🤥 SBF’s Hidden Agenda?

In today's edition: 🎙️ New show on crypto regulation!, 🧐 SBF and the Robinhood shares, 🤝 a new ruling on SBF's bail guarantors, 💼 Alameda sues Voyager, and more!

Earn a Free Premium Tax Plan From CoinTracker!

We're currently testing out a new format for the Unchained Daily and would love to hear your thoughts on it. Fill out this survey for a chance to win 8 Premium Tax Plans from leading crypto tax filing solution CoinTracker!

New Pod Today!

Did FTX Ruin Crypto’s Image on Capitol Hill? Two Lobbyists Discuss

Sheila Warren, CEO of the Crypto Council for Innovation, and Miller Whitehouse-Levine, Policy Director of the DeFi Education Fund, offer insider takes on how lawmakers and regulators are viewing crypto after FTX’s catastrophic failure.

Both expect heightened activity in the U.S. from what they’re calling the “Crypto Congress.” Will this be the year for stablecoin regulation? Is DeFi still in the crosshairs? What about Ripple’s fight with the SEC? The two crypto policy experts look to the U.S. and beyond for what regulatory battles lie ahead in 2023.

What’s Poppin’?

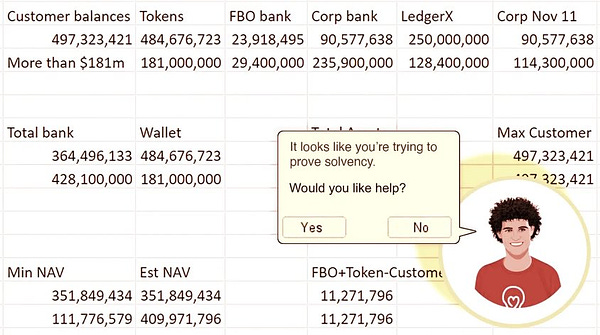

SBF Used Robinhood Stock to Hide Crimes, Say Prosecutors

Former FTX CEO Sam Bankman-Fried is trying to get his hands on the $500 million worth of Robinhood shares he purchased last year, which he claims will help “make customers whole.” Prosecutors want to know – why did he really acquire them in the first place?

Judge Rules SBF’s Bail Guarantors Be Made Public

Bankruptcy judge Lewis Kaplan granted approval for a joint petition from eight media outlets to unseal the names of two individuals who contributed to Sam Bankman-Fried’s $250 million bond.

The former FTX CEO’s massive bail package was granted after his parents co-signed the bond, but the names of two additional signatories were kept out of the public record after Bankman-Fried’s lawyers argued they should be withheld for privacy-centric reasons.

Judge Kaplan said that while he had no reason to doubt that threats were made against Bankman-Fried’s parents, he was yet to see evidence to that effect. The lawyers have until Feb. 7 to contest the decision.

Alameda Research Sues Voyager For $446M

Bankrupt crypto trading firm Alameda Research is suing bankrupt crypto lender Voyager Digital for $445.8 million. According to a Jan. 30 complaint filed by FTX’s lawyers representing Alameda, Voyager was paid $248.8 million in September and $193.9 million in October.

Alameda is now looking to claw back these loan repayments because they were made just months prior to its own bankruptcy. It hopes to reclaim these funds and repay creditors.

The firm acknowledged allegations that it was involved in “secretly borrowing billions of FTX-exchange assets,” but said that Voyager’s own role as a lender in the crypto industry fuelled Alameda’s alleged misconduct, either “knowingly or recklessly.”

“Voyager's business model was that of a feeder fund. It solicited retail investors and invested their money with little or no due diligence in cryptocurrency investment funds like Alameda and Three Arrows Capital,” said FTX’s lawyers.

BlockFi Approved to Sell Crypto Mining Assets

A bankruptcy court has approved crypto lender BlockFi’s request to sell off its crypto mining equipment. In a Jan. 30 filing, the United States Bankruptcy Court for the District of New Jersey ruled that the grounds for selling these assets were fair and reasonable under the circumstances.

The filing stated that all qualified bids should be sent to parties by Feb. 20 and must be filed with the court by Mar. 2. Creditors’ representatives will have until Mar. 16 to object to any sales to qualified bidders.

Last week, Bloomberg reported that BlockFi was looking to sell $160 million worth of loans backed by 68,000 Bitcoin mining rigs.

New York Regulator Investigates Gemini

New York’s State Department of Financial Services is investigating Gemini for the claims it made regarding Earn accounts being insured by the Federal Deposit Insurance Corporation (FDIC), according to a report from Axios.

Some customers believed their Earn accounts were protected by the FDIC after Gemini referenced the agency in several instances of communication. Gemini appears to have been referring to its deposits at external banks and not its own products, but customers felt misled by the lack of a distinction.

Under the Federal Deposit Insurance Act, entities are prohibited from implying that an uninsured product is FDIC-insured by using “FDIC” in its name, advertisements and other documents.

Osprey Sues Grayscale and GBTC for ‘Unfair and Deceptive Acts’

Digital asset manager Osprey Funds has filed a lawsuit against its competitor Grayscale Investments. In a Jan. 30 complaint, Osprey alleged that Grayscale and GBTC engaged in unfair and deceptive acts with misleading statements that led investors to believe that GBTC had a high chance of being approved as an exchange traded fund.

It was this false advertising that allowed Grayscale to maintain a 99.5% market share in a two-participant market, despite charging four times Osprey’s fees, stated the digital assets funds manager.

The U.S. SEC officially rejected GBTC’s conversion into an ETF in June 2022 – something that Grayscale is contesting in a lawsuit filed against the regulator itself. The two are set to present their oral arguments in court on Mar. 7.

In Other News…✍️✍️✍️

An independent examiner for the New York bankruptcy court accused Celsius of deceiving its investors, and using new customer funds to pay for existing customer withdrawals, a hallmark of a Ponzi scheme, in a filing submitted on Tuesday.

Twitter is pursuing regulatory clearance to incorporate payment options, including the possibility of cryptocurrency, into its platform.

A house in Washington, D.C. with ties to former FTX CEO Sam Bankman-Fried is now available for purchase, listed at a price of $3.3 million.

FTX seeks to exclude Turkish units from U.S. bankruptcy case due to lack of control over them and legal or practical effect of U.S. court orders in Turkey.

The England and Wales Charity Commission is investigating the Effective Ventures Foundation, a charity with ties to Sam Bankman-Fried.

LayerZero CEO denied two critical vulnerabilities in connection with Stargate bridge and called the previous accusations from rival cross-chain protocol Nomad "factually incorrect."

Coinbase improved its Wallet app security and user experience with new features like transaction previews, token approval alerts, flagged dApp blocklist, and spam token management.

Today in Crypto Adoption...

The English Premier League entered into a four-year agreement with French startup Sorare to license their platform for fantasy sports gaming.

Binance and Mastercard partnered to introduce a new prepaid rewards card in Brazil, enabling users to transact in crypto for daily purchases.

Cumberland DRW, a leading digital asset liquidity provider, enabled its clients to trade cryptocurrencies in Canadian dollars.

The $$$ Corner…

Pantera Capital is rotating back into altcoins after holding ETH last year to avoid drawdowns. The crypto investment firm believes some altcoins will outperform ether over the next cycle.

Boldstart Ventures and IBI Tech Fund led a $9 million seed round for crypto security firm Hypernative.

ZK-Startup Sovereign Labs raised $7.4 million in a seed round led by Haun Ventures.

Oh Baby Games, a web3 gaming platform, garnered $6 million in a seed round.

What Do You Meme

📈 Your Market Update 📉

BTC is down .88%, trading at $22,919

ETH is down .7%, trading at $1,575

BTC dominance: 41.19%

Crypto market cap: $1.07 trillion

*All data as of today, 5 am ET

Recommended Reads

Thomas Thang, senior investment associate at Sino Global Capital, on zkEVMs:

DeFi Saint on how to read Etherscan:

Emily Parker from CoinDesk on Japan’s crypto regulation

⛓️ Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze