Will 💲 Billions Come After a Spot Bitcoin ETF Approval?

Weekly News Recap: 📰 Controversial crypto terrorism reports, 📈 Bitcoin's ETF-driven surge, ⚡ Lightning Network developer exits, 🔄 FTX nears restart, 🏦 BlockFi emerges from bankruptcy, and more!

In this episode, Alex Thorn, Galaxy's head of firmwide research, delves into the substantial impact that a potential SEC approval for spot Bitcoin ETFs could have on the market. Thorn anticipates an influx of over $14 billion in the ETFs' first year alone.

He emphasizes that approval could be just around the corner and would signify a pivotal moment for Bitcoin. The introduction of these ETFs will serve as a game-changer, especially for wealth managers and financial advisors who have been restrained by their platforms. According to Thorn, "Once it's safely and cheaply available and it's right in the same menu that they do all of their other client investing, I believe they're going to have to consider it."

📚 The Cryptopians - Out in Paperback!

Find out the inside story of the rise of Ethereum in Laura’s book, “The Cryptopians.”

Weekly News Recap

Crypto Community and Lawmakers Clash Over Disputed Terrorism Funding Reports

All may not be what it appears in a recent Wall Street Journal report. An October 10 article claimed that Palestinian militant groups had raised a total of $130 million worth of cryptocurrency ahead of its attacks in Israel, sparking an immediate political reaction. Democratic Senator Elizabeth Warren, Republican Senator Roger Marshall, and over 100 other U.S. lawmakers cited the report in a letter to Under Secretary for Terrorism and Financial Intelligence, Brian Nelson, and National Security Advisor, Jake Sullivan. The lawmakers called for the administration to “provide additional details on its plan to prevent the use of crypto for the financing of terrorism.”

What they failed to mention though, according to one of the Journal’s own sources, London-based Elliptic, is that one of the militant groups agreed with the Senators. In April, news outlets, the New Arab and The Times of Israel, published reports citing a statement from Hamas asking that people stop sending them crypto. Both articles cited a Hamas statement I’ve so far been unable to track down in its original, which reportedly gives the reason for Hamas’s request to stop giving them cryptocurrency as “the intensification of prosecution and the redoubling of hostile efforts against anyone who tries to support the resistance through this currency.” As most of our listeners will know, investigative technology recently has proven incredibly adept at tracking down the origin of even well-laundered assets.

Apparently, donors are already complying with the Hamas request. According to Elliptic, only $21,000 in fresh crypto donations have been made to Hamas since the latest attacks. That compares to $185,000 worth of crypto Elliptic says has been received by a group called Crypto Aid for Israel. Which begs the question: What are the U.S. Senators really hoping to accomplish? On this week’s episode of The Chopping Block, Compound Labs founder Robert Leshner said: “Crypto is not great at illegal finance. Hamas recognizes it too.”

As of the time of this recording, neither the Wall Street Journal nor Senators Warren and Marshall had responded to the claims.

Nevertheless, a number of efforts are underway to capitalize on this moment. The Financial Crimes Enforcement Network (FinCEN), a bureau within the U.S. Department of the Treasury, issued a warning about virtual currencies being used to finance terrorist organizations like Hamas. In a separate move, the Treasury Department also proposed new rules targeting cryptocurrency "mixers" as potential money laundering tools, linking these regulatory efforts directly to concerns about Hamas' use of cryptocurrency.

Adding yet another layer of complexity to the story, another group of U.S. lawmakers are turning their attention to major crypto platforms. Republican Senator Cynthia Lummis and Republican Representative, French Hill, formally requested that the Department of Justice investigate Binance and Tether's potential role in supporting terrorism. In a strongly-worded letter to the DOJ, the lawmakers requested a careful evaluation of whether these platforms are "providing material support and resources to support terrorism through violations of applicable sanctions laws and the Bank Secrecy Act."

The lawmakers are specifically calling for swift action to "choke off sources of funding to terrorists targeting Israel." They have asked Attorney General Merrick Garland to reach a charging decision on Binance that reflects the level of their alleged culpability and to expedite investigations into Tether's alleged illicit activities.

Bitcoin Soars Amid ETF Optimism as Grayscale Gets Green Light for Review

On a more upbeat note, Bitcoin's price this week surged nearly 18% to a high of $35,150, fueled in part by renewed optimism over the potential approval of spot Bitcoin ETFs. The U.S. Court of Appeals for the D.C. Circuit, this week filed paperwork asserting that the SEC must reevaluate Grayscale's bid to convert its GBTC fund into a spot Bitcoin ETF. SEC Chair Gary Gensler said that the agency is actively reviewing multiple filings for spot Bitcoin ETFs. Though Gensler didn’t specifically mention Grayscale, the bitcoin trust has gained 220 percent this year, according to a CoinDesk report, even outperforming chipmaker darling Nvidia.

On this Tuesday’s episode of Unchained, Bloomberg analyst James Seyffart said he expected an ETF could be approved by January 10 next year. That’s less than three months away.

Somewhat surprisingly though, that didn’t keep Ark Invest from offloading approximately $4.3 million worth of GBTC shares and $5 million worth of Coinbase. The market also witnessed over $147 million in liquidations due to Bitcoin's volatility, according to Coinglass data. Despite these developments, the crypto community remains buoyant, with 84% of the $66 million in weekly institutional inflows directed towards Bitcoin-linked funds, according to CoinShares.

Lightning Network Developer Exits Due to Potential Security Flaws

Antoine Riard, a key developer for Bitcoin's Lightning Network, announced his departure from the project, citing what would be a major vulnerability if proven true.

The developer claimed that the network is susceptible to "replacement cycling attacks," which could allow malicious actors to divert funds. In a post on the Linux Foundation’s message board, Riard wrote that "only a sustainable fix can happen at the base layer," suggesting that changes to Bitcoin's foundational layer might be necessary for a long-term solution.

After some Chicken-little, sky-is-falling, responses on social media Riard claimed that the security flaws were not "intentional backdoors." He emphasized that by identifying these alleged vulnerabilities he did not mean to cast doubt on the competence of the Bitcoin and Lightning development community. He wrote, "Lightning experts have already deployed mitigations.”

FTX Exchange Nears Decision on Restart, Weighs Multiple Bidders

Almost a year after filing for bankruptcy, crypto exchange FTX is reportedly in advanced talks with three different bidders for a potential restart. Kevin Cofsky of Perella Weinberg Partners, the firm overseeing the bankruptcy proceedings, said, "We are engaging with multiple parties every day." The options on the table include selling the entire exchange or partnering with another entity to reboot the platform. A decision is expected by mid-December.

Lawyers for FTX's non-U.S. creditors have proposed a deal offering 90% of remaining assets to investors, with conditions for those who withdrew funds before bankruptcy. Over-the-counter trades value FTX creditor claims at 52 cents, up from 20 cents in February, indicating market optimism for asset recovery.

The customer list, considered a valuable asset, has been a point of contention. Judge John Dorsey approved an order to redact customer information for the next 90 days, saying, "a platform without customers is nothing so it has to have value."

On Wednesday, wallets tied to FTX and Alameda transferred $10 million worth of ETH, MKR, AAVE and LINK to exchanges including Binance and Coinbase, according to SpotOnChain. One possible explanation for the move is to liquidate those assets, putting downward pressure on their price.

BlockFi Begins Asset Distribution After Bankruptcy Exit

Nearly 11 months after declaring bankruptcy, crypto lender BlockFi has initiated the process of returning assets to its customers. The company announced on October 24 that it has officially emerged from bankruptcy, with its reorganization plan approved by all relevant stakeholders. "BlockFi is pleased to announce that its bankruptcy plan is effective," the firm said in a statement.

Customers at New York-based BlockFi can now submit withdrawal requests through the company's website, with a deadline set for December 31. BlockFi Interest Account and loan customers will receive their first wave of distributions in the coming months. The amount of recoveries for customers will be contingent on what BlockFi' is able to recover from other bankrupt firms, including FTX.

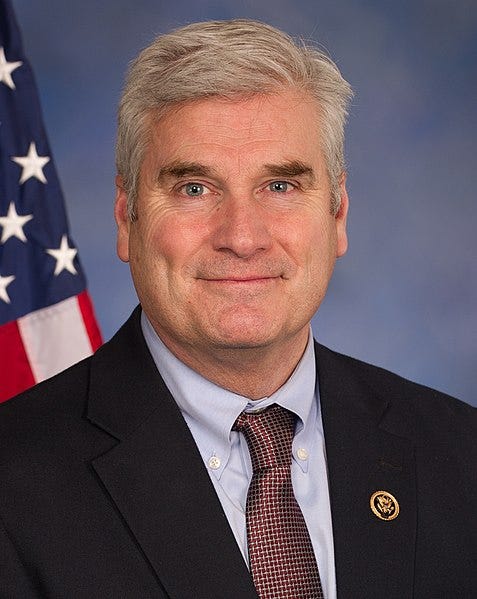

Crypto Advocate Tom Emmer's Speaker Bid Short-Lived Amid Trump Opposition

In a whirlwind turn of events, Rep. Tom Emmer, a staunch crypto advocate, secured the Republican nomination for U.S. House Speaker only to withdraw hours later. Emmer had initially garnered support from House Republicans, receiving 117 votes in a closed-door meeting. The crypto community was abuzz with excitement, but the nomination faced immediate backlash from former President Donald Trump, who labeled Emmer a "Globalist RINO" (a derogatory term that means Republican in Name Only, and called for other Republicans to reject his candidacy. Matt Gaetz, a key Republican congressman, echoed Trump's sentiments, saying, "It's really important that the Speaker of the House have a good relationship with the leader of our party, That's Donald Trump." Instead, a lesser known Representative, and former lawyer for the Creationist Museum, Mike Johnson, was elevated as the new Speaker of the House.

Coinbase Clashes with SEC, Argues for Limits on Regulatory Reach

Coinbase has filed its latest brief against the Securities and Exchange Commission (SEC), arguing that the agency's authority should be limited to securities transactions. The crypto exchange is challenging the SEC's application of the Howey Test, a legal standard used to determine what constitutes a security. "Not every parting of capital with a hope of gain qualifies," Coinbase stated in its court filing.

Binance Resolves Withdrawal Halt

On Wednesday morning Binance, the world's largest cryptocurrency exchange, faced a temporary halt in crypto withdrawals due to a technical issue.

The issue was promptly resolved, and normal service resumed, according to the company's official updates on social media. While the issue was fixed quickly, it reignited concerns in the wake of the FTX exchange collapse last year. Binance later confirmed that "all crypto withdrawals are now back to functioning as usual," thanking users for their patience.