The Downfall of Silvergate ⚰️

Weekly News Recap: 🎙️ New pod on Grayscale vs. SEC, 📉 Silvergate shuts down, 💼 Binance U.S. can move forward with Voyager, 🗽 NYAG sues Kucoin, and more ❕

Grayscale v. SEC: Who Won This Week’s Hearing?

This week the oral arguments in Grayscale’s lawsuit against the SEC over its application to turn the Grayscale Bitcoin Investment Trust into a Bitcoin spot ETF probably went better for the trust sponsor than most would have predicted.

“Going in, I thought it was a close case. I gave the SEC a slight edge,” says this Friday’s Unchained guest, Elliott Stein, senior litigation analyst for the financials sector at Bloomberg Intelligence. “I thought Grayscale had a 40% chance of winning prior to the argument. … I thought courts generally defer to agencies on issues like this because the agencies are the experts, and courts are not quite as versed in securities laws and things like that. But coming out of the argument I think Grayscale is favored now, and I give them a 70% chance to win.”

In this Friday’s episode, Stein unpacks the arguments and what could happen to Grayscale’s application if it wins (hint: it’s not an automatic that GBTC would be turned into a Bitcoin spot EFT). Be sure to tune in to understand why Grayscale’s arguments seemed stronger and what could happen to the $8 billion of bitcoin locked inside the trust.

Take a look at how Marc Cohodes predicted what happened to Silvergate Bank in December and Caitlin Long's insights on the bank's fallout.

Weekly News Recap

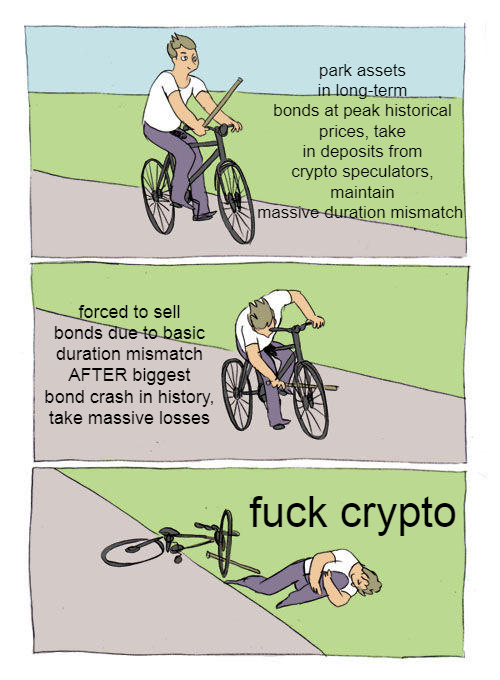

Silvergate Bank Shuts Down

Silvergate Capital Corporation, the holding company for Silvergate Bank, one of the crypto industry’s most important banking partners, announced that it intends to wind down operations and voluntarily liquidate the bank. The decision was made a week after it failed to file its annual 10-K report with the Securities and Exchange Commission and said it was being investigated by the US Department of Justice (DOJ). The announcement tanked the stock by more than 60%.

The bank's wind-down and liquidation plan includes fully repaying all deposits. Silvergate Capital has yet to decide how best to resolve claims and preserve the residual value of its assets, which include proprietary technology and tax assets.

The news came despite Bloomberg reporting earlier in the week that Silvergate was working with regulators to prevent a complete shutdown of its operations, with examiners from the Federal Deposit Insurance Corporation (FDIC) sent to Silvergate's headquarters last week to review the bank's books and records, in a move authorized by the Federal Reserve.

Last week, Silvergate Bank shut down the Silvergate Exchange Network (SEN). However, all other deposit-related services will remain operational as the company works through the wind-down process.

The bank's choice to close down operations and liquidate is expected to have significant implications for the crypto industry as a whole, and will likely be closely watched by regulators and other financial institutions in the space.

In fact, on Monday, White House Press Secretary Karine Jean-Pierre had said it was “aware of the situation” with the troubled crypto bank and would continue to monitor reports.

In a video for Unchained, Caitlin Long, founder and CEO of Custodia Bank, says that this failure isn’t a reflection on crypto.

“This is actually a ‘canary in the coal mine’ for bank regulators and I do hope they see it as that. This has nothing to do with crypto. It has to do with how fast the payments can settle, which means bank runs are going to happen a lot faster.”

NYAG Claims Ether Is a Security

New York Attorney General Letitia James sued Seychelles-based crypto exchange KuCoin for violating securities laws.

James claims Kucoin has been offering tokens, including ether, without registering with her office. This marks the first time a regulator has claimed in court that ether is a security.

James asserts that ether's value is dependent on the efforts of others, including Vitalik Buterin, and that it meets the definition of a security under the Martin Act, New York's anti-fraud law.

Kucoin is also being accused of selling unregistered securities via its product Kucoin Earn, similar to the recent case with Kraken, which settled with the SEC for not properly registering its staking services.

Binance U.S. Gets Approval to Buy Voyager’s Assets

Bankrupt crypto lender Voyager Digital received approval from a U.S. bankruptcy judge to sell its assets and transfer its customers to Binance.US in a deal valued at $1.3 billion. Binance.US will pay $20 million in cash to Voyager and take on crypto assets deposited by Voyager customers, with the customers’ crypto assets accounting for the bulk of the deal’s valuation.

The deal's approval comes despite objections from the SEC and other state regulators. The SEC initially cited concerns over how Binance.US could afford a transaction of such magnitude. However, the regulator was later overruled by the bankruptcy judge who found the objection to be "vague" and lacking concrete evidence.

The deal's approval marks a significant win for Binance.US and Voyager creditors, who could potentially recover 73% of the value of their deposits at the time of Voyager’s bankruptcy filing. The ruling could set in motion the process of transferring customer accounts from Voyager to Binance, and when it is closed, Voyager customers will be able to make withdrawals for the first time since last summer.

However, on Thursday evening, the U.S. DOJ filed an appeal opposing the judge's ruling, which hints that this saga is not over yet.

In related news, a judge approved the company’s agreement to set aside $445 million after an FTX entity sued it for loan repayments. The parties agreed to participate in non-binding mediation and establish a framework for the litigation of remaining disputes.

White House Proposes New Crypto Tax Treatment

In its fiscal year 2024 budget proposal, the Biden administration included a provision that would subject digital assets to "wash sale rules," which means that tax deductions on selling assets at a loss and quickly repurchasing the same or a similar crypto investment would be eliminated, similar to the treatment of stocks and bonds.

The administration estimates that this change could result in roughly $31.6 billion in revenue over ten years.

3AC Founders Launch New Exchange

The founders of collapsed crypto hedge fund Three Arrows Capital (3AC), Kyle Davies and Su Zhu, raised $25 million for a new venture called OPNX.

The platform will specialize in bankruptcy claims trading, allowing creditors to sell their claims quickly without waiting for a long bankruptcy process. The platform lists bankrupt crypto firms such as FTX, Genesis, Celsius, BlockFi, Mt. Gox, and yes, 3AC itself, among the claims it will service. The firm estimates a market size of $20 billion and will cater to investors too small to qualify for OTC deals.

Thankfully, Zhu and Davies did not call it GTX, “because G comes after F,” as was initially pitched.

Separately, Rook, a liquidity protocol on Ethereum backed by 3AC, experienced a surge in activity, with its token rising 23% on speculation of the fundraising.

Alameda Sues Grayscale

Alameda Research, the bankrupt crypto trading firm related to FTX, has taken legal action against Grayscale Investments, the creator of the largest Bitcoin fund. Alameda alleges that Grayscale's "self-imposed redemption plan" is obstructing shareholders from receiving $9 billion in value related to the Bitcoin and Ethereum Trusts.

The lawsuit was filed in the State of Delaware's Court of Chancery and seeks injunctive relief to allow FTX's creditors to obtain over $250 million in net asset value. Alameda holds 22 million shares in the Grayscale Bitcoin Trust (GBTC) and six million shares in the Grayscale Ethereum Trust (ETHE).

Additionally, the suit claims that Grayscale's management fees of $1.3 billion charged over the last two years violate the Trust's agreements, and the firm used fabricated excuses to prevent redemptions.

Alameda Sells Stake in Sequoia

This week, Alameda has also agreed to sell its interest in Sequoia Capital to the Abu Dhabi sovereign wealth fund for $45 million, according to court documents filed on March 9.

The deal is part of FTX's bankruptcy proceedings, in which the company is selling its investments in early-stage crypto and tech ventures to repay creditors. The potential buyer is owned by the Abu Dhabi government and already invests in Sequoia. Still, the deal is subject to approval by a Delaware bankruptcy court but could be closed as soon as March 31.

Meanwhile, Sam Bankman-Fried's lawyers informed a federal judge that he may ask to delay his criminal trial scheduled for October 2023. They say he needs more time to review large amounts of evidence that prosecutors have collected, including cell phones, laptops, and Google accounts of former employees.

Companies Tied to Tether Use Falsified Documents

According to The Wall Street Journal, firms backing Tether, the company behind the most widely traded stablecoin, USDT, allegedly used falsified documents and shell companies to circumvent the banking system. These entities apparently used "shadowy intermediaries" to maintain their access to the global banking system.

As per an email reviewed by Wall Street Journal, Tether owner Stephen Moore detailed how one of Tether’s major traders in China provided fake sales invoices and contracts for each deposit and withdrawal.

Tether-associated companies also allegedly hid their identities behind other businesses and individuals. Moreover, Tether and its sister company Bitfinex reportedly unsuccessfully attempted to expand their bank access through the once crypto-friendly Signature Bank.

Tether called the report "wholly inaccurate and misleading" and stated that they routinely and voluntarily assist law enforcement organizations in preventing money laundering, terrorism, and other crimes by bad actors.

Binance Wanted to Hire Gary Gensler

According to text messages and documents reviewed by The Wall Street Journal, Binance tried to hire crypto public enemy number one as an advisor in 2018. Yes, we’re talking about Gary Gensler, before he became the Chair of the SEC.

At the time, Gensler was teaching a course on blockchain and money at MIT’s Sloan School of Management. After a meeting with Ella Zhang, Binance’s former head of ventures, and Harry Zhou, co-founder of Binance-backed OTC trading desk Koi Trading, Gensler reportedly declined a role as an advisor to the crypto exchange.

The documents indicate that Binance had a legitimate concern regarding potential legal repercussions from U.S. regulatory bodies. A presentation shared in 2018 called for the establishment of a separate U.S.-based entity to insulate Binance from U.S. enforcement, which eventually led to the creation of Binance.US. A Binance spokesperson told the WSJ that the presentation was rejected and had never been implemented.

In related news, Binance-branded stablecoin BUSD's market cap has been declining since the SEC issued a Wells Notice to its issuer Paxos. Investors have redeemed over $8 billion from BUSD, which has resulted in its market cap falling below $8.5 billion.

Is a Celsius Buyout Coming?

Celsius Network has been granted exclusivity by bankruptcy court judge Martin Glenn to prepare a plan for exiting bankruptcy until the end of March, despite the U.S. government and creditors asserting that liquidation is an option. Celsius currently has a potential deal with NovaWulf that could lead to the crypto lender exiting bankruptcy protection by the end of June.

Novawulf, a financial technology company, had originally entered into an agreement with Celsius to explore the possibility of an acquisition.

However, Celsius is still open to "better offers" from potential buyers, according to the firm's attorney. The bankrupt company and its creditor committee have already met with another buyer on an alternate proposal to NovaWulf's. If Celsius chooses a different bidder, it intends to offer NovaWulf up to $20 million in breakup fees.

In a separate move, Celsius allocated $25 million to address the high demand for withdrawals from its platform. The embattled crypto lender has also burned $500 million worth of wrapped bitcoin (WBTC) in an effort to manage its exposure to volatile crypto assets.

FUN BITS

Paul Krugman Gets Rugged

Paul Krugman, the famous economist and longtime crypto skeptic, has fallen victim to the very thing he criticized. He recently took to Twitter to complain about being blacklisted by Venmo, a centralized payments app.

Neeraj Agrawal of Coin Center, tweeted back at him, “were you trying to buy drugs or assassination?” and posted a screenshot of a tweet of Krugman’s in which he said that it wasn’t a big deal to use a third party for payments “unless you’re buying drugs, assassinations, etc.” Samson Mow replied, “Chatting by fax must be tedious,” a dig at Krugman’s famous 1998 proclamation that, by 2005, the internet’s effect on the economy would be no greater than the fax machine’s. And of course, Michael Saylor wrote, “Bitcoin fixes this.”

Vitalik Buterin Sells $700,000 in Shitcoins

When the creator of Ethereum makes market moves, people pay attention. Ginny Hogan from Unchained has the update.

If you enjoyed this, don’t forget to follow Unchained on all social media platforms. Find the links below ⬇️

🔗Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze