🔬This Crypto Sector Is on the Rise

Plus, 📣A new crypto voice in Congress?, 🎲 A high-stakes crypto discussion, 👀 Truth Social eyes Bakkt, and more!

Happy Tuesday! I’m Juan Aranovich, managing editor of Unchained.

In today’s edition:

🔬 DeSci gains momentum

🔍 Republican Rep. Dusty Johnson poised to shape crypto legislation?

🤝Trump and Coinbase’s Armstrong — crypto regulation on the agenda?

🛠️ Starknet slashes costs — blob gas becomes 5x cheaper

🚀 cbBTC’s rise

🏛️ Goldman spins out digital assets unit

📈 Magic Eden’s $ME tokenomics revealed

🪙 Binance's BFUSD launch raises questions

🤑Trump’s crypto ambitions grow with Bakkt acquisition talks

💡Morpho DAO’s $MORPHO to become transferable

With over 20 licensed or regulated assets on-chain and a global ecosystem of 400k+ ramps, Stellar is the network of choice for real-world asset tokenization.

What’s Poppin’?

By Sage D. Young, Veronica Irwin, Tikta, and Juan Aranovich

Decentralized Science Jumps 54%, Led by VitaDAO as Well as Pump Science’s RIF and URO

Decentralized science (DeSci), a movement to create public and permissionless infrastructure using blockchain technology for scientific research, is picking up steam.

According to Google Trends, which gives a value of 100 for peak popularity, worldwide interest in the term “decentralized science” was at zero for most of 2024 and has since increased to over 51 as of Nov. 17. Similarly, artificial intelligence platform Kaito signals rising mindshare in DeSci as shown by the whole category jumping 54% in the last 24 hours to a market cap of $1.3 billion, per CoinGecko.

South Dakota Rep. Dusty Johnson Likely to Lead House Digital Assets Subcommittee

South Dakota Republican Representative Dusty Johnson will likely lead the Subcommittee on Commodity Markets, Digital Assets, and Rural Development, a subset of the House Committee on Agriculture responsible for workshopping legislation on digital commodities exchanges.

Johnson is expected to push for CFTC oversight in a crypto market structure bill, according to three sources active in crypto policy circles and connected to the GOP.

Unlock zero trading fees, up to 5.1% APY on USDC, boosted staking rewards and more with Coinbase One.

Try it free for a month with code UNCHAINED.

Donald Trump to Meet Coinbase CEO Brian Armstrong: Report

President-elect Donald Trump will have a private meeting with Coinbase CEO Brian Armstrong on Monday, according to a report from the Wall Street Journal.

People familiar with the matter said the agenda had to do with discussing personnel appointments for Trump’s incoming administration.

In October, Coinbase said in its Q3 shareholder letter that it was prepared to work with either a Kamala Harris or Trump administration and that the odds of “pro-crypto legislation” are better than ever.

At the Bitcoin conference earlier this year, Trump said he intended to establish a bitcoin and crypto presidential advisory council to design regulatory guidance for the digital asset industry.

Starknet’s New Version Will Make Blob Gas Five Times Cheaper

Ethereum layer 2 scaling solution Starknet is releasing a new version focused on reducing Starknet’s layer 1 blob footprint.

Starknet v0.13.3 will achieve this by compressing state diffs, which is the difference between the previous and new blockchain states, before submitting them to the layer 1. The new version will also squash more layer 2 blocks together to reduce the amount of data that reaches the layer 1.

“Squashing and compression result in a factor of 5x discount for users on data gas (aka blob gas),” said Starknet.

Ethereum co-founder Vitalik Buterin commended Starknet for rising to the challenge and making rollups more data efficient.

The solution is already live on the testnet and will go live on the mainnet on Nov. 20.

Coinbase’s cbBTC Gains Traction on Aave

Coinbase’s wrapped bitcoin token cbBTC has been slowly gaining market share from competitor WBTC. Incentive programs, such as Aave’s October Merit rewards, could have played a hand in some of that growth.

Data from blockchain analytics firm Kaiko shows that cbBTC’s share relative to other wrapped bitcoin assets on Aave has increased from 3% to 17%. The Aave DAO’s merit program rewards users for using cbBTC as collateral to borrow USDC, and switching from WBTC to cbBTC.

Coinbase’s wrapped token now boasts a market cap of $1.3 billion in the two months since its launch.

At the time of writing, around 70% of cbBTC supplied in Aave was on Ethereum.

Earn bitcoin on Gemini here.

Goldman Sachs Plans to Spin Off Digital Assets Unit

Wall Street banking giant Goldman Sachs is reportedly preparing to separate its technology platform focused on digital assets into a standalone entity.

Bloomberg reported that the firm is looking for partners with the goal of implementing the spin off within the next 12 to 18 months.

Goldman’s aim for the initiative would be to allow large financial institutions to create, trade, and settle financial instruments like bonds and cash on the blockchain. It also plans to facilitate blockchain integration and development of crypto-linked trading products.

The bank has previously been involved in issuing tokenized bonds with the European Investment Bank and Hong Kong Monetary Authority. It has three new tokenization projects planned this year, focusing on the U.S. fund complex and debt issuance in Europe.

Magic Eden Reveals $ME Tokenomics Amid Cross-Chain Expansion

Magic Eden announced the tokenomics for its $ME token, which will reward users for trading across Bitcoin, Solana, and EVM ecosystems.

With a total supply of 1 billion tokens distributed over four years, $ME allows holders to stake, earn rewards, and participate in governance.

The initial token generation event (TGE) will distribute 12.5% of the supply, with unclaimed tokens reallocated to stakers.

The $ME token is part of Magic Eden’s broader plan to create a unified platform for trading NFTs and tokens across multiple chains.

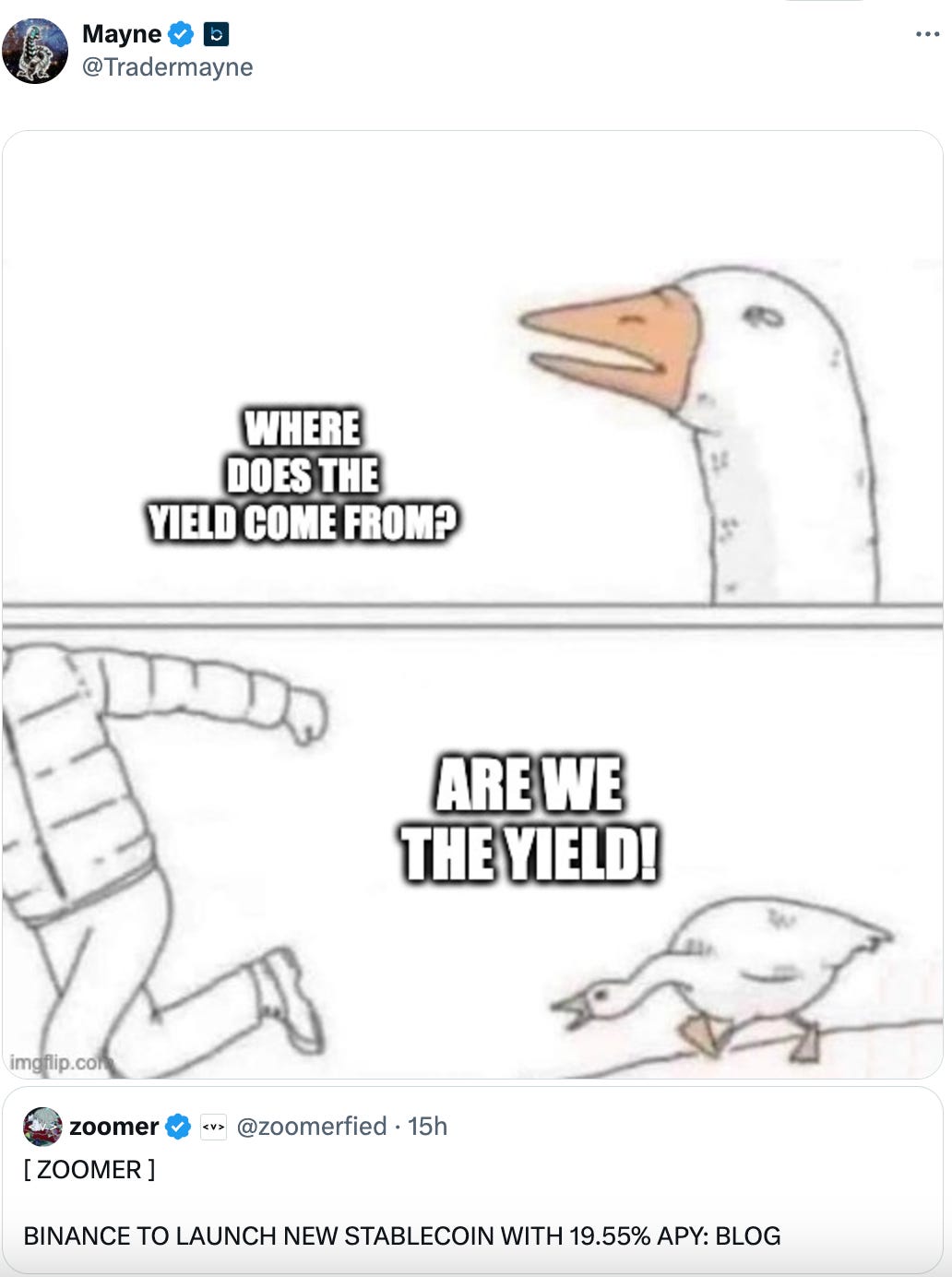

Binance’s New Product BFUSD Could Offer a High Yield

Binance unveiled BFUSD, a "reward-bearing margin asset" offering a 19.55% annual percentage yield.

Despite its name, Binance clarified that BFUSD is not a stablecoin. The exchange has not provided details about how the yield is generated, but said it would release more information soon.

BFUSD will be used as collateral for futures trading, with users accruing daily rewards in their wallets.

The announcement sparked comparisons to previous high-yield crypto products, such as the defunct TerraUSD (UST).

Truth Social in Talks to Acquire Crypto Platform Bakkt

Donald Trump’s social media company Truth Social is reportedly in advanced discussions to acquire Bakkt, a crypto platform founded by Intercontinental Exchange (ICE). The proposed all-stock deal would move Bakkt, which has struggled with profitability and pivoted away from its initial focus on institutional trading, under Trump Media and Technology Group.

Bakkt has previously raised significant funding and launched various products, but it recently began winding down its custody business. Trump’s increasing engagement with crypto aligns with his campaign pledges to support blockchain innovation.

Morpho DAO Enables Transferability of $MORPHO Token

The Morpho DAO approved the transferability of its $MORPHO governance token, with trading set to begin on Nov. 21.

Initially launched as a non-transferable token, $MORPHO was distributed among users, contributors, and partners to encourage decentralized decision-making.

The transferability update includes the introduction of wrapped $MORPHO tokens, which will replace legacy tokens to enable onchain voting and future interoperability. Existing token holders will be able to convert to wrapped tokens through the Morpho app.

Daily Bits… ✍️✍️✍

💵 MicroStrategy announced plans to raise $1.75 billion through convertible notes to expand its Bitcoin holdings, which already total 331,200 BTC worth over $30 billion.

🎤 Heather "Razzlekhan" Morgan was sentenced to 18 months in prison for laundering funds from the Bitfinex hack, following her husband's five-year sentence last week. She made her first public statement on X in over two years following the sentencing.

📱 Lido co-founders are developing “Y,” a blockchain identity platform that avoids biometric data by focusing on online activity, directly competing with Sam Altman’s World Network.

⚖️ A California court ruled that Lido DAO participants could be held liable under partnership laws, rejecting claims that its decentralized structure exempts it from legal accountability.

🛡 Lawmakers urged the U.S. Treasury to intensify action against crypto mixers like Tornado Cash, citing ongoing national security concerns despite prior sanctions.

❌ A judge denied Kraken’s request for an interlocutory appeal in its SEC case, asserting the delay would hinder resolution of whether the exchange's tokens qualify as securities.

🤖 Morpheus, a decentralized AI network t looking to reduce AI centralization and data monopolies, officially launched its mainnet.

🇷🇺 Russia proposed a maximum 15% tax on income from crypto trading and mining, categorizing such earnings as property under new draft amendments.

What Do You Meme?

📈 Your Market Update 📉

BTC is up 2.1%, trading at $92,440

ETH is up 1.8%, trading at $3,138

BTC dominance: 56.3%

Crypto market cap: $3.24T

*All data as of today, 08:00 am ET. Source: CoinGecko

Recommended Reads

DeFi researcher “definikola” on the Fluid DEX

Mert Mumtaz, founder of Helius, on how fees work on Solana

We Are Hiring!

A Part-Time Sponsorships Manager to generate and manage sponsorships across Unchained’s platforms. See the details and apply here.

A Bitcoin Reporter to cover all things Bitcoin. See the details and apply here.

An Audience Development Director to broaden the reach of the publication’s content, whether through the web, social media, newsletters, podcast platforms, or videos. See the details and apply here.

🔝 Are you hiring and want to promote the postings in the Unchained newsletter? Let us know!