SBF Pleads Not Guilty 😇 as Authorities Seize FTX’s Assets

Weekly News Recap: ❌ Gemini's dispute with Genesis, 🗣 FTX's lawyer tells all, 👩⚖️ Alex Mashinsky is sued, 👉 Su Zhu's accusations against DCG, 💸 Coinbase settles for $100 million, and more!

Wait, why am I receiving two emails in one day?

On Unchained, we run two newsletters: the daily ones, which go from Monday through Saturday, and the weekly (this one!) which recaps all the news in the crypto ecosystem in the past week. (It’s narrated in audio form on the podcast, so if you’re looking for the links to those stories heard on the show, they’re all in here!)

If you want to receive only one of the newsletters (for example, receive the daily and not the weekly, or vice versa), you can 100% do it.

How? Just go here and select whichever you want!

Gemini vs. DCG Is Heating Up. Could Gemini Force Genesis Into Bankruptcy?

Earlier this week, shots were fired when Cameron Winklevoss, cofounder of Gemini, posted a public letter to Barry Silbert, the founder of DCG, parent company of Genesis. In it, Winklevoss addressed the issue of Genesis owing the customers of Gemini’s Earn product $900 million, coming up to the line of accusing Silbert of improper behavior.

“Those are obviously fighting words,” concluded Ram Ahluwalia, cofounder of Lumida, who has been closely watching the Gemini/DCG drama unfold, in this Friday’s episode of Unchained.

During the show, we discussed what is likely to happen in this conflict. (Hint: bankruptcy for both Genesis and DCG are on the table. Indeed, after we wrapped, the Wall Street Journal reported that Genesis is considering bankruptcy.)

We also considered some of the class-action motions that have begun: one alleging Gemini Earn was a security, and the other that Genesis and Gemini violated their master agreements. Plus, we looked at how other companies such as Valkyrie and Fir Tree are swooping in and trying to take advantage of the situation. It’s a fascinating conversation. Be sure to tune in!

Weekly News Recap

At His Arraignment, Sam Bankman-Fried Pleads Not Guilty

Sam Bankman-Fried, the former CEO of FTX, pleaded not guilty to eight counts of fraud, money laundering, and other financial crimes at a court hearing in Manhattan on Tuesday.

The charges include wire fraud, violations of campaign finance laws, and securities fraud. The sentences for all the charges adds up to 115 years in prison. He has also been accused of violating political contribution laws by donating to candidates and committees in New York under another person's name.

During the hearing, Judge Lewis Kaplan granted a request from Bankman-Fried's lawyers to seal the names of two individuals who had secured his release on bail with a bond. Federal prosecutor Danielle Sassoon told the court that Bankman-Fried had worked with foreign regulators to transfer assets that FTX's US management had been attempting to seize.

As the process plays out, SBF is not gaining more allies. Reuters reported that Daniel Friedberg, FTX’s former chief regulatory officer, provided information to U.S. prosecutors, the FBI, the Southern District of New York court, and the SEC about the activities of FTX and its sister trading firm, Alameda Research.

Bankman-Fried, who was released on a $250 million bail bond, will remain under house arrest at his parents' home in California. However, his bail conditions have been amended to prohibit him from accessing or transferring any FTX- or Alameda-associated assets. Notably, though, 12 SBF-linked wallets transferred $144,000 worth of assets to different destinations, which included transactions on January 2 and January 3, raising suspicions from industry watchers.

Regulators in the US Seize FTX’s Stake in Robinhood

The US government seized 56 million Robinhood shares, worth about $450 million, from FTX. The shares’ ownership is being disputed by FTX, BlockFi, and creditor Yonathan Ben Shimon. The Department of Justice believes these assets are not part of the bankruptcy estate and may be subject to forfeiture proceedings. The DOJ is also trying to seize FTX assets held in accounts at Silvergate Bank.

Speaking of the crypto-friendly bank, The Wall Street Journal reported that during the recent market downturn, Silvergate was forced to sell assets at a loss in order to meet $8.1 billion in withdrawal requests. The bank also reduced its staff by 40%.

An affidavit filed by Bankman-Fried in an Antigua court in December revealed that he used funds borrowed from Alameda Research to purchase more than 7% of Robinhood's stock.

Additionally, the Southern District of New York created an FTX Task Force to trace and recover lost funds belonging to customers of the collapsed exchange.

As part of bankruptcy proceedings, the debtors of FTX will request the return of seized assets worth $296 million from the Bahamas Monetary Authority. Moreover, the country's Securities Commission is disputing statements made by the new CEO of FTX, John Ray III, calling them "unfounded" and based on incomplete information.

New York AG Sues Former Celsius CEO for Fraud

The New York Attorney General filed a lawsuit against former Celsius CEO Alex Mashinsky, accusing him of defrauding investors of billions of dollars through false and misleading statements about the safety of his crypto exchange.

The suit alleges that the fraud occurred between 2018 and June 2022, when the exchange froze withdrawals. The Attorney General is seeking to fine Mashinsky, impose monetary damages, and bar him from working in the securities industry or leading a company in New York.

Moreover, bankruptcy Judge Martin Glenn ruled that the tokens deposited in Celsius’ interest-bearing accounts belong to the company. This means that Celsius can use its $4.2 billion in crypto assets as it sees fit.

The decision affects 600,000 holders of high-interest accounts at Celsius, who are now considered unsecured creditors. The ruling could also settle a key legal issue in the insolvency cases of Celsius and other companies that went bankrupt last year, including FTX and BlockFi, since it determines the ownership rights of crypto assets at digital exchanges, trading firms, and other platforms.

Many customers had argued that their crypto assets were not the property of the Celsius bankruptcy estate, but the firm argued that its terms of use granted ownership rights to Celsius.

Judge Glenn mentioned that he has not yet made a decision regarding the legal ownership of approximately $700 million worth of cryptocurrency assets used as collateral for fiat loans to individual customers.

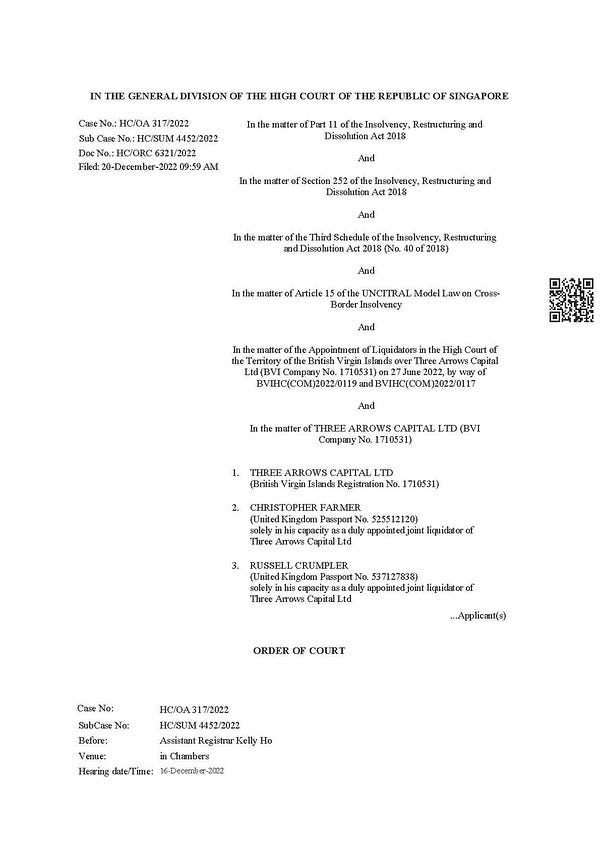

3AC Founder Claims DCG and FTX Conspired

Cameron Winklevoss was not the only one to take a hit at Barry Silbert. Su Zhu, the founder of bankrupt hedge fund Three Arrows Capital (3AC), accused DCG of collaborating with FTX to attack LUNA and stETH, Lido’s Ethereum liquid staking derivative.

Zhu claimed that DCG covered up its losses from 3AC's bankruptcy with a $1.1 billion promissory note due in 2032. He also alleged that DCG used tactics similar to FTX, misleading investors and attacking 3AC while avoiding questions about its own financial standing.

It looks like Zhu’s usage of Twitter backfired on him and on his cofounder Kyle Davies. Following unsuccessful efforts to contact them, liquidators ultimately served subpoenas to the 3AC founders by publishing a tweet tagging “their frequently-used Twitter accounts.”

Coinbase Settles for $100 Million

Crypto exchange Coinbase reached a $100 million settlement with the New York Department of Financial Services (NYDFS) following investigations into compliance failure.

The NYDFS found that Coinbase had failed to adequately review customer identities and transaction alerts along with the surge in customer growth. The exchange was fined $50 million and required to invest another $50 million into its compliance program.

Coinbase has positioned itself as a law-abiding exchange. However, the settlement shows that even exchanges with a reputation for following the rules are under increasing scrutiny from regulators.

Stéphane Ouellette, CEO at FRNT Financial, told The Block: “There is a view that 'OK, the regulators have made their point, and they will leave Coinbase alone for now.'"

Binance.US's Deal to Acquire Voyager’s Assets Is Questioned by the SEC

The US Securities and Exchange Commission (SEC) filed a limited objection to Binance.US's proposed $1bn acquisition of Voyager Digital.

The regulator cited a lack of detail in the purchase agreement about the exchange's ability to close the deal, among other things.

The move follows a warning from the Committee on Foreign Investments in the US that it would conduct a review of the deal that could delay or block it.

The SEC's objections have been communicated to Binance.US's counsel, with a revised disclosure statement set to be filed before the next hearing on the matter. The Texas State Securities Board and the Texas Department of Banking have also filed an objection to the sale, alleging that Voyager and Binance.US are “not in compliance with Texas law.”

BlackRock Bails Out a Bitcoin Miner

BlackRock has given a $17 million loan to crypto miner Core Scientific as part of a $75 million credit facility. The loan is part of a bankruptcy reorganization plan, where the holders of Core's debt will receive a significant amount of the company's stock in the reorganized company in exchange for their debt.

BlackRock already holds $37.9 million of the miner's secured convertible notes.

Core Scientific shut down 37,000 mining rigs belonging to Celsius Mining, amid a long-running legal dispute between the two firms. Core Scientific had accused Celsius of failing to pay fees required for the use of power, which it claimed cost the company $28,840 per day. In response, Celsius agreed to have all of its mining rigs shut down, but insisted that the 37,000 affected rigs were its property and should not be considered part of the bankruptcy estate.

As Bitcoin miners keep struggling, Marathon decided to deleverage and finished 2022 with $103.7 million in unrestricted cash after paying off all its revolver borrowings in December.

Bitcoin OG Gets Hacked

Luke Dashjr, a Bitcoin developer, reported that his wallet was hacked and over 200 Bitcoin, worth approximately $3.3 million, were stolen. Dashjr stated that his PGP key was compromised, but did not provide further details on the hack.

Changpeng Zhao, CEO of Binance, said that his team will be monitoring the stolen assets and will freeze them if they are sent to the centralized exchange. Dashjr also cautioned users about upgrading old versions of the Bitcoin Knots wallet, as he has lost faith in its security.

DeFi protocol Uniswap was not hacked, but it got close. A blockchain security company, Dedaub, discovered a significant flaw in one of its smart contracts, but the issue has since been resolved, with the code being redeployed.

The silver lining is that, despite the recent bad news, the amount of crypto lost to theft, scams, or attacks in December was $62 million, the lowest amount for any month in 2022, according to blockchain audit firm CertiK.

Magic Eden Displays Incorrect Images

Magic Eden, the leading NFT marketplace on Solana, experienced an issue with its verification process when some NFTs displayed incorrect images, including adult content.

The issue was traced back to a compromised third-party image cacher, and the marketplace has since implemented new layers of verification for NFT collections to prevent similar issues in the future.

FUN BITS

Was This Sam’s True Vocation?

This week, a spokesperson from the White House said the meetings held with Sam Bankman-Fried were focused on “pandemic prevention.”

The statement was followed by Crypto Twitter’s skepticism. Nic Carter said: “totally normal for the White House to meet with a private citizen with no medical expertise for their views on pandemics.”

“SBF and Bill Gates. The medical experts we never knew we needed,” Jonathan Long said.

And Gabriel Haines, who never disappoints, posted a funny video of him imitating Sam, using a high-pitch voice and laying out “recommendations” for preventing contagion. Those include using masks, getting vaccinated, and depositing $100 in an FTX account!

🔗Join Unchained Premium to get access to:

Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

And now, a new offering: transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, LinkedIn and/or Medium

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze