Sam Bankman-Fried Is Everywhere - Apple Goes After NFTs?

Crypto Weekly News Recap: SBF talks (a lot), BlockFi files for bankruptcy and sues FTX, regulators are watching the implosion of FTX, the funny journey of Gabriel Haines, and more...

Wait, why am I receiving two emails in one day?

On Unchained, we run two newsletters: the daily ones, which go from Monday through Saturday, and the weekly (this one!) which recaps all the news in the crypto ecosystem in the past week.

If you want to receive only one of the newsletters (for example, receive the daily and not the weekly, or vice versa), you can 100% do it.

How? Just go 👉 here and select whichever you want!

On this Friday’s episode of Unchained, Adam Cochran of Cinneamhain Ventures had harsh words about Sam Bankman-Fried’s interview at the New York Times Dealbook Summit. “I thought it was one of the greatest works of fiction since Game of Thrones,” he said.

We also discussed the knock-on effects to BlockFi, which filed for bankruptcy this week, and perhaps to Genesis and DCG. His view on the potential for further contagion is bleak. “I wouldn't be surprised if we continue to see contagion impacts of forced selling for the next six months,” he said.

Be sure not to miss this insightful episode that gives a clear-eyed view of how the fallout from FTX’s collapse might unfold.

Crypto Weekly News Recap 👇

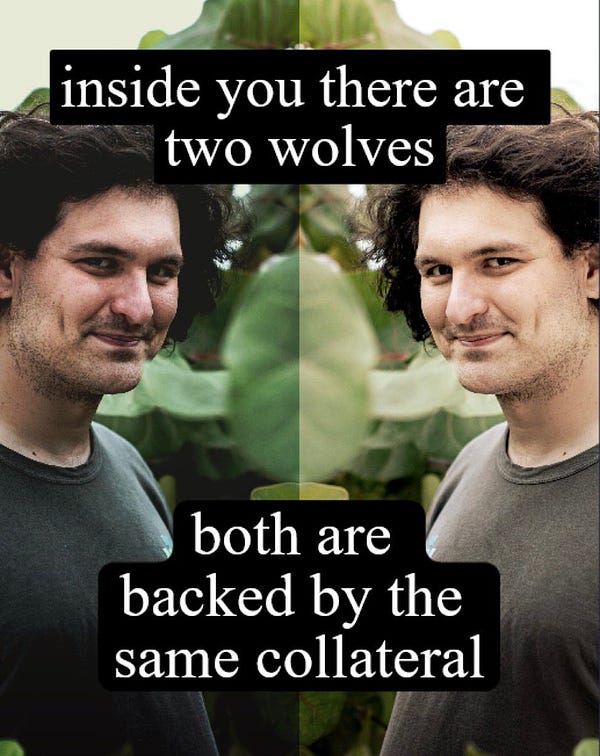

Sam Bankman-Fried Tries to Win Over the Public

As we just discussed on the show, Sam Bankman-Fried did an interview with Andrew Ross Sorkin at The New York Times’s DealBook Summit, but he was everywhere this week.

In response to a question of whether the funds from FTX were sent to Alameda, his trading firm, which was led by Caroline Ellison, he said that he “screwed up” and that he “didn’t knowingly commingle” funds.

Additionally, he said that he didn’t intend to commit fraud. As was noted on The Chopping Block livestreamed show on Wednesday (which will be released on the podcast tomorrow), whether Bankman-Fried knew what was going on or not is very important, because it could determine whether he will face criminal or civil charges.

Many on Crypto Twitter did not believe a word of Bankman-Fried’s comments. Vinny Lingham, general partner at Multicoin Capital, said: “the SBF legal strategy is to attempt to characterize fraud as incompetence, in order to stay out of jail.” David Marcus, Cofounder & CEO at Lightspark, said he was “speechless at the level of reality distortion field at play here.”

However, SBF got at least one supporter. CEO Pershing Square and billionaire Bill Ackman tweeted he believes SBF is “telling the truth” – which promptly got ratioed – and to which SBF responded that he “deeply appreciates” it.

Also this week, in an audio interview with Celsius creditor Tiffany Fong, SBF dismissed the rumors of a “backdoor,” which he allegedly used to move funds without triggering any alerts. He also addressed the value of FTT, the token of FTX, saying that it was “more legit than most tokens.”

In a later interview with ABC News' George Stephanopoulos on Good Morning America, Bankman-Fried claimed again that he knew nothing about the improper use of FTX’s funds, and said that he didn’t “even try to do risk management.”

Moreover, talking with New York Magazine’s Jen Wieczner, SBF said he wishes he hadn’t bailed out the industry, and avoided the question of how the customers’ funds were lost.

BlockFi Sues FTX

Apart from filing for bankruptcy, BlockFi is also suing Sam Bankman-Fried over Robinhood shares that FTX pledged as collateral. Bankman-Fried held about 7.6% of Robinhood Class A common stock.

According to BlockFi’s first-day court bankruptcy hearing, FTX and Alameda Research owe over $1 billion to BlockFi. with Alameda owing $671 million on a now-defaulted loan, and FTX owing $355 million in frozen funds.

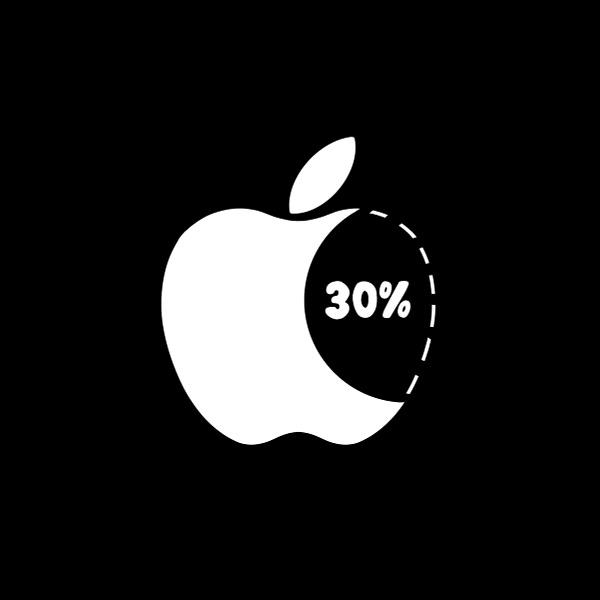

Apple Decides that Users of Coinbase Wallet Shall Not Transfer NFTs

Tech giant Apple, valued at $2.36 trillion, blocked the latest version of Coinbase Wallet until a feature that allows users to send NFTs over iOS is disabled.

The decision has to do with Apple’s policy of charging a fee of 30% for every transaction going under a mobile application in its operating system iOS. According to Coinbase, Apple wants to collect 30% of the gas fees required to send NFTs.

Coinbase was openly critical of Apple’s decision. They wrote, “this is akin to Apple trying to take a cut of fees for every email that gets sent over open Internet protocols (...) Apple has introduced new policies to protect their profits at the expense of consumer investment in NFTs and developer innovation across the crypto ecosystem.”

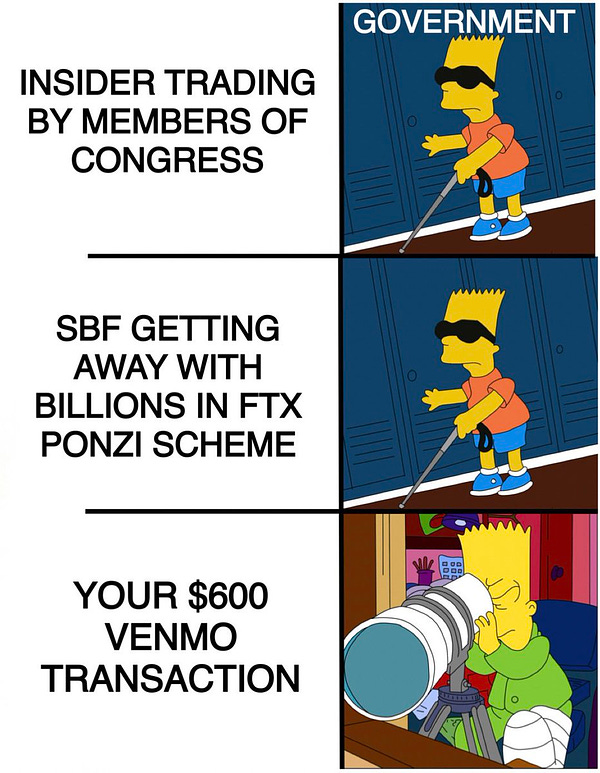

Authorities Have Their Eyes on FTX

The implosion of FTX keeps resonating with authorities in Washington. At the New York Times’ Dealbook Summit, US Treasury Secretary Janet Yellen called it the ‘Lehman moment’ for crypto. In addition, during a Senate Banking Committee hearing, Senator Elizabeth Warren called FTX “not much more than a handful of magic beans.”

Meanwhile, during the first Senate hearing on FTX, CFTC Chair Rostin Behnam kept pushing for his agency to have more power to regulate the crypto industry. He said: “to prevent this from happening again, we must be provided appropriate authority by Congress."

As was previously announced, legislators and regulators are probing the collapse of FTX. The House Financial Services Committee announced it will hold its first FTX hearing on December 13, hoping to get clearer answers about the management of the company.

Additionally, in a speech on Sunday, the Bahamas Attorney General Ryan Pinder said that regulators in the country are also investigating Sam Bankman-Fried and FTX.

Genesis Is Being Investigated by Regulators

According to Barron’s, Genesis is being investigated by The Alabama Securities Commission and other states. Regulators are reportedly studying how crypto firms are connected to each other, the connection between Genesis and retail investors, and the possibility that Genesis violated securities laws.

One of the most pressing issues of DCG and Genesis is Grayscale’s Bitcoin Trust (GBTC). Many were worried that, amid the liquidity crisis, Genesis was going to dump its GBTC on the market. Ryan Selkis, founder of Messari, brought some calm for GBTC shareholders, saying that it’s not possible for DCG and Genesis to sell GBTC because of certain market rules that don’t allow them to do so.

South Korean Authorities Seek an Arrest Warrant for Terraform Labs Cofounder Daniel Shin

Yonhap, a South Korean news agency, reported that the Seoul Southern District Prosecutors Office is seeking an arrest warrant for Terraform Labs cofounder Daniel Shin. Terraform Labs is the entity behind the Terra blockchain, which collapsed in May along with its native tokens LUNA and UST.

Shin, who’s no relation of mine, is being accused of allegedly taking illegal profits of around $105 million through sales of LUNA before Terra collapsed. In addition, the Prosecutors Office issued warrants for three other Terraform Labs investors and four engineers. The news comes after a prior request to arrest Do Kwon, cofounder of the company.

Wrapped Tokens Cause Confusion Amongst Some Crypto People

Crypto Twitter is where everything happens, and it can be a great source of information, but this week it certainly went the other direction.

Many influencers such as Eric Wall, Anthony Sassano and Banteg started messing around and saying that wETH, the wrapped token of ether, was going to depeg and that it was insolvent. (This isn’t possible since it’s a smart contract, and, barring a hack, it’s easy to see at all times that the wETH contact is fully backed.)

While they meant it as a joke, there were many who misunderstood the message, leading to widespread confusion. Since wETH is such an important backbone of decentralized finance applications, fear spread throughout people who didn’t catch the joke.

On a related note, Kaiko, a company that provides data and reports to institutions, published a blog post saying that wrapped assets were “under scrutiny,” highlighting WBTC’s discount to Bitcoin of -1.5% days ago.

DeFi Protocols Respond to Market Conditions

While many centralized companies are suffering from their own mismanagement, decentralized entities have been taking a different approach to go through the current crisis.

According to The Block, volume on decentralized exchanges soared in November, increasing by 93% from the previous month.

The community of DeFi protocol Aave, which has a total value locked worth $3.9 billion, decided to freeze 17 tokens on its platform that had low liquidity. The intention, according to the passed proposal put forth by risk management firm Gauntlet, is to reduce the risks of the protocol.

Moreover, after a governance proposal put forth also by Gauntlet, Compound Finance established a max borrow cap on ten tokens on its platform, meaning it restricted the maximum amount that can be borrowed on these tokens. Gauntlet’s Pauljlei wrote: “Setting borrow caps help avoid high-risk attack vectors while sacrificing little capital efficiency and allowing for a threshold of organic borrow demand.”

On a related topic, the community of Maker DAO passed a proposal to increase the savings rate for its stablecoin DAI from 0.01% to 1% – a 100x increase.

And, speaking of decentralized entities, major DeFi protocol Uniswap launched an NFT aggregator on its platform. Users can now trade NFTs across major marketplaces like OpenSea, X2Y2, Sudoswap, Larva Labs and LooksRare on the Uniswap platform. With the launch, Uniswap also announced it was airdropping $5 million to early users of Genie, the NFT aggregation platform that Uniswap acquired five months ago

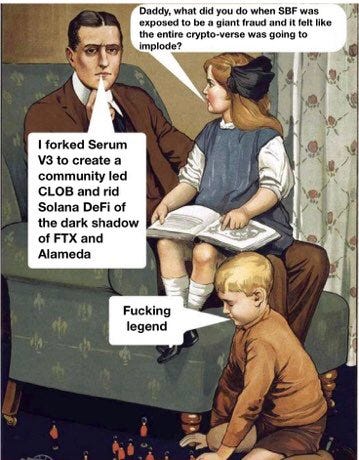

Solana DEX Serum Becomes ‘Defunct’

The blockchain that appears to have suffered the most from FTX’s meltdown was Solana.

Serum, a decentralized exchange built on Solana backed by Sam Bankman-Fried, said that its mainnet program has become “defunct.” The project depended on FTX to sign transactions and modify the code.

However, community members are working on forking the project, so that it can survive. The initiative is led by a developer named “Max Mango.”

Three trading pairs of SRM, the native token of the exchange, were delisted from crypto exchange Binance. SRM is down 98% from its all-time highs and is trading at $0.23

Massive Layoffs Keep Hitting the Industry

Market conditions have been tough, both inside and outside the crypto industry.

This week, crypto exchange Kraken (disclosure: a former sponsor) laid off 30% of its employees. Jesse Powell, cofounder and CEO (and recent Unchained guest), said the decision was taken “in order to adapt to current market conditions.”

CoinDesk estimates that over 26,000 people lost their jobs in the industry during the course of 2021. However, 11,000 of that total correspond to Meta.

Fun Bits

Gabriel Haines Wants to Find SBF

Gabriel Haines, who was on last week’s Unchained Black Friday 2022 edition, has taken on the task of hunting down Sam Bankman-Fried in The Bahamas.

During this week, he’s been posting hilarious videos of his journey in the Caribbean country. For instance, he shared some footage of his ‘training for Normandy’ and a video of him doing push-ups, as they “increase investigation effectiveness,” according to Gabriel.

He has even challenged SBF to a duel.

Join Unchained Premium to get access to:

Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

And now, a new offering: transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Facebook, Instagram, Twitter, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze