They Are a Big Deal 🤝

The Friday episode features Bloomberg's Eric Balchunas on the launch of spot bitcoin ETF options. Plus, the weekly news recap.

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

In this week’s edition:

💼 Gary Gensler exits SEC

💸 Trump Media eyes Bakkt

⚖️ FTX creditor payouts set for early 2025

📈 MicroStrategy’s bitcoin spree

🔄 Coinbase drops Wrapped Bitcoin amid controversy

🚨 “Razzlekhan” sentenced in $10.8B Bitcoin heist

🔧 Lido DAO faces lawsuits, co-founders launch rival project

💵 Sky’s USDS hits Solana

Spot Bitcoin ETF Options Are Here. Why You ‘Can’t Overstate’ Their Importance

Bloomberg’s Eric Balchunas says ETF options attract whales and that they create a moat of liquidity for Bitcoin, similar to gold ETFs like GLD.

On Tuesday, options on Blackrock’s bitcoin ETF, IBIT, launched, seeing $1.9 billion worth of those options changing hands on the first day.

The launch of these options could mark a turning point for crypto markets, with implications for liquidity, volatility, and institutional adoption.

Eric Balchunas, senior ETF analyst at Bloomberg, explains why these options are so significant, who they’re designed for, and how they could impact the broader ecosystem.

Plus, he offers some cautionary advice to bitcoiners, gives insight into whether spot ether etf options are on their way, and discusses the odds of SOL ETFs launching.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Weekly News Recap

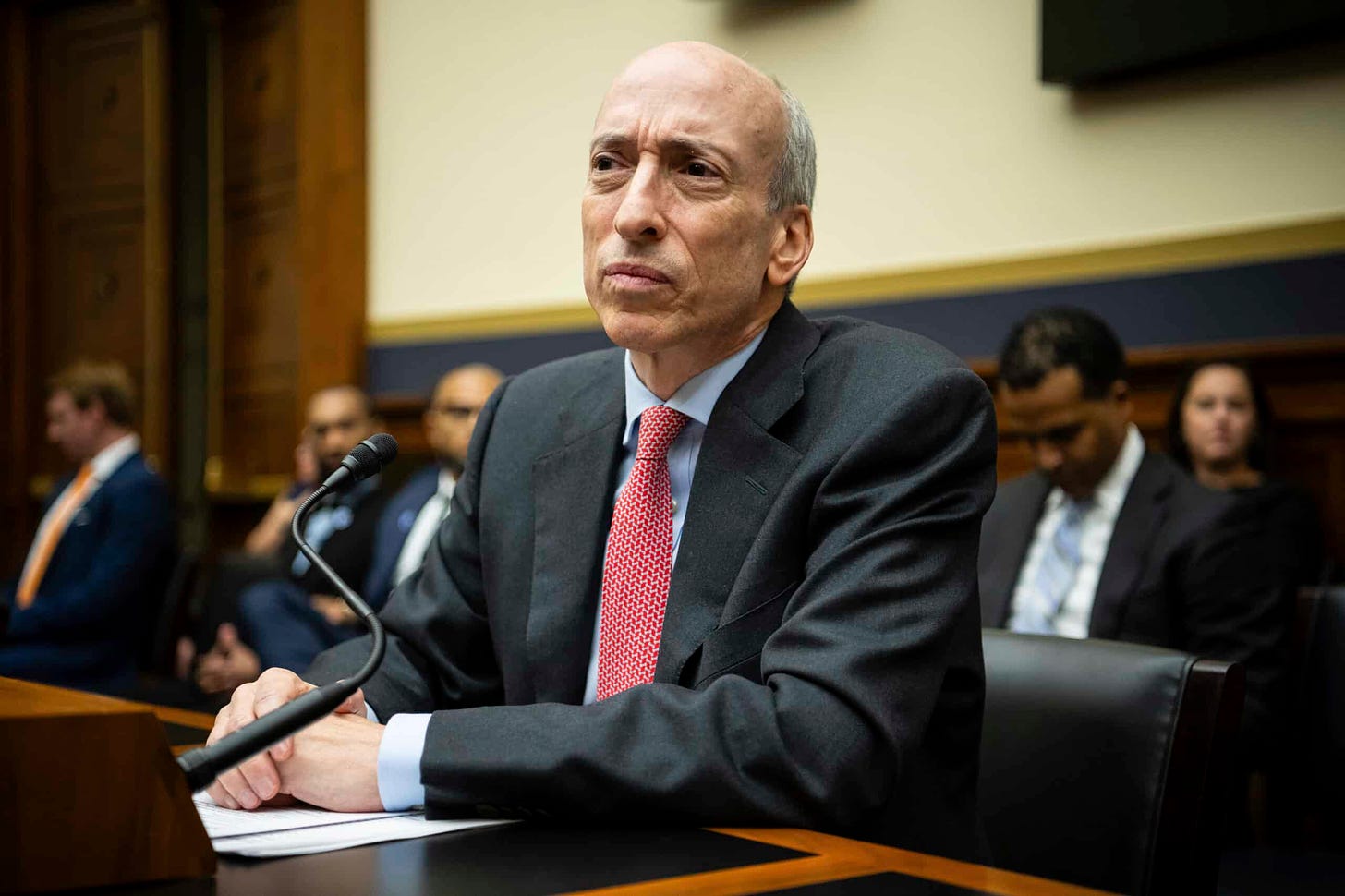

Gary Gensler to Leave SEC

Gary Gensler, Chair of the U.S. Securities and Exchange Commission (SEC), will resign on January 20, 2025, just as President-elect Donald Trump takes office.

Gensler’s departure ends speculation about whether he would seek to remain as a commissioner. During his tenure, Gensler expanded the SEC's focus from targeting individual token issuers to filing lawsuits against crypto exchanges such as Binance, Coinbase, and Kraken, accusing them of operating as unregistered securities brokers.

While he initially opposed approving spot bitcoin and ether ETFs, a court ruling forced the SEC to greenlight these products.

Trump has yet to announce Gensler’s successor, but names such as Brad Bondi, Paul Atkins, Brian Brooks and Teresa Goody Guillén are reportedly under consideration.

Trump’s Plans for a Crypto ‘Czar’ and Advisory Council

A picture is emerging of the types of people President-elect Donald Trump is considering to be his crypto policy advisors, but sources emphasize things could change quickly.

Trump promised the crypto community that he would create a crypto-focused “advisory council” at the Bitcoin 2024 conference in July. Sources say that people surrounding Trump have also been floating the idea of creating a separate role in the White House, typically referred to as a “crypto czar,” since July as well.

The crypto czar would likely be someone with a policy background, sources told Unchained, primarily because Office of Government Ethics (OGE) rules would prohibit such a person from owning crypto. Some speculate, however, that Trump could appoint a new Director of the OGE who could then waive that restriction for federal staff.

One possibility is Chris Giancarlo, who served as chair of the CFTC under Trump during his first term. In an X post published last Thursday, Giancarlo said that he was not interested in the role of either SEC chair or a crypto role in the Treasury Department. But Giancarlo did not say he was uninterested in a White House or advisory council role.

Trump Media Explores Bakkt Acquisition, Expanding Crypto Footprint

Social media company Trump Media, which is owned by Trump, is reportedly in advanced talks to acquire cryptocurrency trading firm Bakkt, the Financial Times reported. Shares of both companies soared following the news, with Bakkt surging over 162% amid trading halts due to volatility.

Created by Intercontinental Exchange, the parent company of the New York Stock Exchange, Bakkt has faced financial hurdles, including warnings of potential delisting earlier this year. The reported acquisition by Trump Media aligns with Trump’s growing involvement in crypto ventures, such as his recent backing of crypto platform World Liberty Financial.

FTX Sets Timeline for Creditor and Customer Distributions

FTX announced it is nearing the final steps to implement its Chapter 11 Plan of Reorganization, with creditor and customer distributions expected to begin in early 2025. According to CEO John J. Ray III, the company has already recovered billions for creditors and is working to finalize arrangements with global distribution agents.

FTX plans to provide customers with detailed instructions to set up approved accounts for distributions by December, including completing KYC verification and tax documentation. The Plan’s effective date is anticipated to be January 2025, with the first payments to claim holders in "Convenience Classes" occurring within 60 days.

FTX emphasized the importance of meeting deadlines to ensure eligibility, and noted potential delays for claims traded within 45 days of the record date.

MicroStrategy Scales Bitcoin Holdings, Becomes Top-Traded Stock

MicroStrategy continued to make headlines this week. On Wednesday, the company announced it was increasing its convertible senior note offering from $1.75 billion to $2.6 billion in order to acquire additional bitcoin and fund general corporate purposes. The unsecured notes, due 2029, bear 0% interest and can be converted into cash, equity, or both, offering the firm flexibility in managing its debt.

Earlier this week, MicroStrategy, the world’s largest corporate holder of bitcoin, announced it had acquired 51,780 BTC, valued at $4.6 billion at an average price of $88,627 per coin. The purchase brings the total value of its bitcoin holdings to approximately $29.7 billion, which were acquired at a cost of $16.5 billion since 2020.

The latest news spurred a trading frenzy, with MicroStrategy’s stock (MSTR) surpassing Tesla and Nvidia to become the most-traded US stock by dollar volume on Wednesday. Bloomberg analyst Eric Balchunas called the development "wild times," reflecting the stock's 43% single-day surge and staggering 910% gain year-to-date.

Coinbase to Delist Wrapped Bitcoin

Coinbase announced it will delist Wrapped Bitcoin (WBTC) on December 19, 2024, citing concerns over its listing standards, although users will still be able to move their WBTC off the exchange even after the trading suspension goes into effect. The decision follows recent scrutiny of WBTC after BitGo, WBTC’s primary custodian, entered a partnership with BiTGlobal, a firm partly owned by TRON founder Justin Sun. The partnership has raised concerns about Sun’s influence over the protocol.

WBTC, launched in 2019, tokenizes bitcoin for use on Ethereum and other blockchains, with a market capitalization exceeding $13.6 billion. Despite BitGo CEO Mike Belshe’s assurances that Sun’s role is limited and that WBTC remains decentralized, critics have raised transparency and governance concerns.

Coinbase’s delisting comes shortly after Coinbase introduced its own wrapped Bitcoin token, cbBTC, on its Base blockchain.

FTX Co-Founder Gary Wang Avoids Prison

Gary Wang, co-founder and former CTO of FTX, has been sentenced to time served with three years of supervised release for his role in the collapse of the massive cryptocurrency exchange.

U.S. District Judge Lewis Kaplan highlighted Wang’s cooperation, calling him the “easiest cooperator” authorities had encountered, and noting that his assistance was critical in the prosecution of FTX co-founder and former CEO Sam Bankman-Fried.

Wang pleaded guilty in December 2022 to multiple fraud and conspiracy charges, admitting that under Bankman-Fried’s direction, he coded features that enabled Alameda Research to withdraw unlimited funds from FTX customer accounts.

During Bankman-Fried’s trial, Wang testified about the “special privileges” granted to Alameda, which he said misled the public and resulted in an $8 billion deficit.

Prosecutors credited Wang with aiding not only this case but also broader efforts to detect financial fraud. His contributions, Judge Kaplan remarked, were worthy of significant leniency, acknowledging Wang’s minimal culpability compared to other defendants.

‘Razzlekhan’ Sentenced to 18 Months in Prison for Role in $10.8 Billion Bitcoin Heist

Heather Morgan, better known by her rap name “Razzlekhan,” was sentenced to 18 months in federal prison on Monday for her involvement in the 2016 Bitfinex hack, one of the largest cryptocurrency heists in history. Her husband, Ilya Lichtenstein, the mastermind behind the scheme, received a five-year prison sentence last week.

Prosecutors revealed that Lichtenstein used advanced hacking tools to steal 120,000 bitcoin, worth approximately $11.7 billion at today’s prices, from Bitfinex.

The couple then laundered the stolen funds using a mix of darknet markets, fictitious accounts, and cryptocurrency mixers. Some of the funds were even converted to gold and buried by the pair.

Lido DAO Faces Legal Challenges While Co-Founders Target World Network With New Project

Lido DAO, the organization behind Ethereum’s largest liquid staking platform, is facing legal scrutiny after a California federal court ruled that it could be classified as a general partnership under state law. The decision paves the way for DAO participants to be held liable for its actions.

Judge Vince Chhabria stated that Lido’s profit-driven structure allows for liability under general partnership laws, even for token holders engaged in governance. This precedent-setting case now advances to discovery, potentially reshaping the liability framework for decentralized autonomous organizations.

At the same time, CoinDesk reported that Lido’s co-founders, Konstantin Lomashuk and Vasiliy Shapovalov, are pursuing a new venture aimed at challenging Sam Altman’s World Network, previously known as Worldcoin. The pair’s blockchain-based identity platform, dubbed “Y,” seeks to address privacy concerns raised by World Network’s iris-scanning technology. Y instead plans to authenticate users via blockchain activity and social data, avoiding biometrics entirely.

Sky’s USDS Stablecoin Launches on Solana with $2 Million Monthly Incentives

Sky, formerly known as Maker, has launched its USDS stablecoin on Solana in a bid to expand its footprint. The launch marks USDS as the first major DeFi-native stablecoin on Solana, with a circulating supply surpassing $89 million within 24 hours of its launch. In order to encourage early adoption and liquidity, Sky is offering $2 million in monthly rewards to users who deposit USDS on platforms such as Kamino Finance, Drift Protocol, and Save Finance.

USDS, previously known as DAI, competes against dominant stablecoins such as USDT and USDC, which together control 88% of the stablecoin market. Sky also plans to roll out its SkyLink cross-chain bridge, further integrating USDS into Solana’s ecosystem.

Fun Bits: Kid Cashes Out Early on Memecoin, Misses Millions

Imagine launching a memecoin, making a tidy five-figure profit, and then realizing you just left millions of dollars on the table. That’s the saga of a young entrepreneur who minted a token via Pump.fun this week. The child, whose name is not known, sold their entire stash while on a livestream for thousands of dollars, only to watch the crypto community catapult the token’s market cap past $100 million later that day. Ouch.

Adding to the story, the kid created two additional memecoins after the initial sale, but these did not achieve the same explosive success. The crypto community’s fascination remained focused on the original token, which was “CTO’d” by others in the space, meaning a new technical direction was assumed for it. The community even launched spin-off memecoins linked to the creator’s family, amplifying the spectacle.

Ultimately, the $2.5 million figure refers only to the potential gains from the first token. The additional two memecoins added modest profits but didn’t replicate the original’s meteoric rise.