🎉 Privacy Prevails

Plus, 🤷♂️ Kraken pulls plug on NFTs, 🐞 History’s largest bug bounty? 🛠️ Ren plans V2, and more!

Good Wednesday! I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

⚖️ Tornado Cash wins key legal battle

🤖 Aave automates risk with Chaos Labs

🛑 Kraken shutters NFT marketplace

🔗 Ren V2 set to revamp DeFi

🐞 Uniswap’s record bounty for V4 bugs

With over 20 licensed or regulated assets on-chain and a global ecosystem of 400k+ ramps, Stellar is the network of choice for real-world asset tokenization.

What’s Poppin’?

By Sage D. Young and Tikta

Treasury Overstepped With Tornado Cash Sanctions, Rules U.S. Appeals Court

The U.S. Department of Treasury’s sanctions against decentralized crypto mixer Tornado Cash were unlawful, according to a ruling from the U.S. Fifth Circuit Court of Appeals.

“The immutable smart contracts at issue in this appeal are not property because they are not capable of being owned,” stated the ruling filed on Nov. 26.

“Because these immutable smart contracts are not ‘property’ under the word’s common, ordinary meaning or under OFAC definitions, we hold that OFAC exceeded its statutory authority.”

Smart contracts must now be removed from the sanctions list and US persons will now be allowed to use the protocol, said Paul Grewal, Coinbase’s chief legal officer, on X,

Consensys lawyer Bill Hughes echoed similar sentiments on X, hailing the court’s decision as “a good win” for the industry and one which the Supreme Court would be unlikely to reverse.

Aave Is Using New Oracles by Chaos Labs to Automate Its Risk Management System

Aave, the dominant lending protocol in the decentralized finance space, has started using oracles developed by Chaos Labs, a risk management firm that has a long working relationship with Aave.

The move automates processes for changing the lending protocol’s risk parameters such as liquidation thresholds as well as supply and borrowing capacities.

Unlock zero trading fees, up to 5.1% APY on USDC, boosted staking rewards and more with Coinbase One.

Try it free for a month with code UNCHAINED.

Kraken Shuts Down NFT Marketplace

Crypto exchange Kraken is closing its non-fungible token (NFT) marketplace as it shifts resources into new products and services.

The Kraken NFT marketplace will enter “withdrawal only” mode on Nov. 27, after which users will no longer be able to list, purchase, bid on, or sell NFTs.

Kraken advised users to transfer their NFTs to a self-custodial wallet or their Kraken Wallet before the withdrawal period ends on Feb. 27, 2025.

Kraken launched its NFT marketplace in beta in November 2022, followed by a full launch in June 2023 with support for 250 NFT collections across multiple blockchains including Ethereum, Solana, and Polygon.

The NFT market as a whole has declined significantly since its peak in 2021. The third quarter of 2024 saw NFT trading volumes decrease by 61% from $3.1 billion at the start of this year to $1.2 billion, according to data from CoinGecko.

Ren Protocol Promises V2 After Binance Delists Token

Controversial interoperability protocol Ren said in an X post on Tuesday that version 2 is coming, with the team anticipating it will have a “more outsized and sustainable impact on DeFi than Ren v1.”

The team said it plans to address protocol design and governance lessons learned from the earlier version, which was shut down in December 2022. At the time, the team attributed the decision to events related to FTX and Alameda and in April 2023, Ren transferred nearly all of its assets to FTX debtors’ wallet for safeguarding in case of a possible shutdown.

Ren’s v2 announcement comes after its native token REN was named in a Binance delisting notice. The price of REN sank 20% following the news to a low of $0.042. Its market cap has declined from its 2021 peak of $1.7 billion to around $42 million at press time.

Uniswap Announces ‘Largest Bug Bounty in History’ Ahead of V4

Decentralized exchange Uniswap will offer up to $15.5 million in rewards to bounty hunters who discover critical flaws in the protocol’s v4 core contracts.

Uniswap Labs said “the largest in history” bug bounty was an extra step to make sure that the new version of the protocol is as secure as possible, given that the codebase has already been reviewed by nine independent auditors.

Uniswap v4 is a major protocol upgrade that introduces hooks, a feature that allows developers to inject custom logic at specific points in a pool's lifecycle, enabling dynamic adjustments and diverse use cases.

It also aims to reduce gas fees and make pool creation 99% cheaper compared to v3.

Earn bitcoin on Gemini here.

What’s the Best Way for Ethereum to Grow? Justin Drake and Martin Köppelmann Debate

Ethereum has had an abysmal year in the midst of a crypto boom. Justin Drake and Martin Köppelmann, each of whom has proposals for scaling the OG smart contract blockchain, face off.

Ethereum has been left behind in this bull market. As rivals like Solana gain ground in metrics such as speed, cost, and developer mindshare, questions are being raised about whether Ethereum’s reliance on Layer 2 solutions is the right path forward—or if it needs a more fundamental redesign.

In this episode, Martin Köppelmann, co-founder of Gnosis, and Justin Drake, researcher at the Ethereum Foundation, discuss the trade-offs of native and based rollups, execution capacity, and Ethereum’s ability to maintain its dominance. They debate how Ethereum should address fragmentation across rollups, whether ETH has strayed from its ultrasound money narrative, and whether its deliberate pace of innovation could make it vulnerable in an increasingly competitive landscape.

Whose ideas will lead Ethereum out of this dark forest?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Daily Bits… ✍️✍️✍

⚖️ The Trump administration is reportedly planning to shift crypto regulation to the CFTC, reducing the SEC’s oversight by granting the commission authority over exchanges and digital assets classified as commodities such as bitcoin and ether.

✨ Starknet became the first major Ethereum layer 2 rollup to launch staking, allowing users to earn rewards with at least 20,000 STRK or by delegating smaller holdings, signaling a step toward further decentralization.

🌐 Justin Sun joined Trump’s crypto project World Liberty Financial as an adviser, following his $30 million investment in WLFI tokens.

⚡️ Flashbots launched BuilderNet to tackle centralization in Ethereum’s block-building process by encouraging a decentralized approach where multiple operators share transaction processing and order flow securely.

Today in Crypto Adoption...

🇧🇷 A Brazilian lawmaker proposed creating a "Strategic Sovereign Bitcoin Reserve" to allocate up to 5% of Brazil’s international reserves to bitcoin, aiming to boost economic resilience against currency and geopolitical risks.

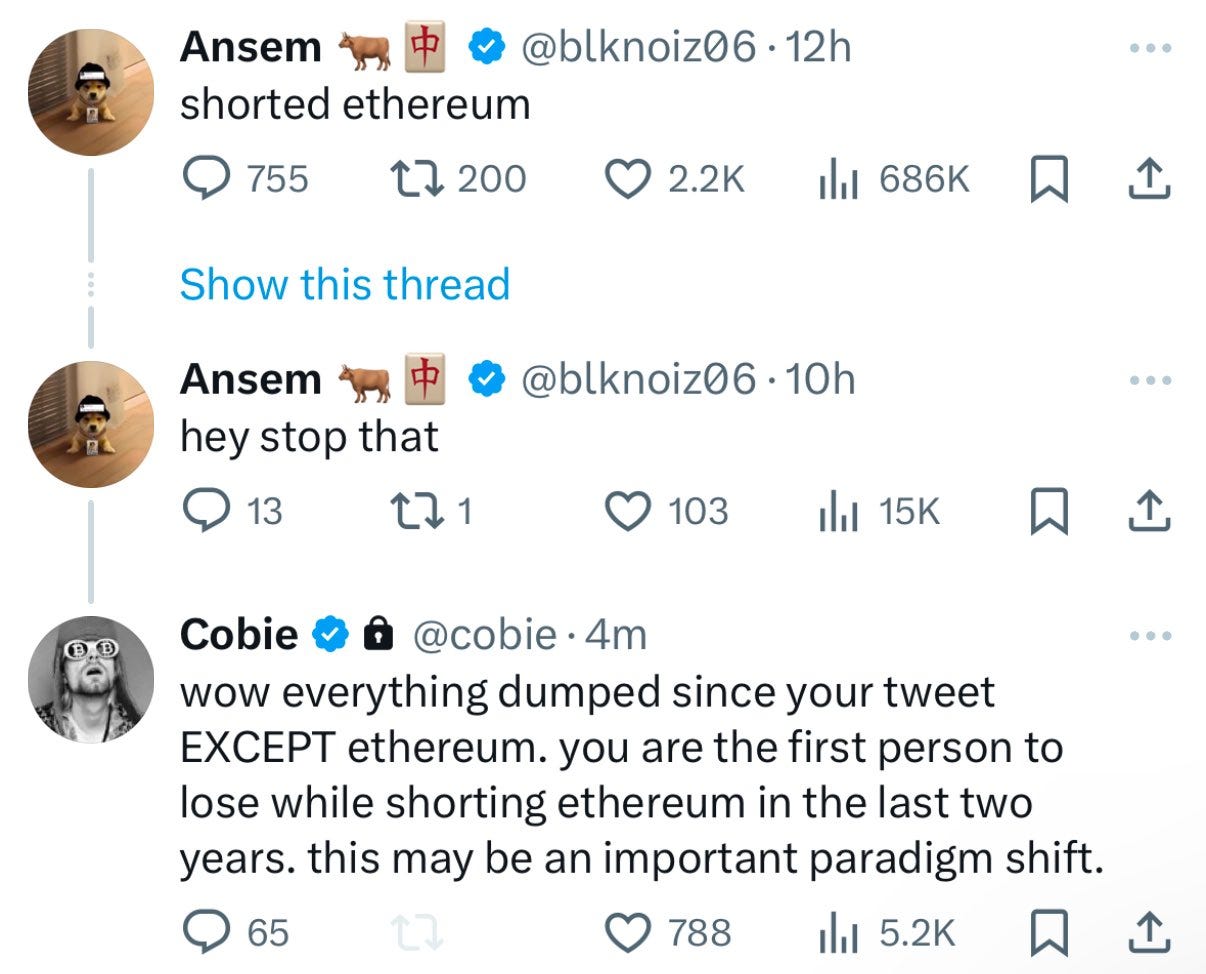

What Do You Meme?

📈 Your Market Update 📉

BTC is up 1.1%, trading at $93,012

ETH is up 4.1%, trading at $3,450

BTC dominance: 54.75%

Crypto market cap: $3.37T

*All data as of today, 07:40 am ET. Source: CoinGecko

Recommended Reads

André Dragosch, European head of research at Bitwise, on whether the bottom is already in

Doug Colkitt, founder of Ambient Finance, on how to fix the surge in Base reverts

We Are Hiring!

A Part-Time Sponsorships Manager to generate and manage sponsorships across Unchained’s platforms. See the details and apply here.

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!