Was BlackRock Key to Crypto This Cycle?

The Friday episode features BlackRock's Robbie Mitchnick on how the world's largest asset manager took crypto mainstream. Plus, the weekly news recap.

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

In today’s edition:

💼 How BlackRock took crypto mainstream

💥 FTX sues Binance and others in a $1.8B legal spree,

⚖️ 18 states and DeFi Fund take on the SEC over crypto rules,

🔒 Bitfinex hacker sentenced for laundering billions,

📈 Ether ETFs rebound with millions in inflows,

🔧 Ethereum’s Beam Chain proposal sparks heated debate,

📊 BlackRock expands its crypto fund to five new blockchains,

⚡ Jito outage spikes Solana fees,

🚀 Trump’s win sparks talk of crypto IPOs.

And more!

How BlackRock, the World’s Largest Asset Manager, Took Crypto Mainstream

BlackRock’s bitcoin ETF has set new ETF records, driving unprecedented inflows and making Bitcoin more accessible. Robbie Mitchnick, head of digital assets at BlackRock, breaks down how this came to be.

BlackRock’s entry into crypto through its bitcoin ETF (and later on the spot ether ETF) has rewritten the record books, driving massive inflows and reshaping the narrative for institutional crypto adoption.

Robbie Mitchnick, head of digital assets at BlackRock, unpacks the story behind this monumental shift. He shares the journey from skepticism to success, how BlackRock’s ETF has changed the market, and the surprises even he didn’t expect.

Plus, he explains why he believes people mistake bitcoin for a risk-on asset, what the investment case is for Ethereum, and what’s next for crypto in 2025.

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Weekly News Recap

FTX Sues Binance and Others in Spree of Lawsuits

FTX, the bankrupt crypto exchange, has filed a series of lawsuits, including a high-profile $1.8 billion claim against Binance and its former CEO Changpeng "CZ" Zhao. The lawsuit alleges that FTX’s Alameda Research fraudulently transferred funds to repurchase Binance’s stake in FTX in 2021 while insolvent. Binance has dismissed the claims as “meritless.”

The suits are part of a broader legal effort by FTX to recover assets for creditors. Other lawsuits target Anthony Scaramucci’s SkyBridge Capital for $67 million and Storybook Brawl’s developers for $25 million, as well as a prominent exploiter known as “Humpy the Whale,” who FTX has accused of siphoning $1 billion from it via token manipulation.

FTX is also pursuing funds from nonprofits tied to effective altruism and political advocacy that received donations from FTX. The estate aims to recover over $2 billion through these actions to compensate creditors of the defunct exchange.

Meanwhile, US prosecutors have filed to seize $17.9 million in crypto tied to alleged bribes Sam Bankman-Fried paid to Chinese officials in 2021 to unfreeze $1 billion in assets.

18 States and DeFi Fund Sue SEC Over Crypto Regulation

Eighteen Republican attorneys general, along with the DeFi Education Fund, have filed a lawsuit against the U.S. Securities and Exchange Commission, alleging the agency has exceeded its authority in regulating digital assets. The suit, filed in the Eastern District of Kentucky, names SEC Chair Gary Gensler and the agency’s commissioners as defendants.

The plaintiffs argue the SEC’s approach to digital assets—classifying nearly all cryptocurrency transactions as “investment contracts”—violates state regulatory authority and lacks Congressional approval. They seek a court declaration that digital asset transactions are not inherently investment contracts and an order preventing the SEC from enforcing registration requirements on platforms handling such transactions.

The case challenges the SEC’s use of the Howey Test to classify digital assets as securities, claiming it fails to account for distinctions between assets and ongoing obligations.

Bitfinex Hacker Sentenced to Five Years in Bitcoin Laundering Case

Ilya Lichtenstein, the hacker behind the 2016 theft of approximately 120,000 bitcoin from the crypto exchange Bitfinex, has been sentenced to five years in federal prison. The U.S. District Court in Washington, D.C., handed down the sentence following his guilty plea to conspiracy to commit money laundering. His wife and co-conspirator, Heather Morgan, is scheduled for sentencing next week.

Lichtenstein orchestrated the hack using advanced techniques to transfer 119,754 bitcoin—worth billions today—into wallets under his control. To cover his tracks, he erased access logs and credentials from Bitfinex's system. He and Morgan laundered the stolen funds through a series of sophisticated methods, including darknet markets, cryptocurrency mixers, and chain hopping, converting bitcoin into other digital assets.

The Justice Department credited the IRS, FBI, and Homeland Security for their investigative work. Prosecutors also confirmed a formal forfeiture process for seized assets, marking a significant recovery in one of the largest crypto thefts in history.

BlackRock Expands Fund Across Multiple Blockchains

BlackRock, the world’s largest asset manager, has taken its $500 million USD Institutional Digital Liquidity Fund (BUIDL) multi-chain. In partnership with tokenization firm Securitize Markets, the fund is now available on Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet, and Polygon PoS, expanding beyond its initial launch on Ethereum earlier this year.

The BUIDL fund allows institutional investors to earn yields on tokenized U.S. Treasuries. Annual management fees vary by blockchain, with Aptos, Avalanche, and Polygon set at 20 basis points, while Ethereum, Arbitrum, and OP Mainnet have higher fees at 50 basis points.

“Real-world asset tokenization is scaling,” said Carlos Domingo, CEO of Securitize, adding that these new blockchains will enhance the efficiency of the BUIDL ecosystem.

This expansion comes as tokenized treasuries continue to grow rapidly, with $2.4 billion in circulation, an increase of 200% so far this year.

Native tokens of the added blockchains, including OP, APT, and AVAX, saw modest price increases following the announcement.

Ether ETFs Turn Positive, Netflows Surpass $241 Million

For the first time since their launch in July, ether (ETH) exchange-traded funds (ETFs) have achieved positive cumulative netflows, totaling $241 million as of Thursday. This turnaround follows a six-day streak of inflows, including record-setting days of $146 million on Wednesday and $296 million on Tuesday, according to data from Farside.

Bitwise further bolstered market interest by announcing the acquisition of Ethereum staking firm Attestant. The acquisition could position the crypto asset manager to introduce an ETH ETF that incorporates staking rewards, a feature currently absent from existing offerings.

Commenting on the broader market outlook, Jim Hwang, COO of Firinne Capital, told Unchained that “post-election, you see the broadening out of market gains beyond BTC into ETH, alt-L1s, and DeFi.” Hwang added that expectations for clearer crypto regulations and institutional adoption are “no longer a pipe dream.”

Ethereum’s Beam Chain Proposal Faces Mixed Reactions

At the Devcon conference in Bangkok, Ethereum Foundation researcher Justin Drake unveiled "Beam Chain," a proposed redesign of Ethereum's consensus layer. The ambitious five-year plan aims to enhance transaction finality, integrate zero-knowledge technologies, and consolidate upgrades into a single significant fork. Drake described the initiative as a “dashing opportunity” to execute multiple improvements all at once.

While the proposal received applause at the event, prominent Ethereum community members subsequently expressed concerns. Critics such as Ethereum builder Martin Köppelmann dismissed the plan as a “big refactoring” that optimizes Ethereum’s internal code without delivering external innovations. Similarly, José Maria Macedo of Delphi Digital argued that Beam Chain’s timeline and scope fall short of making Ethereum Layer 1 more competitive.

Others, such as EigenLayer engineer Bowen Li, voiced frustration with the lengthy development timeframe. “We may reach Mars before Beam Chain goes live,” Li commented. Meanwhile, core developer Péter Szilágyi warned against implementing multiple changes to the consensus layer all at one time, instead advocating for incremental upgrades in order to maintain system stability.

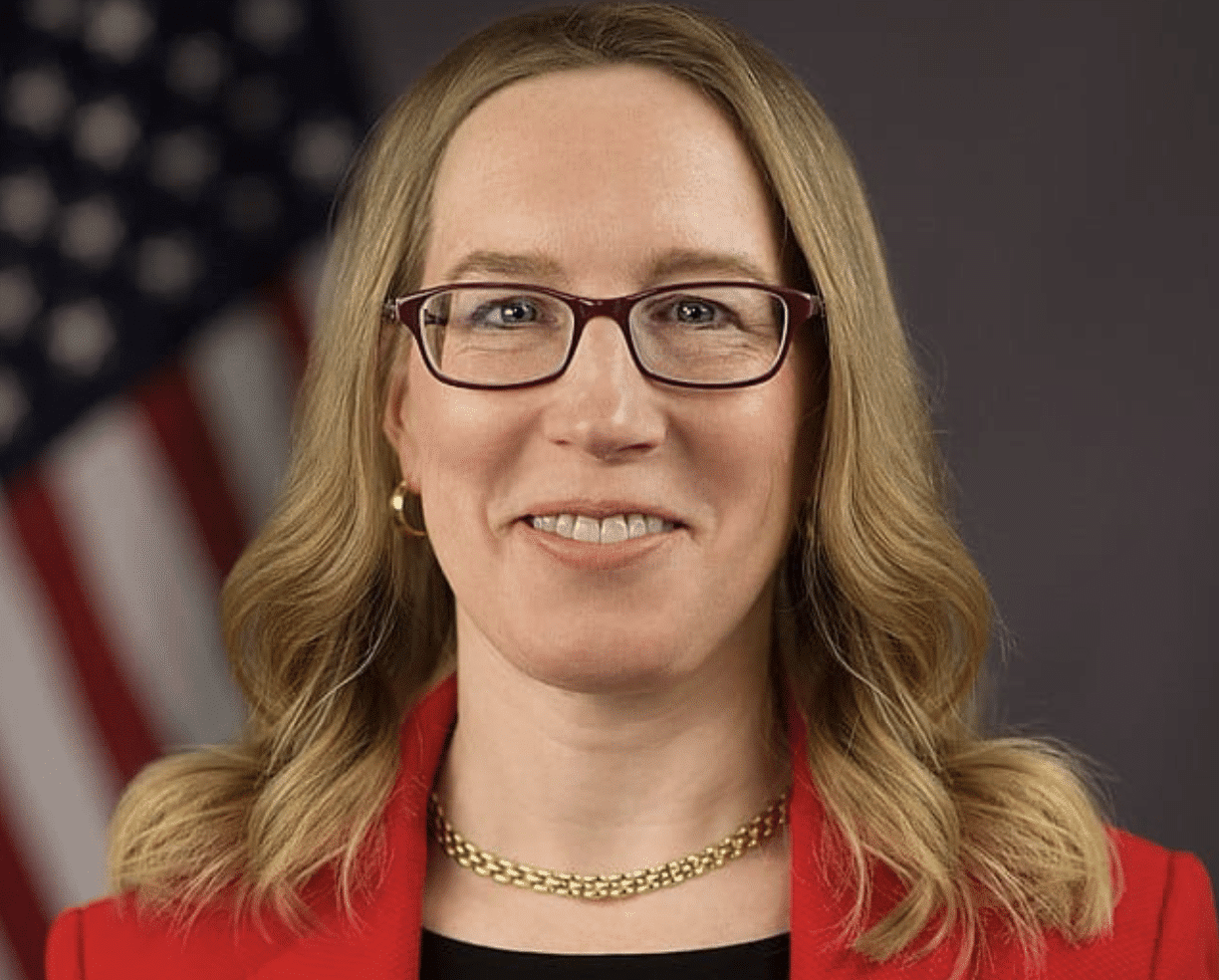

Hester Peirce Questions SEC’s Readiness for Pro-Crypto Shift

SEC Commissioner Hester Peirce expressed concerns about the agency’s preparedness for clearer cryptocurrency regulations under a Trump administration. Speaking on the Block & Order podcast, Peirce warned, “What I worry is going to happen is [we will] get a more open mind toward developing good rules, and then [when] they say ‘okay, so what should those rules be?’ no one knows what to do.”

After Unchained published this story, Peirce responded on X, writing that “my point was simply that people inside & outside the agency need to be thinking now about what good crypto regulation looks like.”

Trump has promised to provide regulatory clarity and create a crypto advisory council within his first 100 days of his new administration, and has also pledged to fire SEC Chair Gary Gensler as soon as he takes office. While these changes could expedite policy shifts, SEC rulemaking is inherently slow, often requiring years to implement.

George Mason University’s J.W. Verrett suggested an interim SEC Chair could issue a “concept release” to gather industry input and speed up reforms. On the podcast, Peirce also called for clearer NFT regulations, urging issuers to engage with the SEC to test boundaries and improve clarity.

Jito Outage Temporarily Increases Solana Fees

Jito, a leading Solana-based MEV protocol, experienced a temporary system-wide outage early Wednesday, causing transaction priority fees on the blockchain to spike. Jito Labs attributed the disruption to high demand potentially overloading its block engine server. The issue was resolved within an hour, with the team stating all systems were “fully operational and secure” shortly after the problems arose.

During the outage, priority fees surged approximately 25-30 times, with the median fee peaking at $0.01, according to Compass Solana. Jito’s co-founder told The Block the issue was isolated to the protocol’s bundle delivery system and did not affect Solana’s overall network performance.

The downtime followed record-breaking demand for Jito, which processed 15 million transaction bundles the previous day. A full post-mortem is expected from Jito Labs.

Trump’s Win Sparks Talk of Crypto IPO Surge

The election of Donald Trump has reignited discussions about cryptocurrency firms going public, as his administration promises a pro-crypto regulatory environment. Trump’s campaign commitments, including establishing clearer regulations for crypto, have fueled optimism among industry leaders that an IPO wave could follow his inauguration.

Ram Ahluwalia, CEO of Lumida Wealth, expects stablecoin issuer Circle and blockchain analytics firm Chainalysis to be among the early IPO candidates. Circle, the company behind the $37 billion market cap USDC stablecoin, has long expressed interest in going public. Its previous IPO attempt through a SPAC deal fell apart in 2022 amid market turbulence, but CEO Jeremy Allaire remains committed to the goal.

Experts caution, however, that not all crypto companies are suited to be public companies. Quynh Ho of GSR noted that firms must demonstrate stable profitability and manage the complexities of being publicly-listed. Infrastructure companies such as Anchorage Digital and NYDIG may be better positioned, given their relative stability, Ho said.