Will This Product Unlock Crypto’s Next Bull Run? 🐂

Weekly News Recap: ⚖️ Caroline Ellison sentenced, 🏦 BNY's SEC exemption, 🇺🇸 Harris talks crypto, and more!

You are reading the Unchained Weekly newsletter, where we cover all the major news in the crypto space, providing insights into the market's latest trends, regulatory shifts, and technological advancements. Stay informed with your no-hype resource for all things crypto.

Why Bitcoin ETF Options Could Unlock Massive Amounts of Capital for Crypto

As Bitcoin ETF options come closer to launching, Joshua Lim breaks down how these options could bring more capital into crypto, affect volatility, and even ignite a new boom for altcoins and NFTs.

With Bitcoin ETF options on the horizon, the crypto market is bracing for significant changes. In this episode, Joshua Lim, co-founder and CEO of Arbelos Markets, joins us to explain what the launch of Bitcoin ETF options means for the broader market. Could they unlock vast amounts of capital and set off a new altcoin boom? Josh also dives into the potential effects on Bitcoin volatility, DeFi lending, and even the on-chain options markets. Plus, what could the 2024 U.S. presidential election mean for Bitcoin?

Listen to the episode on Apple Podcasts, Spotify, Pods, Fountain, Podcast Addict, Pocket Casts, Amazon Music, or on your favorite podcast platform.

Weekly News Recap

Caroline Ellison Receives Two-Year Prison Sentence for Role in FTX Fraud

Caroline Ellison, former CEO of Alameda Research, has been sentenced to two years in prison for her involvement in the FTX fraud scheme. She also faces three years of supervised release and is required to pay $11.02 billion in restitution. The sentence was heavier than expected, as many anticipated she might avoid prison time altogether. Judge Lewis Kaplan acknowledged her significant cooperation with prosecutors, stating, “I’ve never seen one quite like Ms. Ellison.” Her testimony was instrumental in convicting FTX founder Sam Bankman-Fried, who received a 25-year sentence in March.

Ellison expressed deep remorse during her sentencing, saying, “Not a day goes by when I don’t think about all the people I’ve hurt.” She admitted to helping mislead investors and misuse $8 billion in FTX customer funds under Bankman-Fried’s direction. Despite her cooperation, she is barred from ever working in finance again.

BNY Becomes First Bank to Receive SEC Exemption From Crypto Custody Rules

In what could be a major development for institutional cryptocurrency custody, BNY has been identified as the first bank to receive an exemption from the SEC’s Staff Accounting Bulletin (SAB) 121, first reported by Unchained. During a public hearing in Wyoming, Chris Land, general counsel to Senator Cynthia Lummis, confirmed that BNY had secured a “variance” from the rule, which typically requires entities holding crypto to list it on their balance sheet as a liability. The exemption allows BNY to move forward in its digital asset custody business, a significant step for the banking giant.

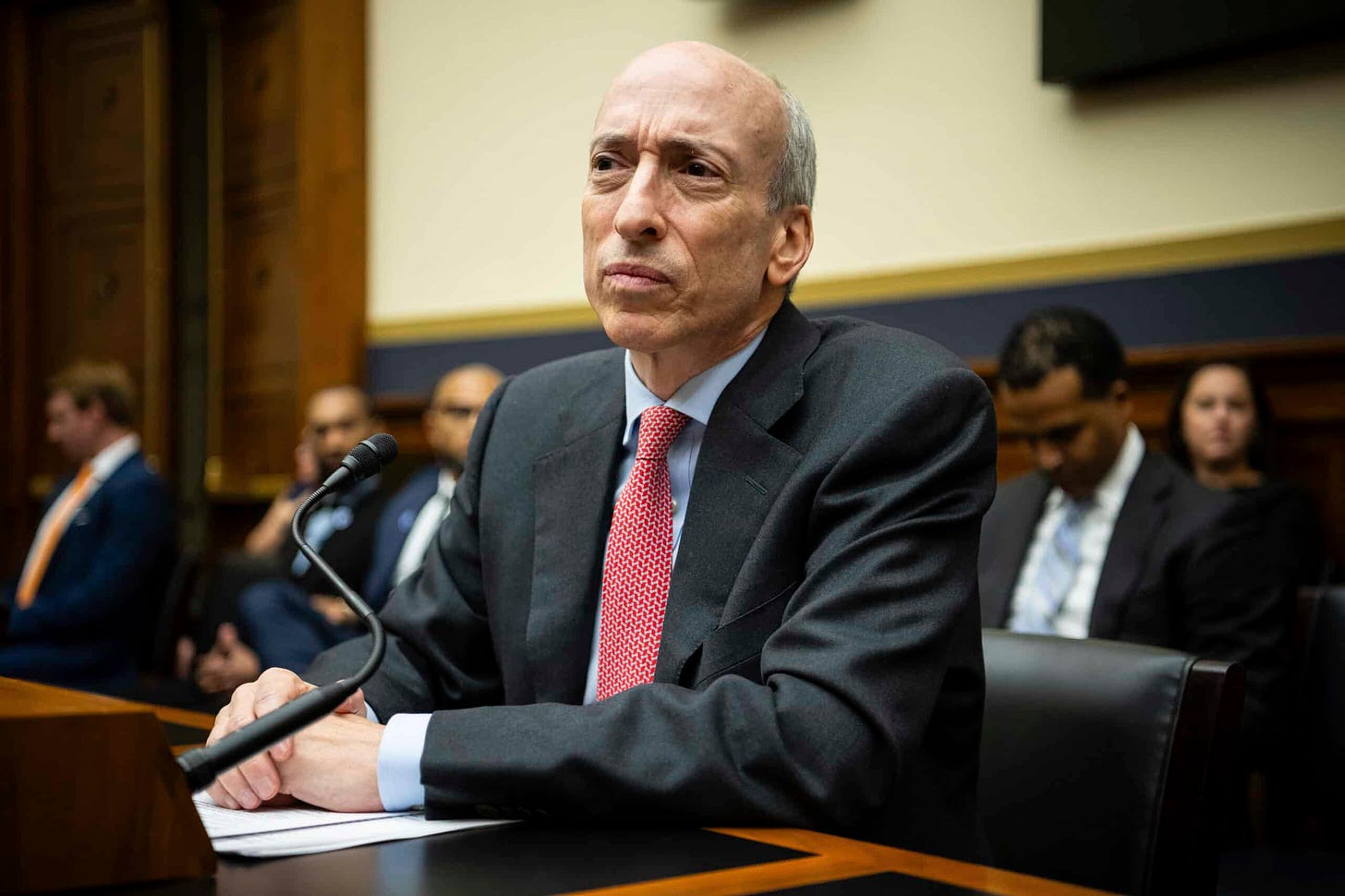

SEC Chair Gary Gensler said on Thursday that BNY’s approved custody structure could be used beyond Bitcoin and Ether exchange-traded products. The bank’s individual wallet structure, designed to protect customer assets in case of insolvency, could potentially be applied to a broader range of digital assets. Gensler stated, “It didn’t matter what the crypto was,” indicating that the framework is flexible for other digital currencies as well.

BNY now has the green light to expand its crypto custody services while safeguarding client assets, and other banks could adopt similar structures. Gensler praised BNY for doing the "legwork" to ensure customer protection, noting this model could help avoid the pitfalls seen in past crypto platform failures like Celsius and FTX.

Kamala Harris Makes First Remarks on Crypto

At a donor event in Manhattan on Sunday, Vice President Kamala Harris made her first public comments on cryptocurrency since launching her presidential campaign. She stated that her administration would “encourage innovative technologies like AI and digital assets, while protecting consumers and investors,” signaling cautious support for the crypto industry. While some, like Uniswap CEO Hayden Adams, saw this as a positive step, others found her remarks similar to past Biden-Harris statements on crypto.

Moreover, Harris outlined her broader economic vision during a speech in Pittsburgh on Wednesday, emphasizing the importance of the U.S. maintaining dominance in emerging technologies, including blockchain. She stressed the need for America to lead in sectors like AI, blockchain, and quantum computing to ensure "America, not China, wins the competition for the 21st century." Harris’s newly released economic plan mentions digital assets once, reiterating her earlier comments about fostering innovation while ensuring consumer protection.

Gensler Grilled on Crypto Regulation in Congressional Hearing

During a Congressional oversight hearing on Tuesday, Gary Gensler faced intense questioning from Republican lawmakers about the agency’s approach to regulating cryptocurrency. House Financial Services Committee Chair Patrick McHenry criticized Gensler’s reliance on "regulation by enforcement" and pointed to the lack of regulatory clarity as a key issue. McHenry warned that, “The United States will continue to fall behind Europe in technological innovation.”

In response, Gensler defended the SEC’s stance, referencing the Howey Test to clarify how the agency determines whether digital assets are securities. Meanwhile, Democratic Representative Maxine Waters used the hearing to propose bipartisan collaboration on passing a stablecoin bill, emphasizing the need for strong consumer protections and federal oversight. McHenry expressed openness to further discussions on stablecoins and broader digital asset regulation, hinting at the importance of his FIT21 bill.

TrustToken and TrueCoin Settle with SEC Over TUSD Misrepresentation

TrustToken and TrueCoin have reached a settlement with the SEC regarding allegations of misleading investors about the reserves backing the TrueUSD (TUSD) stablecoin. The SEC claimed that by March 2022, the reserves purportedly backing TUSD had been invested in a speculative fund, leading to redemption issues later that year. Despite knowing these problems, both companies continued to misrepresent TUSD as fully backed by U.S. dollars.

As part of the settlement, both TrustToken and TrueCoin will pay $163,000 in penalties, with TrueCoin also paying $340,000 in disgorgement. Neither company admitted nor denied the allegations. By September 2024, the SEC noted that 99% of TUSD’s reserves were invested in the speculative fund, undermining its stability.

Polymarket Seeks $50 Million Funding But Faces Uncertain Future

Crypto-based prediction platform Polymarket is seeking $50 million in new funding as U.S. election-related bets surge, according to a Fortune report. The startup is also considering launching its own token, which would allow users to validate real-world event outcomes. The move follows a successful year for Polymarket in which it raised $70 million over two prior rounds, including from investors such as Peter Thiel's Founders Fund.

However, concerns loom over Polymarket’s future post-election. In August, nearly 80% of its $472 million trading volume was tied to election bets. Analysts predict that once the November 5 election ends, trading volume could drop significantly. Despite this, some experts believe Polymarket could retain users for non-election bets, but competition from new entrants like dYdX and Limitless adds further uncertainty to Polymarket’s long-term success.

Tornado Cash Developer Roman Storm to Stand Trial, Judge Rules

A New York judge has ruled that the criminal case against Tornado Cash developer Roman Storm will proceed to trial. Storm faces charges of conspiracy to commit money laundering, operating an unlicensed money transmitting business, and violating the International Emergency Powers Act. These charges are tied to his work on Tornado Cash, a privacy mixer allegedly used to launder over $1 billion, including funds from North Korea’s Lazarus Group.

Storm has pleaded not guilty, arguing that he only wrote the code for Tornado Cash and is not responsible for any illegal activities. If convicted, Storm faces up to 45 years in prison. The trial is set to begin on December 2.

PayPal’s PYUSD Stablecoin Sees Sharp Decline on Solana Amid Reduced Incentives

PayPal’s stablecoin, PYUSD, has experienced a significant market cap decline on the Solana blockchain, falling by 42% over the past month. From its peak, PYUSD saw its market cap drop from $663 million to $368 million, reducing its share of Solana's stablecoin market to 9%.

This sharp decline follows PayPal’s reduction of high-yield incentives, which had driven PYUSD’s early growth on DeFi platforms. As these incentives diminished, user interest waned, reflecting a broader trend in decentralized finance, where users often chase the highest returns and move on quickly to the next investment.

Grayscale’s Ethereum Trust Sees Largest Single-Day Outflow Since July

Grayscale’s Ethereum Trust (ETHE) recorded its largest single-day outflow since the launch of spot ether ETFs, with $80.6 million exiting the fund on Monday. The sharp outflow, surpassing the previous nine days combined, coincided with a recent 20% rally in ether’s price, which hit $2,700 before recently settling at around $2,600.

Following Monday's significant outflows, spot ETH ETFs bounced back on Tuesday with $62.5 million in net inflows—marking the third-highest daily inflow so far. BlackRock led the charge, accounting for $59.3 million. On Wednesday, spot ETH ETFs also had positive inflows of $43.2 million.

In related news, the SEC delayed its decision on allowing options trading for BlackRock’s ether ETF until November, after recently approving similar options for bitcoin ETFs.

Sky Reconsiders Offboarding Wrapped Bitcoin After Talks with BitGo CEO

Sky, formerly MakerDAO, is reconsidering its decision to offboard wrapped bitcoin (WBTC) as collateral, after discussions with BitGo CEO Mike Belshe. Concerns had been raised about Tron founder Justin Sun’s involvement in WBTC custody, especially given the $200 million in loans tied to WBTC on the platform. However, Belshe clarified that Sun would not have control over key management practices, easing concerns.

BA Labs, a key Sky advisor, now recommends pausing the offboarding process, citing reduced exposure to WBTC and a more acceptable risk level.