The Ripple Rumor Mill 🤔

Plus, 🔥 A dose of dynamism for SOL?, 🚀 Coinbase’s creditor plans, 🎯 Tether’s new stablecoin, and more!

Friday again already! I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

🪙 Altcoin rumors lift XRP and SOL

🌟 Solana plan may see inflation retreat

💸 Coinbase back in the lending game

🌐 Tether’s USDT gets a cross-chain spinoff

🏛️ Exchanges prepare to tell the taxman

🔍 TRON cleans up its act

🛒 ZKsync goes big on real-world assets

Share your vision with Stellar’s Build Better initiative. Help shape blockchain’s future and enter to win from a $30,000 prize pool.

What’s Poppin’?

By Veronica Irwin, Sage D. Young, Tikta and Juan Aranovich

Likely False Rumors of Altcoin Reserve Send XRP and SOL Prices Soaring

The XRP token was spiking in digital-asset markets after a New York Post report Thursday morning said that incoming president Donald Trump was “receptive” to including non-bitcoin, American cryptocurrencies in a national reserve.

The speculation made XRP one of the most traded tokens on popular crypto exchanges by volume, with the third-largest cryptocurrency jumping 10% in 24 hours on Thursday to a seven-year high of around $3.40 before retreating below $3.30 Friday morning.

Meanwhile, Solana’s SOL token also saw its price leap more than 5% in the same period to $213. It was trading 7.5% higher Friday morning, changing hands for $216.

Three sources told Unchained the market-driving rumor was likely untrue.

Solana’s Inflation Rate Could Drop Under Multicoin Proposal

Crypto investment firm Multicoin Capital published a Solana governance proposal on Thursday to change the network’s current emission model and reduce the inflation of the network’s native token, SOL.

The proposal, SIMD-0228, aims to make Solana’s emissions of SOL more market-oriented by making the emission rate dynamic and variable. Proof-of-stake blockchains such as Solana and Ethereum issue new tokens as a means to incentivize validators and stakers, contributing to network security.

Coinbase Is Back in the U.S. Bitcoin Loan Business

Coinbase is bringing back crypto-backed loans for U.S. customers outside the state of New York, the exchange said in a blog post on Thursday.

Eligible users can borrow up to $100,000 of USDC, depending on how much bitcoin they have available to pledge as collateral.

Once confirmed, their BTC will be converted to Coinbase’s version of wrapped bitcoin, cbBTC, and transferred onchain through Morpho Protocol’s smart contracts.

Coinbase previously offered bitcoin-backed loans through its Borrow program, but the service was discontinued in May 2023 after the exchange received a Wells notice from the U.S. Securities and Exchange Commission.

Tether Deploys USDT0 Stablecoin on Kraken’s L2 Ink

Tether has launched a new cross-chain version of its USDT stablecoin on Kraken's layer 2 blockchain, Ink.

The new USDT0 coin is designed to enhance USDT's interoperability across multiple blockchain ecosystems and is built on LayerZero’s Omnichain Fungible Token standard.

The cross-chain stablecoin maintains a 1:1 backing with USDT on Ethereum and eliminates the need for liquidity pools or custom bridges.

“Tether fully supports innovation, but as a note this is separate from Tether’s direct operations,” said Tether CEO Paolo Ardoino on X, clarifying that the launch was an “ecosystem initiative” separate from Tether’s direct operations.

US Crypto Exchanges to Send Info Directly to IRS in 2025

Crypto investors in the U.S. have been awaiting a new era of pro-crypto policy, but they may also need to brace for changes as far as crypto tax reporting goes.

For the first time, many crypto transactions will be subject to third-party reporting requirements, with information sent directly to the Internal Revenue Service, according to a CNN report.

The new reporting system applies to transactions conducted on centralized crypto trading platforms such as Coinbase and Gemini, which will be required to track and record users' buy and sell transactions throughout the year.

The information will be reported on a new form named 1099-DA that will be sent to both users and the IRS in early 2026.

Reporting for peer-to-peer transactions on decentralized platforms such as Uniswap and Sushiswap will be postponed until 2027.

TRON Sees Biggest Drop in Illicit Transfer Volume: TRM Labs

Blockchain intelligence firm TRM Labs found that the Tron blockchain saw the largest decline in illicit activity during 2024, exceeding Ethereum and Bitcoin.

TRM’s report says that TRON saw a 58% decline in illicit volume, which dropped by $6 billion.

That marked a significant shift from 2023, when TRM Labs found that TRON had been the blockchain with the highest volume of illicit cryptocurrency transactions in recent years.

TRM attributed the decline in illicit activity in part to its own initiative with Tron and Tether, known as the T3 Financial Crime Unit, which aims to tackle illicit activity.

ZKsync Becomes No. 2 Blockchain for Real-World Assets

ZKsync, an Ethereum layer 2, has emerged as the second-largest blockchain for real-world assets (RWA), with a 23% market share, following Tradable’s announcement of $1.7 billion in tokenized private credit assets.

According to data from RWA.xyz, ZKsync now trails only Ethereum, which holds the top spot, with $4 billion in RWA and a 52% market share.

Tradable, a platform focused on tokenizing institutional-grade investments, achieved the milestone by tokenizing nearly 30 private credit positions.

Institutional collaborators, including Victory Park Capital, Janus Henderson, and ParaFi Capital, supported Tradable’s rollout, leveraging ZKsync’s infrastructure for cost-effective and secure on-chain operations.

“By leveraging blockchain rails, we’re enabling the supply side to provide any arbitrary institutional grade asset, starting with best-in-class private credit opportunities, to any number of demand side investors, whether on-chain or not,” said Tradable’s CEO, Alex Cordover.

“This is a huge win for Ethereum and a big one for ZKsync,” added Omar Azhar, head of business development at Matter Labs, the developer of the layer 2.

Build real-time, reactive, fully on-chain applications with Somnia: 400,000 TPS, sub-second finality, and sub-cent fees. Perfect for gaming, social, and metaverse builders.

Daily Bits… ✍️✍️✍

⚠️ Senator Cynthia Lummis threatened legal action against the Federal Deposit Insurance Corporation on Thursday for allegedly destroying crypto-related documents, tying the claims to broader concerns over regulatory suppression of the digital asset industry.

🪙 Nasdaq filed a 19b-4 form for a Canary Litecoin ETF, marking a key step in gaining Securities and Exchange Commission approval for a spot Litecoin investment vehicle with custody by U.S. Bank and Coinbase.

⚖️ Blockchain entrepreneur Michael Lewellen sued the Department of Justice on Thursday, seeking protection for his Ethereum-based crowdfunding project amid rising concerns over criminal prosecutions of crypto developers such as Tornado Cash developer Roman Storm.

The $$$ Corner…

📱 Phantom Wallet raised $150 million at a $3 billion valuation, led by Sequoia and Paradigm, positioning itself as a dominant self-custody solution with 15 million monthly active users and $25 billion in assets.

💰 Nomura-backed Komainu secured a $75 million investment in Bitcoin from Blockstream Capital, completing its series-B round to fund global expansion, with Blockstream’s CEO joining its board.

⚡ MegaETH-based DEX GTE closed $10 million in funding, including $2.5 million via Echo, positioning itself as “the world’s fastest decentralized exchange,” with performance aimed at rivaling centralized platforms.

🌐 Solana-based Tapestry garnered $5.75 million in series-A funding, co-led by Union Square Ventures and Fabric Ventures, to expand its social graph protocol ecosystem and support app development.

🕹️ Hyve Labs, a Web3 gaming firm, raised $2.75 million in pre-seed funding to develop a cross-chain gaming rollup leveraging EigenDA for decentralized data and social platform integrations.

📊 Trading platform eToro confidentially filed for a U.S. initial public offering, targeting a $5 billion valuation and planning to list in New York by the second quarter with backing from Goldman Sachs, Jefferies, and UBS.

🔐 Ctrl Wallet, a multi-chain self-custody wallet with 650,000 users, is up for sale following two acquisition approaches, with bids due by Jan. 28 and a target to grow its user base to 2 million by year-end.

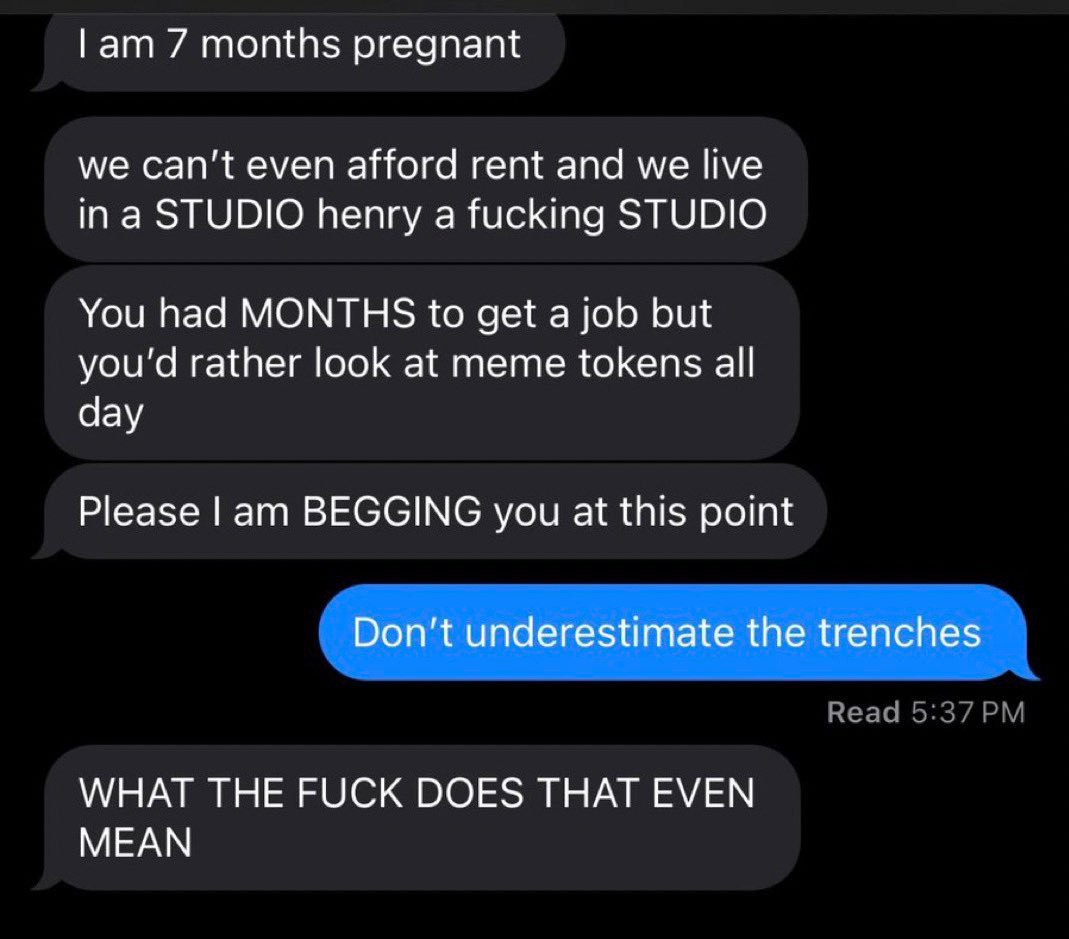

What Do You Meme?

📈 Your Market Update 📉

BTC is up 3.2%, trading at $102,533

ETH is up 1.6%, trading at $3,407

BTC dominance: 53.94%

Crypto market cap: $3.76T

*All data as of today, 07:43 am ET. Source: CoinGecko

Recommended Reads

Ryan Yi, an investor at Coinbase Ventures, on Coinbase’s bitcoin loans

Bloomberg: Trump Plans to Designate Cryptocurrency as a National Priority

DL News: Meet the activist pushing Big Tech to copy MicroStrategy and embrace Bitcoin

We Are Hiring!

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!