Will the Senate Kill DeFi in the US? 🥵

Weekly News Recap: 📄 New crypto bill, 📣 Gensler is 'disappointed,' 💱 Arkham Intel Exchange goes live, 🗣️ Coinbase's Armstrong to discuss legislation, and more!

The recent judgment in the SEC vs Ripple case has been an earthquake in the landscape of crypto regulation. The SEC now faces the challenge of whether to appeal or not. Meanwhile, a new DeFi bill looms in the U.S. Senate, potentially affecting every stakeholder in the decentralized finance world. Amid this flux, the SEC has been surprisingly tactical, dropping lawsuits right before Congress debates crypto.

On this episode of Unchained, we are joined by Bill Hughes, director of global regulatory matters at ConsenSys. Bill deciphers the implications of these developments, shedding light on the SEC's strategies, the potential fallout of the DeFi bill, and why he believes that the crypto community needs to focus more on the stablecoin and market structure bills.

Weekly News Recap

Capitol Crypto: Lawmakers and Presidential Hopefuls Weigh In

This week, apart from the new DeFi bill we just discussed during the episode, the U.S. political landscape buzzed with crypto-related discussions. During an event at the Atlantic Council, Senior House Republican French Hill, and Democrat Jim Himes, both members of the Financial Services Committee, emphasized the need for comprehensive stablecoin legislation, hinting at a potential bipartisan agreement. Hill stated: "We do want to facilitate a state pathway, but... we don’t want any race to the bottom," suggesting that stablecoins could fall under Federal Reserve review.

During the episode, Bill Hughes clearly said that the crypto community should focus on the stablecoin bill, as well as the market structure one.

Meanwhile, presidential candidates have been vocal about their crypto stances. Democratic hopeful Robert F. Kennedy Jr. proposed exempting Bitcoin from capital gains tax and backing the dollar with hard assets like gold, silver, platinum, and Bitcoin. On the other hand, Republican candidate and current Florida Governor Ron DeSantis pledged that, if he is elected, he would ban central bank digital currencies (CBDCs), citing concerns over "government-sanctioned surveillance."

SEC and Ripple Clash: Gensler Disappointed, Ripple CEO Optimistic

SEC Chair Gary Gensler said he was “disappointed” over a recent court ruling that declared sales of XRP on public exchanges were not securities transactions, but that institutional sales, in which the buyer and Ripple Labs had established a legal relationship, were securities transactions. Gensler, speaking at a National Press Club event, emphasized the SEC's commitment to bringing non-compliant firms into compliance and protecting investors.

Meanwhile, Ripple CEO Brad Garlinghouse expressed optimism, stating that the ruling clarified XRP's status and that an SEC appeal would further solidify the judge's decision. The ruling has sparked debate in Washington, with some U.S. lawmakers advocating for clearer Congressional oversight of crypto. The full court process over XRP could take years, according to recent Unchained guest Lewis Cohen.

SEC Clock Ticks for Spot Bitcoin ETFs: Six Applications Under Review

On Tuesday and Wednesday, the SEC began the formal review process for six spot Bitcoin ETF applications, including those from industry giants BlackRock and Bitwise.

The review process, which officially starts when applications are published in the Federal Register, sets an initial deadline of 45 days, extendable to 240 days. The SEC's acceptance of these applications marks a significant step in the agency's decision-making process. However, there's no guarantee of approval, as the SEC has previously rejected numerous spot Bitcoin ETF applications citing investor protection and anti-fraud standards. Despite this, the involvement of BlackRock has sparked optimism among crypto investors. An SEC approval of these applications could open the floodgates for institutional investments in Bitcoin, marking the end of a long wait by crypto investors.

Binance Lays Off 1,000 Employees: WSJ

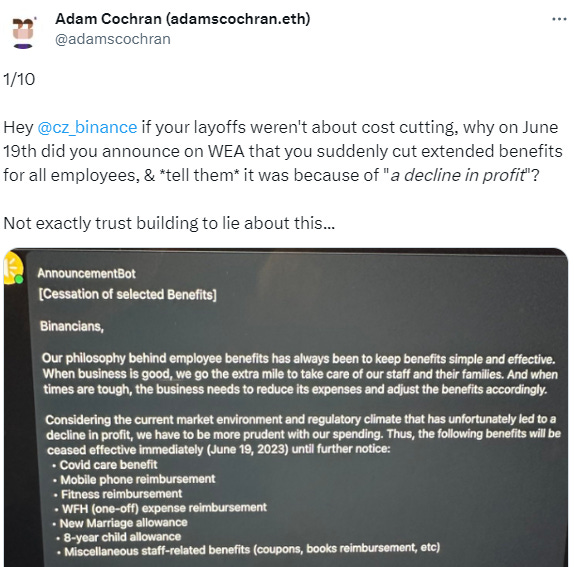

Binance, the world's largest crypto exchange, recently made significant cost-cutting moves. According to the Wall Street Journal, the company laid off over 1,000 employees worldwide, a major reduction from its previous workforce of around 8,000.

Binance CEO Changpeng Zhao said that the numbers were “way off” and that the company is still hiring.

Additionally, Binance has reportedly scaled back employee benefits due to a decline in profits. The company is said to have stopped reimbursing certain expenses, including mobile phone usage, fitness, and remote work costs.

Crypto Media Giant CoinDesk Is On Track for $125 Million Acquisition

An investor group headed by Matthew Roszak of Tally Capital and Peter Vessenes of Capital6 is on the verge of finalizing a $125 million deal to acquire crypto news outlet CoinDesk, according to The Wall Street Journal. The purchase will allow the parent company, Digital Currency Group (DCG), to maintain some ownership in the media publication. This move comes after DCG, which has faced financial difficulties and legal challenges, explored various options for a sale. CoinDesk's current management is set to remain post-acquisition.

BlockFi Ignored Warnings, Creditors Say

BlockFi, the bankrupt crypto firm, is under fire as creditors allege that the lender’s CEO Zac Prince ignored warnings about the shaky financials of FTX and Alameda Research and continued to increase lending to both entities.

The report reveals that BlockFi had access to the same balance sheet that later triggered FTX's collapse, and despite knowing that Alameda’s assets relied heavily on FTT, BlockFi continued lending, leading to losses of over $1 billion. The report also highlights three major failed investments that led to staggering losses for BlockFi: Grayscale Bitcoin Trust (GBTC), Three Arrows Capital, and Alameda Research/FTX.

These allegations suggest that mismanagement and excessive risk-taking were significant factors in the company's downfall, whose leadership hasn’t suffered as many accusations as most of the other collapsed crypto companies.

Coinbase CEO Advocates for Crypto Legislation Amid SEC Scrutiny

According to Bloomberg, Coinbase CEO Brian Armstrong is set to meet with the New Democrat Coalition, a group of over 100 House Democrats committed to pro-economic growth and innovation. They intend to address issues ranging from taxes to national security to privacy to climate.

This comes as Coinbase faces lawsuits from the SEC for allegedly failing to register their operations with the agency. Despite the legal challenges, Armstrong remains a vocal critic of the SEC's stance on cryptocurrency and has been pushing for clearer rules around digital assets. Meanwhile, Coinbase has paused its retail staking service in four states due to regulatory requirements.

Ex-Alameda CEO's Diaries Reveal Struggles

The New York Times obtained access to the diaries of Caroline Ellison, former Alameda Research CEO and ex-girlfriend of Sam Bankman-Fried, in which she chronicled her discomfort with her position and her personal relationship with Bankman-Fried. She doubted her ability to lead at Alameda, listing “leadership” and “decisiveness” as areas in which she felt she floundered.

Additionally, Bankman-Fried's rising fame and their romantic past caused her angst, as she stated, “having to be around you all the time, hearing people talk about how great you are all the time.” As their fraudulent operations crumbled, Ellison expressed relief, writing to SBF, “I just had an increasing dread of this day that was weighing on me. Now that it’s actually happening it just feels great to get it over with.” Despite the crucial role she played, she received significantly lower compensation ($6 million) compared to other executives, such as the hundreds of millions of dollars that went to Gary Wang and Nishad Singh, and the billions that went to Bankman-Fried.

Terraform Labs Seeks FTX Data for SEC Case Defense

Terraform Labs is seeking court approval to subpoena transaction details from the defunct cryptocurrency exchange, FTX, for its legal defense against an SEC lawsuit. The company, facing accusations from the SEC of misleading investors with its algorithmic stablecoin TerraUSD that collapsed, claims a coordinated short attack precipitated the currency's downfall. The lawyers insist that the records from FTX are essential for performing analysis to refute the SEC's claims. The hearing on the motion is scheduled for August 2.

Celsius Allocates $24 Million to Fees From GK8 Sale

Bankrupt crypto lender Celsius proposed a $25 million settlement from the proceeds of the GK8 sale to its Series B holders.

A hefty $24 million of this sum is earmarked for legal expenses, with the remaining $1 million to be distributed among the group. The self-custody platform GK8 was sold to Galaxy Digital as part of Celsius' bankruptcy proceedings, at a price significantly less than the $115 million Celsius originally paid. The proposal has sparked controversy among Series B shareholders, with some arguing that the $24 million does not fully cover their legal expenses. Meanwhile, former Celsius CEO Alex Mashinsky faces charges related to a multi-billion dollar fraud and market manipulation scheme.

Arkham's Intel Exchange Debuts With a Bounty Hunt for Crypto Mysteries

Arkham Intelligence's native token (ARKM) made a splashy debut on the Binance launchpad, trading at $0.75 after an initial sale at $0.05. However, the launch of a related offering, Arkham Intel Exchange, stirred controversy. The platform offers bounties for crypto sleuths to solve high-profile cases, including the $415 million FTX heist, which will be rewarded with nearly $70,000 in ARKM tokens.

Critics have labeled the program a "dox-to-earn" scheme, although Arkham CEO Miguel Morel believes the platform serves an entirely different purpose, as he explained in an episode of Unchained Premium last week.

Despite the controversy, the platform has seen significant activity, with over 47,000 addresses claiming 23.7 million tokens worth over $15 million.

Uniswap Founder Hayden Adam Unveils UniswapX

Uniswap launched a new open-source protocol, UniswapX, aiming to aggregate liquidity across decentralized exchange pools. The protocol introduces an ecosystem of 'fillers' who compete to fill swaps at the best prices, offering users gas-free execution and protection against Maximal Extractable Value (MEV). Uniswap founder Hayden Adams emphasized that users will maintain self-custody of their funds throughout the swaps, and the protocol will be immutable.

Meanwhile, major DeFi lending and borrowing platform Aave deployed its decentralized stablecoin GHO on the Ethereum mainnet. This follows several DeFi giants which recently entered the stablecoin space, including Curve and Frax Finance.

FUN BITS 😁

As Judge Torres ruled that selling XRP on exchanges did not violate securities laws… Which means what exactly? Hear Unchained’s Ginny Hogan explain.

If you enjoyed this, don’t forget to follow Unchained on all social media platforms. Find the links below ⬇️

If You Like What You Read:

👯♀️ refer Unchained with a friend and earn a Premium subscription

👍 follow Laura on Twitter, Facebook, Instagram, TikTok, Mastodon and/or LinkedIn

🎧 subscribe to Unchained on YouTube, Apple Podcasts, Spotify, Google Podcasts, Pandora or wherever you get your podcasts

and/or 📚buy my book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze