Will FTX Relaunch? 😱

Weekly News Recap: 🎙️ What's next for Ethereum?, 👀 FTX could reopen, 💵 SBF wants money to pay legal fees, 🤳 the new Saga phone, and more ❕

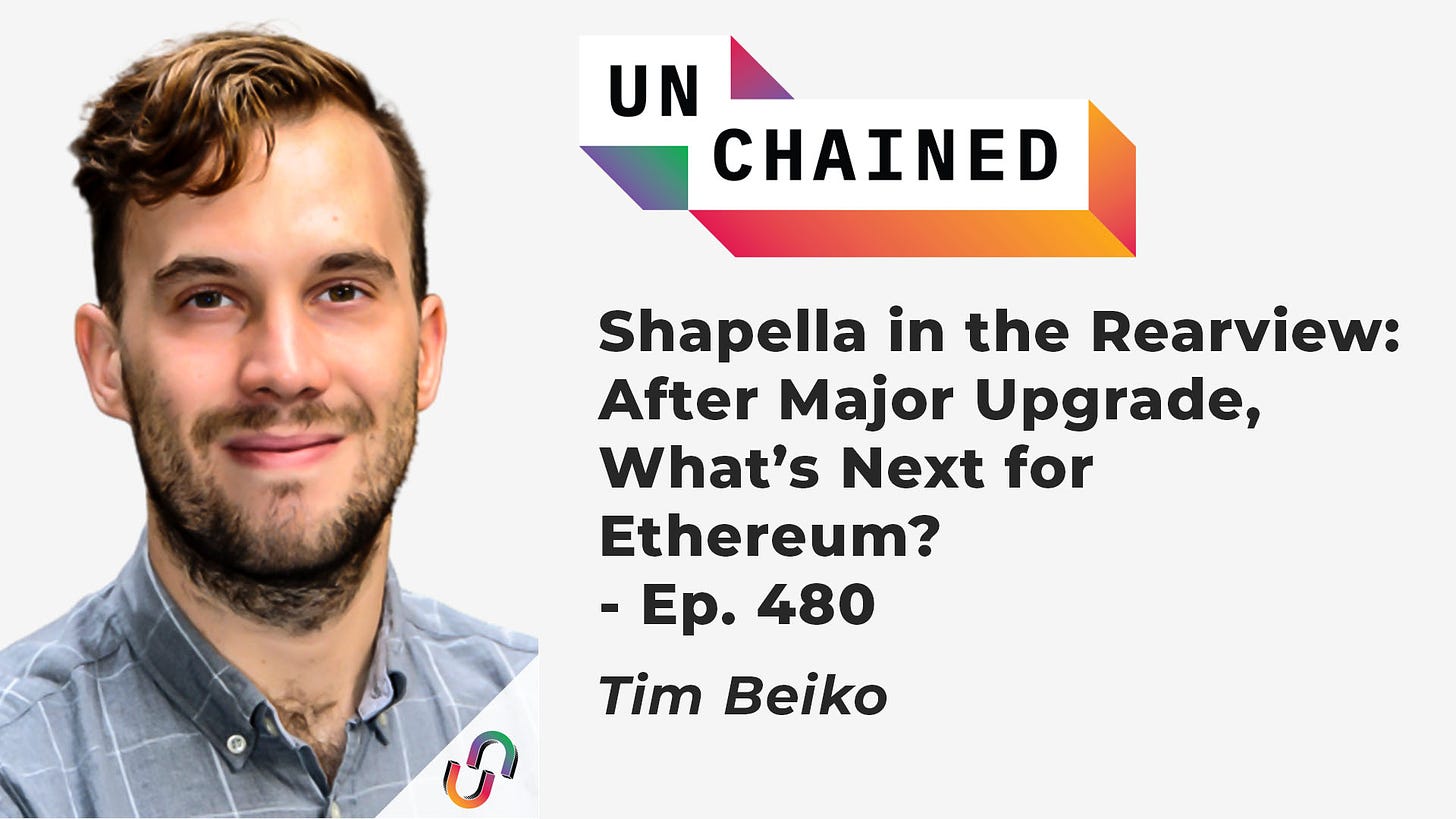

Shapella in the Rearview: After Major Upgrade, What’s Next for Ethereum?

In this episode of Unchained, Tim Beiko, head of the Ethereum protocol developer calls, offers an in-depth look at Ethereum's Shapella upgrade, which completed the multi-year transition from proof-of-work to proof-of-stake.

Beiko explains how Ethereum successfully transitioned to the new consensus mechanism, highlighting the collaborative efforts of developers and researchers in overcoming challenges.

“Even though there's possibly a bunch of people who will withdraw, I think the introduction of withdrawals de-risks the network,” Beiko says, while highlighting that now it’s more likely for more solo stakers to enter the space.

Even though this has been a historic milestone, the network is far from over. Beiko shares insights on Ethereum's roadmap, particularly EIP-4844, which aims to decrease the cost of posting data for Layer 2 solutions, further enhancing scalability and efficiency. He also explains the concept of "proposer-builder separation" and its significance in the future of the ecosystem.

Weekly News Recap

FTX Considers Reopening as FTT Token Surges

Cryptocurrency exchange FTX, which collapsed in November, is considering reopening in the future, according to FTX’s bankruptcy attorneys from Sullivan & Cromwell. FTX's FTT token more than doubled in price after the news broke. Lead attorney Andy Dietderich informed the court that restarting the exchange is one of many potential options being considered, with no decisions being final yet.

Dietderich revealed that the $7.3 billion in recovered assets include $2 billion in cash and $4.3 billion in "Category A" crypto, like Bitcoin and Ethereum. A potential restart, to be assessed this quarter, may require raising additional capital and could involve a 363 sale, selling the firm's assets to pay creditors. Talks regarding the restart are underway with FTX's official committee of unsecured creditors.

Former FTX Head of Institutional Sales Zane Tackett suggested that the exchange relaunch and offer a token representing creditor claims, providing value to creditors and immediate liquidity for those who wish to sell off their claims. Tackett cited Bitfinex's BFX token as a successful example. He believes FTX could succeed if run "like a crypto company" that is "able to be nimble."

FTX Faces Massive Legal Fees Amid Bankruptcy

FTX faced more than $30 million in legal bills and consultant fees in February, with over 35,400 hours of work logged by six firms, according to compensation reports filed in bankruptcy court. Sullivan & Cromwell charged the largest amount, billing $13.5 million for their services, while Alvarez and Marsal billed $12 million. FTX's February tab was slightly smaller than January's $38 million bill.

Meanwhile, a bankruptcy court judge denied former FTX CEO Sam Bankman-Fried's motion to access a $10 million insurance policy to cover his legal expenses. Judge John Dorsey stated that Bankman-Fried did not provide evidence or establish cause for the request. However, the judge noted that SBF can return with evidence at a later time. Companies typically have director and officer liability insurance to protect executives from legal action. The Official Committee of Unsecured Creditors had objected to the motion, stating any cash he might receive could instead go to FTX creditors.

FTX Roundup:

A Delaware bankruptcy court judge ordered that Alameda Research, the trading arm of FTX, should be repaid nearly $53 million for a loan made in 2021 to Deltec International Group.

In addition, Alameda-backed Ren Protocol will transfer all of its pegged assets, including Bitcoin and Dogecoin, to FTX Trading.

Lastly, FTX was given the green light by a Swiss court to explore the potential sale of its European business arm, FTX Europe AG, after the holding company filed for a Swiss moratorium proceeding.

Winklevoss Twins Loan $100 Million to Gemini Amid Struggles

Billionaire founders of Gemini, Tyler and Cameron Winklevoss, have reportedly loaned $100 million to their crypto exchange. The personal loan comes after unsuccessful attempts to secure external funding.

Since last year, Gemini has faced multiple challenges during the crypto downturn. FTX's collapse sparked the bankruptcy of crypto lender Genesis Global Holdco, which significantly impacted Gemini. In February, Gemini and Genesis agreed in principle to resolve their dispute, with Gemini contributing up to $100 million. However, the Winklevoss loan will be used to fund operations, not the Genesis dispute resolution.

SEC Summons Tron's Justin Sun, Soulja Boy, and Austin Mahone

The Securities and Exchange Commission (SEC) issued a summons for Tron founder Justin Sun, Deandre Cortez Way (aka rapper Soulja Boy), and YouTuber Austin Mahone following a civil complaint from last month which involves tokens issued by Tron and BitTorrent that the SEC has deemed as unregistered securities offerings.

If Sun, Mahone, and Soulja Boy do not respond within 21 days, a default judgment will be entered against them. The SEC is seeking to bar Sun and his companies from offering securities, including digital assets, again and to impose civil penalties. Way and Mahone may face bans on receiving money for future digital asset endorsements and pay their own penalties.

In related news, Binance.US delisted Tron's TRX token, resulting in a 6.4% decline in its value. The exchange cited its responsive digital asset monitoring process and changing industry circumstances for the delisting decision, stating that a token may be subject to review when it no longer meets their “high standards.”

Solana's 'Saga' Smartphone With Crypto Features Launches in May

Solana Labs is launching its crypto-focused Saga smartphone on May 8. The Android device features custom add-ons, a "seed vault" for securely storing private keys, and a dedicated "dapp" store for crypto applications. Priced at $1,000, the Saga aims to bring crypto capabilities to mobile users, but will only include Solana-based protocols, leaving out the most used applications like Curve, Aave, and Balancer.

For a better understanding of how it actually works, check out the review done by Unchained reporter Jeff Benson.

Tether Blacklists Validator Who Exploited MEV Bots

Tether blacklisted the wallet address of a "rogue validator" who managed to front-run Maximal Extractable Value (MEV) bots last week, amassing $25 million in profits. The validator's wallet holds $3 million worth of USDT. MEV bots, which have extracted an estimated $1.38 billion from users, have been widely criticized in the decentralized finance community.

Tether's decision to blacklist the validator has sparked protests from industry experts. As Lefteris Karapetsas, founder of Rotkiapp tweeted, “MEV Bots have been slaughtering retail users via sandwiching for years. Nobody blacklists them. Someone dare fool a MEV bot and give them a taste of their own medicine and they get blacklisted,” while Polygon co-founder Jaynti Kanan called it a "bad precedent."

SushiSwap Is Hit by $3 Million Exploit

A SushiSwap exploit led to a $3 million loss from user 0xSifu's wallet due to an approve-related bug in the code. SushiSwap CEO Jared Grey confirmed the exploit and advised users to revoke permissions for contracts on the platform. Grey also stated that over 300 ETH had been recovered, and the team was working with Lido to recover another 700 ETH.

White hat hackers helped return some funds, but their efforts were hindered by MEV bots that replicated and executed the exploit. SushiSwap is working on a retrieval plan to secure stolen funds and compensate affected users.

Furthermore, SushiSwap is preparing to launch a claims website for vested SUSHI tokens held in its Merkle Distributor contract, with unclaimed tokens being directed to SushiSwap's treasury after April 23.

Nexus Mutual Seeks Return of $2 Million From Euler Finance Hack Victims

DeFi insurance protocol Nexus Mutual is looking to recover $2 million in claims paid out to victims of the Euler Finance hack, as users have since redeemed their funds. Following the return of the stolen funds by the hacker, Euler Finance enabled user redemptions, totaling $133 million. However, five policyholders have yet to repay the claims received from Nexus Mutual. The policy terms state that in the event of funds being returned by the hacker, the claim value must be returned to Nexus Mutual. The insurer is considering potential legal action against those who haven't returned their claims.

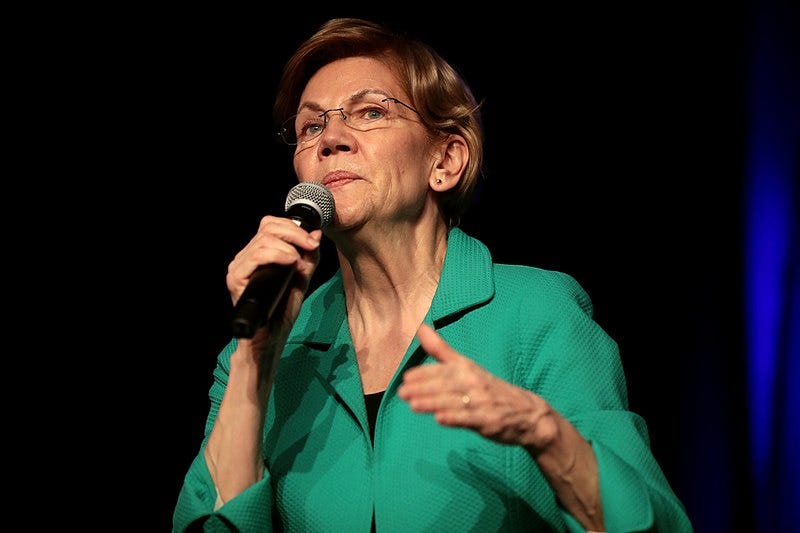

US Lawmakers Probe Circle and BlockFi's Banking Terms With Silicon Valley Bank

This week, US Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez sent letters to Circle and BlockFi, among 14 firms, questioning their decision to bank with the now-collapsed Silicon Valley Bank (SVB). The lawmakers are investigating SVB's potential "white glove" treatment of certain depositors, including possible "mutual backscratching arrangements" that may have led to massive uninsured deposits. Circle and BlockFi held approximately $3.5 billion in uninsured deposits at SVB, with Circle accounting for $3.3 billion. The letters, addressed to Circle CEO Jeremy Allaire and BlockFi CEO Zac Prince, inquire about the history of their relationships with SVB, amounts deposited and maintained, and any investment relationships between the firms, their related entities, and SVB.

In other regulatory developments, the SEC’s Investor Advisory Committee requested that the SEC provide formal guidance for the crypto industry, but is still endorsing Chair Gary Gensler’s efforts to enforce securities laws.

Meanwhile, Wyoming Attorney General Bridget Hill filed a motion to intervene in Custodia Bank's lawsuit against the Federal Reserve Board and Kansas City Fed. The lawsuit alleges that they unfairly delayed and denied the crypto-friendly bank's application for a master account and membership. Hill seeks to defend "the legitimacy and viability" of Wyoming's special purpose depository institution (SPDI) framework, which the Fed reportedly criticized as inadequate.

Arbitrum Community Against Proposal to Return 700 Million Tokens

Following the controversial Arbitrum Foundation proposal last week, the community is now voting over a new proposal, AIP-1.05, which calls for the return of 700 million ARB tokens "unjustly allocated" to the Foundation.

The proposal also asks for a token buyback from market maker Wintermute and disclosure of the Arbitrum Foundation's deal terms with Wintermute.

However, this AIP is not getting much traction, as over 80% of voters are against it. The proposal's author has also suggested putting AIP-1.1 and AIP-1.2 on hold until community faith in the governance process is restored. Some community members believe the new proposal goes too far, calling it an "overkill."

Bitcoin Reaches the $30,000 Line

Bitcoin surpassed the $30,000 mark for the first time since June 2022, continuing a crypto rally that began at the start of the year. So far this year, Bitcoin has risen 89%, while Ether has increased by 59%. Some attribute this surge to the recent bank runs that have called into question the resiliency of the banking system. However, Bitcoin is still down 25% from this time last year.

Meanwhile, MicroStrategy's Bitcoin holdings are now in the green, as the cryptocurrency's price rose above the company's average purchase price of $29,803. However, the firm's profit margin remains slim, and a large-scale sale of its holdings could potentially cause prices to drop.

Bitcoin Ordinals Bug Results in 1,200 'Orphan' Inscriptions

A bug in the Bitcoin Ordinals protocol caused 1,200 valid inscriptions to be excluded, leading to debates within the community on how to address the issue. Ordinals collector "Leonidas.org" revealed the bug on Twitter, explaining that it was found in the indexer function of the protocol, which only counts inscriptions in the first input of a transaction.

Two potential solutions are being discussed. The first would retroactively index the missed inscriptions, aligning with the on-chain logical ordering. The second solution would change the indexing rules going forward, keeping the current inscription numbers and leaving the orphaned inscriptions out. A Twitter poll indicated that the community leans towards the second option. Zhuojie Zhou, founder of NFT marketplace Magic Eden, argued that "history should be immutable.” Some believe the orphaned inscriptions could be worth more if a fix is ever made.

FUN BITS

If you enjoyed this, don’t forget to follow Unchained on all social media platforms. Find the links below ⬇️

🔗Join Unchained Premium to get access to:

🎙️ Behind-the-scenes interviews, in which I talk with crypto experts and entrepreneurs to learn all about the latest developments in the industry.

💬 A subscriber-only Telegram group, where you can talk with the other members of the Unchained community, build a network in crypto, and talk directly with me and the Unchained team!

📰 Transcripts of all the shows, for subscribers only.

If you liked what you read:

👍 follow me on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

👯♀️ share Unchained with a friend

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze