Spot BTC ETF: Here Are All the Details of the First Day 🤑

Weekly News Recap: 📈 Circle's IPO ambitions, 🚫 Bitcoin's NFT proposal rejected, 💼 FTX's Bahamas property sale, 🕵️ Mysterious Bitcoin transfer, 🌏 Lazarus Group's $1.2M move, and more!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed. Your no-hype resource.

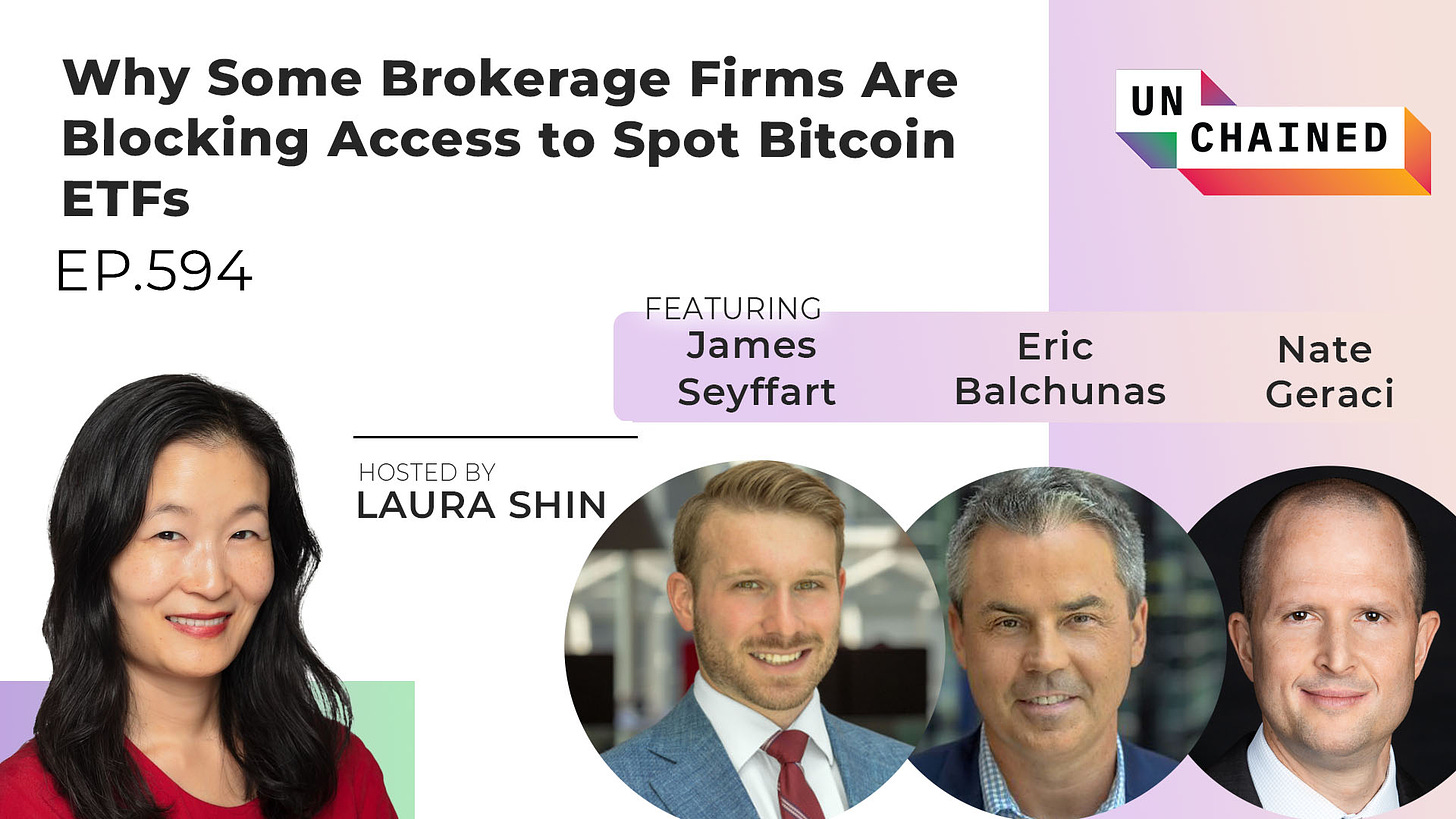

In the latest episode of Unchained, the spotlight is on the recent approval of spot Bitcoin ETFs and the ensuing effects. Nate Geraci, and ETF specialists Eric Balchunas and James Seyffart, delve into the significant trading volumes observed following the launch and the intricacies of ETF operations.

They assess the SEC's roll-out process, highlighting how it's been less than ideal for retail investors. Nate articulates this concern, noting, "My advocacy around Bitcoin ETFs is that if we look historically at the ways retail investors have been provided access to Bitcoin, they have all been completely suboptimal."

The episode further explores why major brokerage firms are restricting access to these ETFs. Also, is it the time for Ethereum spot ETFs?

Listen to the episode on Apple Podcasts, Spotify, Fountain, Overcast, Podcast Addict, Pocket Casts, Pandora, Castbox, Google Podcasts, Amazon Music, or on your favorite podcast platform. Or watch it on YouTube.

Weekly News Recap

Circle Files for IPO in US

Circle, the issuer of the USDC stablecoin, has confidentially filed for an initial public offering (IPO) in the United States. The filing of a preliminary registration statement, or Form S-1, with the U.S. Securities and Exchange Commission marks a significant step in the company's journey, although it didn’t disclose details such as the number of shares it plans to sell and proposed price range.

Headquartered in Boston, Circle has sole governance over USDC following the closure of the Centre Consortium, a joint venture with Coinbase. As of now, USDC is the world’s second-largest stablecoin, second to Tether’s USDT, with a market cap of $25 billion, and a market share that has decreased significantly since its depegging episode in March last year.

The filing comes after a failed attempt to go public in 2022 through a merger with a special purpose acquisition company that valued Circle at $9 billion. The decision to file for an IPO is consistent with the company’s goals, despite the challenges faced during the downturn in the crypto industry in 2022, including the collapse of major crypto firms and heightened regulatory scrutiny.

In September last year, Circle CEO Jeremy Allaire said on Unchained: “We're definitely on the path to be an independent public company.”

Bitcoin Developer's Anti-Spam Ordinals Proposal Rejected

A contentious proposal by Bitcoin developer Luke Dashjr, aimed at filtering out NFTs on the Bitcoin blockchain, was rejected this week.

Dashjr's proposal, introduced last September following the emergence of Ordinals—a protocol that enabled users to inscribe data like NFTs onto the Bitcoin blockchain—was aimed at updating the Bitcoin Core software to handle newer data-carrying styles.

This proposal rapidly sparked a heated debate within the Bitcoin community. While some experts and developers were skeptical, citing potential difficulties in gaining support from Bitcoin miners, others saw it as a necessary step to maintain network integrity and security. Dashjr argued that Ordinals and similar tokens exploit vulnerabilities in Bitcoin Core, causing spam and network congestion. He believes his proposal was a sophisticated way of filtering out Ordinals transactions by applying stricter data-size limits to Bitcoin transactions.

However, Bitcoin Core maintainer Ava Chow terminated the discussion on this proposal without taking any action, pointing to its highly controversial nature and lack of consensus. Dashjr criticized Chow's decision, accusing her of censorship and arguing that all objections to his proposal had been refuted.

Mystery Transfer: $1.2 Million in Bitcoin Sent to Satoshi's Genesis Wallet

This week, the Bitcoin network witnessed a mysterious transaction, as an anonymous user transferred 26.9 BTC, worth approximately $1.2 million, to the Genesis wallet, historically associated with Bitcoin's pseudonymous creator, Satoshi Nakamoto. This wallet, which is integral to the Bitcoin origin story, has been inactive since Nakamoto's disappearance in 2010.

The funds, believed to have originated from Binance, underwent a complex series of transfers through multiple wallets before reaching the Genesis wallet. This wallet, which initially contained only the 50 BTC mined at Bitcoin’s inception, has now grown to almost 100 BTC, valued at around $4.3 million, as Nakomoto’s admirers seek to “tip” him. Despite this substantial sum, it's just a fraction of the estimated 1.1 million BTC controlled by Nakamoto across early Bitcoin wallets.

The crypto community is rife with speculation about the intent behind the transaction. Theories range from Nakamoto himself moving his funds, to the possibility the coins were being “burnt” in a scheme or being used in a pump-and-dump maneuver. Others suggest it could be an attempt to flush out Nakamoto, considering new IRS rules require reporting of crypto receipts over $10,000.

North Korea’s Lazarus Group Shifts $1.2 Million in Bitcoin from Coin Mixer

The North Korean hacking syndicate, Lazarus Group, moved $1.2 million worth of cryptocurrency from a coin mixer to a holding wallet. Blockchain analysis firm Arkham reported that the group processed this transaction, which involved 27.371 Bitcoin, in two phases before diverting 3.34 BTC to an already used wallet.

This movement is part of Lazarus Group's continued crypto theft operations, a major funding source for North Korea, despite facing international sanctions. Notably, in 2023, the group reportedly stole more than $600 million in cryptocurrencies, according to TRM Labs. Such activities are essential for North Korea to sustain itself, and are becoming increasingly sophisticated in order to evade international law enforcement. The Lazarus Group's current holdings are estimated at $79.6 million, including significant amounts of bitcoin and ether, as reported by Arkham Intelligence.

DCG Creditors Dispute Repayment

Digital Currency Group (DCG) recently claimed that it had fully repaid its short-term loans to its bankrupt subsidiary Genesis. However, this claim is being contested by an ad hoc group of Genesis creditors. They assert that DCG still owes substantial amounts in unpaid interest and late fees, totaling approximately $26 million.

The controversy also extends to the nature of the repayment. Creditors argue that DCG's use of "illiquid instruments" such as Grayscale Ethereum Classic Trust (ETCG) and Grayscale Ethereum Trust (ETHE) shares for repayment violates the original agreement, which specified settlement in USD and Bitcoin only. These trust shares were trading at significant discounts, raising questions about their liquidity and compliance with SEC regulations.

Ripple Announces $285 Million Equity Repurchase, Increasing Valuation to $11 Billion

Ripple Labs has initiated plans to repurchase $285 million of its shares, according to a Reuters report. The buyback is expected to elevate Ripple's valuation to approximately $11 billion. The tender offer, aimed at early investors and employees, limits the sale of holdings to a maximum of 6% per stakeholder.

CEO Brad Garlinghouse highlighted Ripple's robust financial standing in comments to Reuters, saying it had over $1 billion in cash and $25 billion in crypto assets, primarily in XRP. The latest move follows a pivotal legal victory against the SEC, in which a judge ruled that XRP sales on public exchanges did not constitute unregistered securities offerings.

FTX Aims to Sell Luxury Bahamian Properties

Amid its bankruptcy proceedings, FTX is seeking court approval to sell a series of luxury real estate properties in the Bahamas. These properties, purchased before the company's collapse, include a variety of beachfront homes and condos, including the notorious Orchid Penthouse where Sam Bankman-Fried and his top lieutenants lived.

The proposed sale, part of a settlement with Bahamian liquidators, requires that buyers offer at least 80% of the properties' appraised values. This process aims to reimburse FTX customers and creditors. Initially acquired through FTX's Bahamian entity FTX Property Holdings, the properties reflect the exchange's significant investment in high-end real estate, including properties bought from sports celebrities such as tennis player Milos Raonic.

US Regulatory Landscape Shifts: CFTC Focuses on DeFi, Blockchain Association Rebuts Warren's Critique

This week in crypto regulation updates, the Commodity Futures Trading Commission's (CFTC) Technology Advisory Committee voted on a report to make recommendations to attain a more focused understanding and regulation of decentralized finance (DeFi). This report is viewed as the first comprehensive DeFi review by a US government agency, and emphasizes enhancing knowledge about DeFi to improve enforcement effectiveness and reassess existing regulatory frameworks. This approach marks a departure from traditional regulatory methods, recognizing the unique challenges posed by decentralized financial systems.

Simultaneously, the Blockchain Association responded to Senator Elizabeth Warren’s critique regarding the hiring of former government officials in the crypto industry. The Association, led by CEO Kristin Smith, clarified that while no current employees fit Senator Warren's specified profiles, many members come from military and law enforcement backgrounds. Smith emphasized that these professionals are attracted to the crypto industry's values of freedom, creativity, and sovereignty. The Association also opposed Senator Warren's legislative efforts to regulate crypto, particularly the Digital Asset Anti-Money Laundering Act, citing the enormous costs and infringement on constitutional rights.

Lastly, the New York State Comptroller criticized the BitLicense program, urging for improved oversight and financial stability checks for applicants.

Apple Removes Major Exchange Apps Following Government Directive in India

In a development reflecting India's tightening grip on cryptocurrency regulation, Apple has removed several major offshore cryptocurrency exchange apps from its App Store in the country. This decision came after the Indian Financial Intelligence Unit issued notices to nine exchanges, including Binance, KuCoin, and OKX, for non-compliance with India’s money laundering laws.

The government's notices, served under the Prevention of Money Laundering Act, accused the crypto firms of operating illegally in India and not adhering to local tax rules. The Ministry of Finance also directed the Ministry of Information Technology to block the URLs of these firms, although this process is still ongoing.

While these apps have been removed from Apple's India store, they remain available on the Google PlayStore, indicating a varied response from tech giants to Indian regulatory measures.