PolyGone? 💔

Plus, 💵 Billions bound for FTX creditors, 🛠️ New strategy to boost ETHFI, 🚀 Avalanche’s biggest upgrade, and more!

Hooray for Tuesday! I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

💔 Aave ponders Polygon breakup

💸 FTX payouts to start in January

🌐 Ether.Fi rewards loyal stakers

📉 Avalanche9000 slashes gas fees

💰 Curve founder Egorov’s $1.2M CRV buy

📈 CoinFund doubles its investment headcount

What’s Poppin’?

By Sage D. Young and Tikta

Aave DAO Mulls Split From Polygon Following Morpho Move

Aave DAO is considering a breakup with Polygon.

Aave Chan Initiative, a service provider for the largest lending protocol in the DeFi space, published a governance proposal on Monday to exit from the Polygon network.

The proposal calls for six recommendations to incentivize migration away from Polygon, including freezing the reserves of several assets on Aave V3 and setting the loan-to-value ratio to 0% for all assets on Aave’s V2 and V3 instances of Polygon. As a result, Polygon users would not be able to borrow any capital on Aave against deposited collateral.

The move comes in response to a Polygon pre-proposal to use lending protocol Morpho to generate a $70 million annual yield on its $1.3 billion in bridged stablecoins.

FTX Distributions to Start in Under 2 Weeks

FTX’s bankruptcy estate yesterday announced that its court-approved Chapter 11 plan of reorganization will become effective on Jan. 3, 2025.

The plan was first approved in October, with between $14.7 billion and $16.5 billion marked for distributions to creditors.

“We are well positioned to begin executing the distribution of recoveries back to all customers and creditors, and encourage customers to complete the necessary steps to begin receiving distributions in a timely manner,” said CEO John Ray.

FTX has entered into agreements with digital asset custody platform BitGo and U.S.-based crypto exchange Kraken to distribute the recovered funds to creditors.

According to FTX’s claims portal, creditors can receive their bankruptcy payouts in stablecoins by converting their fiat to digital assets.

Ether.Fi Proposes Token Buyback to Reward Stakers

Ethereum-based decentralized staking protocol Ether.Fi has proposed a new buyback strategy aimed at enhancing the utility and market strength of its ETHFI token.

A proposal posted to Ether.Fi’s governance forum on Monday called for allocating 5% of the protocol's monthly revenue to buy back ETHFI tokens from the market and then distribute those tokens to stakers as a reward.

In order to qualify for the rewards, users must have been staking ETHFI for at least one month prior to the distribution cutoff.

Ether.Fi already buys back tokens from its main liquidity pool — something that the protocol claims has brought around $2 million of onchain liquidity to the ETHFI market since July.

Ether.Fi is the fourth-largest DeFi protocol, with $9.5 billion in total value locked, according to data from blockchain analytics platform DeFiLlama.

Avalanche’s Biggest Upgrade Goes Live on Mainnet

Layer 1 blockchain Avalanche has launched what it describes as its biggest network upgrade — Avalanche9000.

The team behind the blockchain said the upgrade was live on the mainnet, and it expects the new infrastructure to reduce the cost of deploying a layer 1 by 99.99%.

Avalanche9000 will also bring down the minimum gas fee on its C-Chain by 96% and connect layer 1s — formerly known as subnets — with enhanced interchain messaging that will enable better communication and shared liquidity.

The upgrade is expected to have a big impact on Web3 games thanks to its lower barriers to entry for developers who want to explore utilizing blockchain for building games.

Curve’s Michael Egorov Buys $1.2M of CRV Tokens

Curve Finance founder Michael Egorov has acquired 1.08 million CRV tokens for around $1.2 million, according to data from blockchain analytics platform Spot On Chain.

Egorov acquired the tokens over the course of three hours late on Monday. The purchases are Egorov’s first major buyback since his massive onchain loans were liquidated in June.

The price of CRV dropped around 7% in the 24 hours preceding Egorov’s token purchases. CRV had since recovered to around $1.10, still down 2% over the previous 24 hours, as of press time.

CoinFund Expands Investment Team, Plans Further Growth

Crypto investment firm CoinFund has expanded its workforce, nearly doubling the number of investment team members excluding its managing partners and increasing its overall headcount by 28% this year.

“We had such conviction that crypto is likely to be a fertile area to produce big investment gains that we focused on expanding the team during a bear market,” David Pakman, CoinFund managing partner and head of venture investments, told Unchained. “So we added five people to the investing team over the last year.”

The U.S. Has Failed on Crypto Policy. ‘Crypto Dad’ Has Ideas on How to Fix It

At the Blockchain Association’s Policy Summit in DC, Chris Giancarlo, former CFTC Chair and senior counsel at Willkie Farr & Gallagher, dives into how the U.S. can fix its crypto policy, tackle the problem of de-banking, and support stablecoins. He also shares his thoughts on Trump’s crypto-related nominations, the Digital Dollar Project, and why traditional finance entering crypto could be a turning point for the industry.

Unlock zero trading fees, up to 5.1% APY on USDC, boosted staking rewards and more with Coinbase One.

Try it free for a month with code UNCHAINED.

Daily Bits… ✍️✍️✍

🏦 Ethena launched its USDtb stablecoin, backed by BlackRock’s BUIDL fund, marking a shift towards a reserve-backed model with 90% of its reserves held in tokenized U.S. Treasury products.

🎮 NFT collection CyberKongz revealed yesterday that it had received a Wells Notice from the U.S. Securities and Exchange Commission, signaling potential enforcement action due to concerns over token integration with blockchain gaming mechanics.

📜 The SEC has also issued a Wells Notice to crypto investment firm Unicoin, alleging violations including fraud and unregistered securities sales.

💵 Ripple will roll out its RLUSD stablecoin today, backed by U.S. dollar assets, alongside the addition of former central bankers to its advisory board to guide the firm’s growth strategy.

🏛️ German former Finance Minister Christian Lindner criticized Chancellor Olaf Scholz in the Bundestag for not adopting Bitcoin in Germany's financial strategy, citing the U.S.'s crypto-friendly policies as an example of innovation.

🛠️ The Monad Foundation was established on Monday, aimed at promoting the development and adoption of the Ethereum-compatible Monad blockchain, with its creation hinting at an imminent mainnet and token launch.

🛡️ Hackers linked to the 2022 LastPass breach stole $5.36 million in crypto from more than 40 wallet addresses, converting funds to bitcoin via instant exchanges, blockchain investigator ZachXBT reported.

🏦 Crypto wallet maker Exodus secured SEC approval to list on the NYSE American exchange on Wednesday.

🚫 British Columbia upheld its province-wide bitcoin mining ban, extending it to December 2025 despite Vancouver's exploration of becoming a bitcoin-friendly city, to preserve energy for clean initiatives.

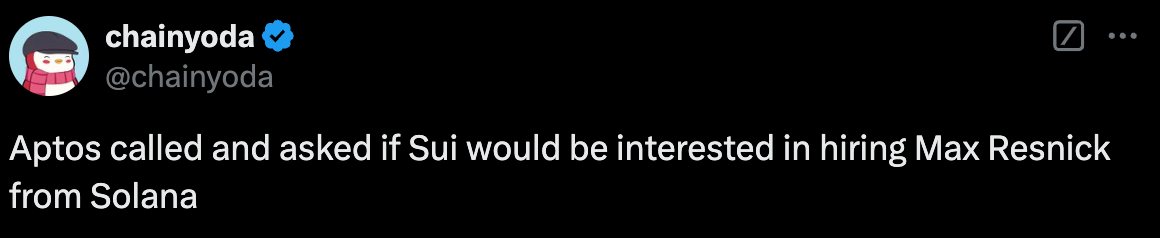

What Do You Meme?

📈 Your Market Update 📉

BTC is up 2.9%, trading at $106,804

ETH is up 2.3%, trading at $3,997

BTC dominance: 53.66%

Crypto market cap: $3.95T

*All data as of today, 06:55 am ET. Source: CoinGecko

Recommended Reads

"You don't understand AI agents" by Wayne Hamadi

Architectural Digest: Will Bitcoin and Data Centers Soon Heat Your Home?

We Are Hiring!

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!