lawsuit filed by the SEC earlier this year.

Balancer Protocol Faces Frontend Attack

The Ethereum-based decentralized finance (DeFi) protocol, Balancer, faced yet another security breach on Tuesday night and urged users to refrain from interacting with its website. Following an attack last month that led to $900,000 worth of losses at the time, representatives of the platform on Tuesday tweeted a warning about a frontend attack, which at the time of the tweet they wrote was still being investigated.

Early reports from blockchain security firms indicate that approximately $238,000 in cryptocurrency might have been siphoned off. Following the previous attack users were advised to exercise caution as the website seemed to have suffered a redirect attack, tricking users into thinking they were using a real investor interface, when in fact they were willfully turning over assets to the thief. Following this latest attack, it looks like that warning might have been worth paying attention to.

Hong Kong Police Intensify Probe Into JPEX Crypto Exchange

Hong Kong police intensified their investigation into the JPEX crypto exchange, arresting six individuals, including crypto influencer Joseph Lam, alleging they misled the public regarding the exchange’s licensing and other operational aspects. The crackdown reportedly follows over 1,400 complaints made to local authorities and suspected involvement of assets worth approximately HK $1 billion ($128 million).

Meanwhile, the exchange faces a liquidity crisis, with halted operations and skyrocketed withdrawal fees, which JPEX attributes to "malicious" actions by third-party market makers. It’s entirely possible, of course, that these were just investors making a better bet than the exchange could, or wanted to handle. Japan’s Securities and Futures Commission (SFC) had previously flagged JPEX for allegedly falsely claiming it had a valid license. The exchange, asserting its commitment to continue operations, is actively negotiating with market makers to resolve the cash flow shortage.

Bitcoin Ordinals Developer Advocates for Numbering System Overhaul

In the face of plummeting bitcoin NFT sales, and a broader asset class downturn, the creator of the Bitcoin Ordinals protocol, Casey Rodarmor, is advocating for a revamp of the current inscription numbering system that lets users draw, or “inscribe” images and other data directly into the bitcoin blockchain. In a post on the Github code repository that houses the Ordinals codebase, the software engineer argued that the existing method has led to complex code and hindered progress.

Initially, the numbering was designed to remain stable, meaning inscriptions would retain their original numbers; however, maintaining this stability has proven to be a significant challenge, especially with alterations to the inscription protocol. The current system assigns negative numbers to unrecognized inscriptions, creating what Rodarmor calls "cursed" inscriptions that fail to indicate the order of creation and adding complexity and bugs to the system. Rodarmor proposes integrating these cursed numbers into the main sequence, and eliminating their use in URLs. This adjustment, he notes, would result in minimal changes, with new numbers differing by about 1% from the old ones.

When Ordinals first launched this January, they were controversial for potentially bogging down bitcoin transaction volumes by creating traffic that some viewed as being not fundamental to bitcoin’s core value, while others saw them as a crucial step to remaining competitive against the likes of Ethereum, which started to popularize NFTs as far back as 2015. Those concerns have waned of late, with Ordinals volume down 97 percent between May and August, according to a Dapp Radar report.

DeFi Roundup

As always, there’s plenty going on in DeFi, and DAOs. Here’s a quick roundup:

Over 70% of ApeCoin DAO members backed proposal AIP-297, co-authored by Animoca Brands chairman, Yat Siu, to create a sister DAO and NFT community treasury for influential NFT acquisitions.

Layer 1 blockchain network Canto said it plans to transition to an Ethereum Layer 2, utilizing the Polygon Chain Development Kit (CDK) for a network emphasizing the integration of real-world assets.

The creators of Layer 2 network Optimism announced a $26 million airdrop, distributing 19.4 million OP tokens to 31,870 addresses as a part of their engagement and reward strategy.

After much deliberation, the founder of F2Pool, a crypto mining operating business, decided to refund 19.8 bitcoin to blockchain infrastructure firm Paxos after the firm inadvertently paid a $520,000 fee on a $2,000 transaction.

Mark Cuban, the American billionaire investor, reportedly lost $870,000 in a crypto scam.

Fun Bits

Genesis is rebranding… You may wonder why… To what? Hear it from standup comedian Ginny Hogan.

If You Like What You Read:

👍 follow Laura on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

Quand personne vous croit ont à tendance à ce faire confiance de plus en plus moi j'ai mes preuves de travail à qui je peux les remettre qui ne les fera pas disparaître depuis très longtemps je me fais priver de mes avoirs mes compte sont maintenu à zéro et mes avoir ce font appropriés pars BTCC

..BINANCE..COINBASE ......BAKE et bien d'autre j'ai maintenant des trillions $$ et il ne veulent pas que ça se sache il préfère éliminer les peuvent et me faire passer pour un fou .. j'ai les preuves